The 60/40 stock-and-bond portfolio mix is dead in 2016

Scott Puritz in USA TODAY: Say goodbye to 60/40 portfolio… Rules for stock/bond formula not just dated, it’s “downright dangerous.”

Years ago, managing your investment portfolio was pretty simple: Invest in 60% stocks and 40% bonds, and rebalance your assets once a year.

But financial advisers are increasingly moving away from this traditional model of asset allocation.

“Those were not terribly bad rules a generation ago, but they’re now not just outdated but downright dangerous,” says Scott Puritz, managing director of retirement services firm Rebalance in Bethesda, Md.

The two big reasons that clinging to the old 60/40 formula is a bad idea, Puritz says, are a combination of short- and long-term factors.

“There’s the historic low-interest-rate environment, but also the fact that people are living dramatically longer,” he says.

For context on just how low interest rates are, bond yields are currently “lower than 97% of history,” says Charlie Bilello, director of research for asset management firm Pension Partners. For instance, right now 10-year U.S. Treasury bonds yield less than 2.2% — which adds up to just $220 in a year’s return from a $10,000 investment. That’s down from about 5% yields right before the Great Recession, and yields on the 10-year that regularly approached 7% across the 1990s.

As for Americans living longer, the average life expectancy is up to about 79 years old and climbing thanks to modern medicine. That means if you quit working at age 60, you must have the savings to support your family for at least 20 years.

What’s the Right Mix for You in 2016?

Of course, there is no magic number that fits every portfolio. Even when the 60/40 rule was in fashion, it was just a rule of thumb to help investors get started on the right track.

So it’s not surprising that even when experts agree that the old guidelines are imperfect, they differ greatly on what the proper mix is.

For starters, Puritz recommends broadening the definition of “bonds” to include other income-producing investments, including high-quality dividend stocks.

“Would you rather have the AT&T dividend yield, which has historically been at about 5% and growing at about 5% a year,” he asks, “or would you prefer to have the AT&T bonds, which are at only about 2% and change?”

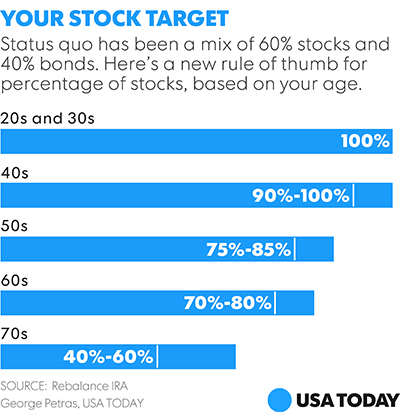

Beyond that, Puritz and Rebalance recommend a much more substantive allocation to stocks across all age groups and risk tolerances. Here is the percentage of stocks they recommend:

“That’s considerably higher than the previous norm,” Puritz admits, but plenty of historical data shows that it is exceedingly rare for the stock market to post a loss across 10-year periods, and that even these are short-lived. Looking out a bit longer, the market at large has never lost money over any consecutive 20-year period.

Therefore, Puritz says, someone in their 50s and even their 60s should have plenty of exposure to stocks as they focus on growth over the long term and not the risk of short-term losses.

“The biggest risk you face is not that the equity portion of your portfolio is going to bounce around 10%, 15% or even 20% in a short-term cycle,” he said. “If your time horizon is more than 10 years, your biggest risk by far is that you’re going to outlive your money.”

Consider International Investments, Too.

On the other hand, while Bilello admits that current bond yields are paltry and Americans are, indeed, living longer and are in need of growth, he cautions against just throwing money at U.S. stocks and hoping for the best.

After all, the old 60% stocks/40% bonds was fashionable at a time when there weren’t a lot of international opportunities. As such, seeking diversification and growth opportunities abroad should be a key part of any long-term investment strategy.

“The risk/reward is more favorable today outside the U.S., because U.S. returns have far outpaced the rest of the world over the past five years,” says Bilello, who thinks investors with lots of cash in American stocks may be disappointed going forward. Diversifying into international investments is not without its own risks, however, and he cautions that “investors may incur higher short-term volatility for this higher long-term expected return.”

Of course, these are all starting points, and your personal investment needs may vary greatly — not just based on your financial goals, but also based on your personal risk tolerance.

After all, an investor who isn’t comfortable investing big-time in overseas markets or being 100% in stocks may ultimately panic even if they understand intellectually why these higher-risk investments should pay off long-term.

“There’s no sense in creating the optimal asset allocation that works at an intellectual level if when the markets drop, the investor can’t sleep at night,” Puritz says. “Particularly, as people get older, have families and mortgages and are paying down debt, their financial situations get more complex, so it’s good to have a seasoned professional in the mix to strike the right balance for you personally.”