Roth IRAs Can Transform Your Retirement Planning

by Christie Whitney, CFP®Savers maxing out their 401(k) plans are likely to hear about one strategy preached endlessly: open a Roth IRA or get taxed to death in retirement. It can get overblown, but there is a kernel of truth here. Having tax flexibility in your later years is a gift that keeps on giving. That is because… Continue reading

What I Learned When I Stopped Watching the Stock Market

WSJ Columnist Jason Zweig, as he returns from a lengthy sabbatical, excellently illustrates Rebalance’s tried and true mantra: think long-term and turn off the “noise”. What I Learned When I Stopped Watching the Stock Market Over-reacting to the news can poison your portfolio and sour your life. Here’s how to keep your investment plan on track.… Continue reading

Four Lucrative Tax Deductions That Seniors Often Overlook

Attention seniors: there are several tax deductions available that can greatly affect one’s financial planning at year end. This Wall Street Journal article explains each of these tax breaks, and how to go about taking advantage of them. Four Lucrative Tax Deductions That Seniors Often Overlook There are a host of tax breaks available to… Continue reading

The Exact Age When You Make Your Best Financial Decisions

Believe it or not, there is a magic age for making the best financial decisions of your life. You may or may not be surprised what this age is. Read this excellent Wall Street Journal article to discover the magic number. The Exact Age When You Make Your Best Financial Decisions There’s a magic number… Continue reading

Yes, There Are Alternatives to Stocks

Curious about where to invest your cash? New York Times columnist Jeff Sommer outlines how money market accounts and bonds have risen to the top as compelling investment options. Yes, There Are Alternatives to Stocks At the moment, money market funds and many bonds are not only less risky, but at current interest rates, they… Continue reading

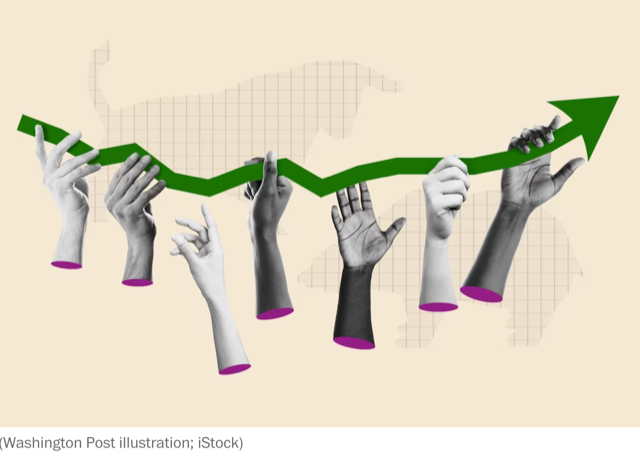

More Americans own stocks. This is great for their financial future.

For the first time since the stock market crash of 2008, consumer confidence with the stock market has returned. According to legendary Washington Post columnist, Michelle Singletary, investors have had a bumpy ride over the past decade. In the process, they have been rewarded with annual returns of approximately 12%. More Americans own stocks. This… Continue reading

Who Needs an Estate Plan? Maybe You

by Christie Whitney, CFP®More than 60% of Americans don’t have a will, much less a full-blown estate plan. It’s understandable. It can feel morbid to think about what happens after you die. Yet many of those same people have life insurance, precisely to safeguard the finances of loved ones should they pass away unexpectedly. People sometimes use the… Continue reading

3 Income Scenarios Widows Face with Social Security

by Christie Whitney, CFP®It is incredibly hard to lose a lifelong spouse, and the weeks following a funeral are undeniably tough for the surviving partner. Yet that’s exactly when many recently widowed people are expected to make consequential decisions about their finances, choices that could set them back thousands of dollars in income each year during retirement. The… Continue reading

How to Build a Retirement Paycheck

by Christie Whitney, CFP®Most people entering retirement naturally would prefer to continue to collect a paycheck, much like when they worked for a living. That regular income is likely to come from Social Security, a pension if you have one, as well as from money in tax-deferred retirement plans such as your 401(k) and IRA accounts. The goal… Continue reading