Is Indexing Doomed? Not If History Is Any Guide

by Scott PuritzMeme stocks. Cryptocurrency. Non-fungible tokens. Flashy and controversial trends in investing tend to get the headlines. So be it. Still, the likelihood is that simple, quiet index investing will only grow in popularity. Why? Because inertia is a powerful force in any industry, and particularly so if the process or product in question works. “If… Continue reading

$1 Billion Dollars Is Just the Starting Point

by Scott PuritzMy firm, Rebalance, recently celebrated a milestone — $1 billion in assets under management. It is an easy figure to misunderstand. The firm is not “bigger” or “more important” than a few years ago. What has changed is that an increasing number of people trust us with their investments, and those investments have grown. That… Continue reading

An NFL Fantasy Football Draft Strategy Is Not An Investment Strategy

by Scott PuritzAs summer winds down many of us are heartened by the promise of crisp autumn air, pumpkin spice coffee drinks, and the weekly showdowns of NFL football giants. Amazingly, alongside the absolutely enormous revenue machine that is pro football, a secondary, completely virtual game has grown into a massive industry of its own — fantasy… Continue reading

What’s Your Next Chapter? The Time To Plan For It Is Now

by Scott PuritzMany people, prompted to think about how long they might stay at work, fall back on statistics they hear in the media. You know, the ideal retirement age is 65, maybe a few years more, tops. The thing is, that number made sense only briefly around the time the government was setting up Social Security,… Continue reading

5 Reasons to Consider a Modern 401(k) Provider

by Scott PuritzAll 401(k) services are not created equal. You may have had a plan in place for years and never questioned the fees and exactly what roles and responsibilities you might have toward employees. It’s time to dig in and ask those questions. Read this brief guide to learn five reasons to consider a new, more… Continue reading

An Appreciation of Yale’s Star Investment Chief, David Swensen

by Scott PuritzThe lives of financial titans can seem otherworldly, replete with the trinkets of absurd wealth that come from commanding personal billions. Then there’s David Swensen, the one-time Wall Streeter who passed up all that and instead focused on something larger than himself: building a massive gift for the benefit of generations of students to come.… Continue reading

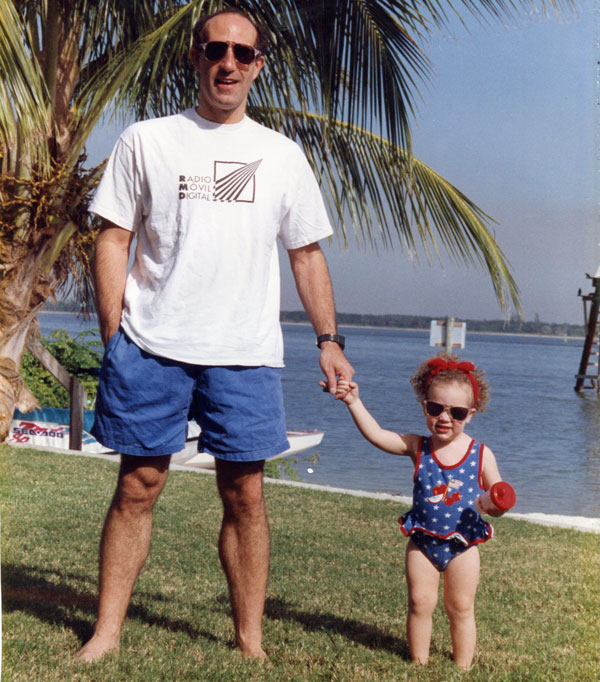

The Best Father’s Day Gift Ever

by Scott PuritzNot long ago, I received an unexpected early Father’s Day gift from my older daughter when she returned home for a long weekend visit with mom and dad. Since graduating from college Alyssa had been living in the Chicago area, where she worked as a research assistant for a prestigious university. She thoroughly enjoyed living… Continue reading

5 Questions to Ask Before Hiring Your Company’s 401(k) Advisor

by Scott PuritzMany business owners think about their 401(k) advisor as primarily focused on investment selection — which funds to buy and why, like a stockbroker might do. They tend to miss the rest of the iceberg under the water: administrative tasks, tax reporting, retirement planning, auditing and compliance, employee education and more. Aside from a few… Continue reading

Reflation Risk (And Why Goldman Sachs Says We Will Be Ok)

by Scott PuritzReflation Risk According to Goldman Sachs With fiscal stimulus and accommodative monetary policy buoying the U.S. economic recovery, prominent economists from former Treasury Secretary Lawrence Summers to former IMF Chief Economist Olivier Blanchard have raised concerns that the U.S. economy could be headed for overheating and inflation. In this recent Goldman Sachs podcast, host Allison… Continue reading