Our Blogs

Inheritance? Here’s Why Not to Pay Off Your Mortgage

by Christie Whitney, CFP®We all know the stories of famous athletes who go broke. And then there is the infamous “lottery curse,” where winners end up bankrupt a few short years after hitting the jackpot. Most folks think that they’re smarter than that. They believe they will properly manage any inheritances that come their way. If only we… Continue reading

What Investors Should Know About Money-Market Funds and CDs

Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains. Source: The Wall Street Journal May 6, 2023. What Investors Should Know About Money-Market Funds and CDs Investors are turning to these cash-equivalent investments, some of which are yielding 5%… Continue reading

What is the worst time to hire a financial adviser?

Rebalance Managing Director Mitch Tuchman outlines in this column how one should take financial advice as seriously as they take medical advice. by Mitch Tuchman, January 31, 2024 If the number of digits on your retirement account balance surprises you, that might be a sign you need to get help with your financial decisions. The average… Continue reading

More Americans own stocks. This is great for their financial future.

For the first time since the stock market crash of 2008, consumer confidence with the stock market has returned. According to legendary Washington Post columnist, Michelle Singletary, investors have had a bumpy ride over the past decade. In the process, they have been rewarded with annual returns of approximately 12%. More Americans own stocks. This… Continue reading

What Investors Should Know About Money-Market Funds and CDs

Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains. Source: The Wall Street Journal May 6, 2023. What Investors Should Know About Money-Market Funds and CDs Investors are turning to these cash-equivalent investments, some of which are yielding 5%… Continue reading

With the Odds on Their Side, They Still Couldn’t Beat the Market

The Rebalance tried-and-true adage remains the same, echoed by this NYTs columnist: it is nearly impossible to beat the stock market. The most prudent long-term investing strategy is to “own” the entire stock market through low-cost, broad exposure index funds. Source: The New York Times April 14, 2023. With the Odds on Their Side, They… Continue reading

The 60-40 Investment Strategy Is Back After Tanking Last Year

With the perspective of time, the calls for the death of the 60%/40% investment strategy came too soon. The click-bait articles of 2022 did not deter the Rebalance long-term investors. Source: The Wall Street Journal April 12, 2023. The 60-40 Investment Strategy Is Back After Tanking Last Year The recovery has emboldened investors who didn’t… Continue reading

Secure 2.0: Wide-Sweeping Retirement Legislation Passed by Congress

by Christie Whitney, CFP®At Rebalance, we strive to make investing and saving for retirement smoother, safer, and easier for our small business owner clients and their employees with our BetterK solution. The recent passage of the new Secure Act 2.0 aims to expand access to retirement plants, increase retirement savings, help Americans preserve income, and streamline retirement plan… Continue reading

Inheritance? Here’s Why Not to Pay Off Your Mortgage

by Christie Whitney, CFP®We all know the stories of famous athletes who go broke. And then there is the infamous “lottery curse,” where winners end up bankrupt a few short years after hitting the jackpot. Most folks think that they’re smarter than that. They believe they will properly manage any inheritances that come their way. If only we… Continue reading

The Point of Retirement? Enlightenment, or at Least Calm

by Scott PuritzRetirement can mean many different things to many different people. But what is its deeper meaning? The Point of Retirement? Enlightenment, or at Least Calm By Mark Edmundson, Jan. 9, 2025 Winter is the season when the most Americans retire. But this year’s retirement wave may be a little smaller than last’s. There seems to… Continue reading

A New Year’s Resolution to Fortify Your 401(k)

by Scott PuritzRebalance Investment Committee Member Professor Burt Malkiel, in his quarterly WSJ column, reinforces the enduring investing principles we put into practice for our clients at Rebalance. A New Year’s Resolution to Fortify Your 401(k) By Burton G. Malkiel, Jan 6, 2025 A new year is a natural time to examine one’s investments, and the stock… Continue reading

