The most impactful financial lesson that you will ever receive almost certainly will be whatever you learned from your own parents. For me, that lesson came from my father, a Cuban immigrant who came to America with no more than 10 cents to his name.

In 1962, my parents and sister arrived from Cuba. They landed in Miami. We were, for all intents and purposes, undeniably poor, but what saved us financially was my father’s work ethic and frugality. He worked two jobs, doing clerical work in the daytime and then, at night, carrying buckets of ice at the drive-in.

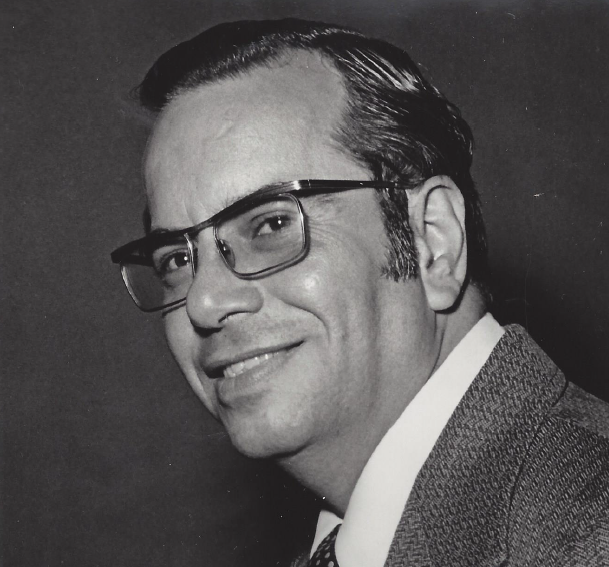

My dad was a conservative investor. For him, investing was all about being consistent, never, ever borrowing money, and living within your means. On Saturdays, we would go to the library together, and he would read the Dow Jones updates and The Wall Street Journal. He was all about consistency. This was before index funds, so he worked to keep our “portfolio” of investments diversified on his own. I still remember how particular he was about measuring his progress. Every Saturday, he sat in the basement of our home and calculated our family’s net worth. He kept all of his financial records in meticulous order, never using a computer or a calculator, just tables and a paper and pen. He loved to look back at where we were one year before and five years before.

My dad has passed away, but he left my mom in good shape. That’s what he was the happiest about. Are we wealthy? No, but my mom doesn’t worry about money, and I have my father to thank for that lifelong lesson: Prudence, care and hard work are all you need to succeed, in both investing and life.