Cash Balance Plans for Businesses

Adding a Cash Balance Plan to your company’s 401(k) plan can save you up to $150,000+ or more on your tax bill!

How a Cash Balance Plan Works

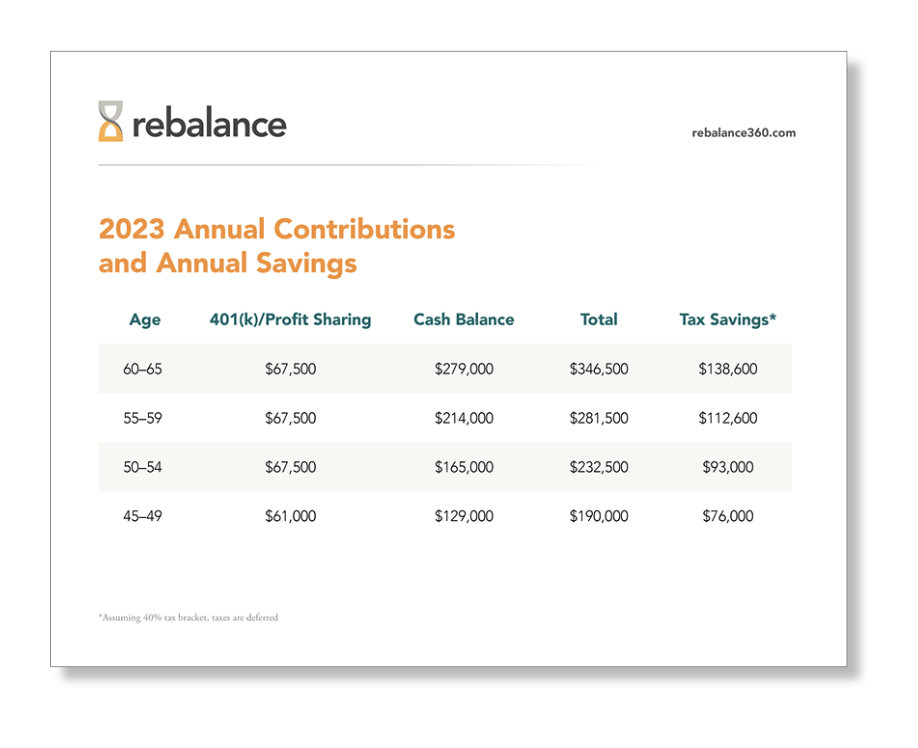

How much can you save with a Cash Balance Plan?

Fund a sizable portion of your retirement nest egg using money that you would otherwise have paid in taxes. Download this helpful one-pager to view potential tax savings by age.

Cash Balance Case Study

See how a high-earning business owner can use a Cash Balance Plan as an IRS-sanctioned strategy to reduce their tax bill by over $100K a year.

Download Our

Cash Balance Guide

Questions about Cash Balance plans? Everything you need to know to unlock huge savings can be found in our Cash Balance Plan guide.

2023 Contribution Limits

Save this handy table to determine just how much you could be contributing to your own retirement — with and without applying a Cash Balance Plan to your retirement strategy.