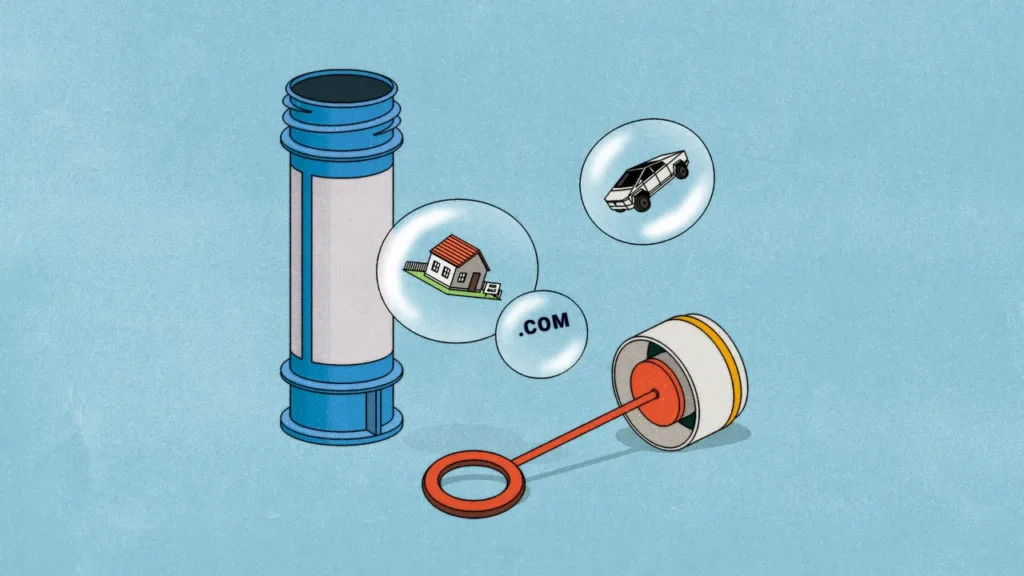

What We Mean When We Talk About an Artificial Intelligence ‘Bubble’

by Scott PuritzThe Dutch Tulip market was all the rage in the 17th century, until it came crashing down. Is AI today’s Dutch Tulip? What We Mean When We Talk About an Artificial Intelligence ‘Bubble’ By John Letzing, Oct. 7, 2025 The sheer amount of money being directed at AI has stirred fears of a bubble. Comparisons… Continue reading

Why Concerns About an AI Bubble Are Bigger Than Ever

by Mitch TuchmanThe news is flooded with opinions about whether the runup in AI-driven stocks portends a once-in-a-generation technological revolution… or is just an overhyped bubble that is going to pop. Why Concerns About an AI Bubble Are Bigger Than Ever By Bobby Allyn, Nov. 23, 2025 Perhaps nobody embodies artificial intelligence mania quite like Jensen Huang, the… Continue reading

Thinking With Machines

by Dan MavraidesNYU Professor Vasant Dhar discusses the fine balance between harnessing the power of AI and learning how to successfully navigate this emerging new landscape. Thinking With Machines By Gerry Baker, Dec. 4, 2025 Announcer: From the opinion pages of The Wall Street Journal, this is Free Expression with Gerry Baker. Gerry Baker: Hello, and welcome… Continue reading

Managing the Risks and Taxes of Highly Appreciated Stock

by Matt Jude, CFP®, ECAInvestors who have done well over the years – whether through savvy stock picks, favorable market returns, or just good luck – often find themselves with a unique set of problems to deal with. After holding stocks for a long period of time and achieving substantial returns, investors may have two unexpected issues to be… Continue reading

Do You Need a Financial Adviser? Ask Yourself These Four Questions

by Scott PuritzBefore you declare “I’ve got this,” make sure you actually do. Do You Need a Financial Adviser? Ask Yourself These Four Questions By Debbie Carlson, Nov. 5, 2025 There has never been an easier time to be a do-it-yourself investor, thanks to the host of technological aids such as financial calculators, budgeting and investing apps,… Continue reading

Why Financial Advice Is Growing More Valuable Than Ever

by Jill Carothers, CFP®Working with a financial advisor is priceless in more ways than one might think. Why Financial Advice Is Growing More Valuable Than Ever By Danny Noonan, Oct. 20, 2025 Apollo CEO Marc Rowan recently shared his view on the future of investing, saying, “We’re moving on from a three-flavor ice cream world.” For decades, stocks… Continue reading

Congress Thinks Hiding Fund Fees Is Good for You

by Scott PuritzOpen your eyes to hidden fees… they can make a huge chunk of your retirement savings disappear. Congress Thinks Hiding Fund Fees Is Good for You By Jason Zweig, Oct. 10, 2025 Asset managers and financial advisers have concocted a zillion ways to disguise their fees. Congress wants to give them yet another. A bill… Continue reading