Investment Advisors Archive

White House Leak: Stock Broker Conflicts Cost Americans Billions

by Mitch TuchmanYou know you pay stock brokers too much for investment advice. That’s a given. But can we put a number on the cost of their often-conflicted advice? Try this on for size: Up to $17 billion a year, according a White House memo leaked to the press. The “conflict” comes in when stock brokers give… Continue reading

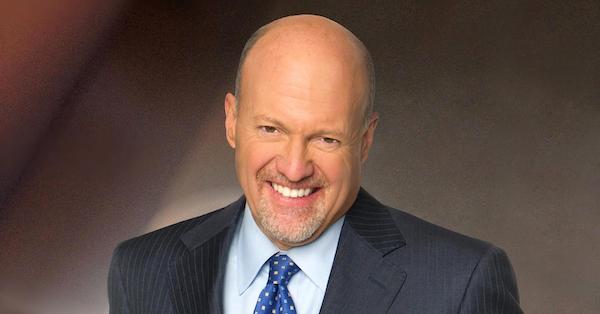

Jim Cramer: Funds Are Fee-Collecting Machines

by Mitch TuchmanMad Money host Jim Cramer, best known for offering stock tips on cable TV, is quickly becoming famous for taking what would seem for him a contrarian viewpoint — that investors should avoid stock-picking mutual funds like the plague. Actively managed funds are in one business and one business only, Cramer argues. They must grow… Continue reading

What Is The Difference Between Rebalance And Conventional Brokers?

by Mitch TuchmanMitch Tuchman, Managing Director of Rebalance, on understanding why conflict-free investing matters to you. Continue reading

John Bogle: Nobody Gets The Market Right

by Mitch TuchmanIf you make the mistake of watching the stock market on cable TV, the drumbeat of nearly every minute of airtime is this: Anyone can pick stocks. It’s easy. It’s not a surprising message. The bulk of advertising on financial TV is from big Wall Street firms and brokerage houses. They too rely heavily on the… Continue reading

‘DeflateGate’ and Your Retirement Investing Plan

by Mitch TuchmanAs you read this, the furor over the DeflateGate scandal will have subsided and the intense roar of a million corner sports bars will be dying down following the most revered of American holidays, Super Bowl Sunday. As always, the best team wins these things. But there’s the rub. As with all high-stakes sports events,… Continue reading

Why I Joined Rebalance

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee on how investment advisors mislead retirement savers. Continue reading

Malkiel: The Dangerous Allure Of Market Timing

by Mitch TuchmanFor all the talk about “smart” money and “dumb” money in investing, you would think that money had a mind of its own. A curious twist in the year-end results of some hedge fund tracking ETFs, however, shows just how strikingly random a year’s returns can be. As Burton Malkiel points out, the relevance of a given year’s performance vs.… Continue reading

2014: Another Great Year For Patient Investing

by Mitch TuchmanA popular article making the rounds on the Internet refers to 2014 as “the year that nothing worked.” I beg to differ. Patient investing through a low-cost portfolio of index funds worked just fine. I have no quarrel with the author of the piece and find his commentaries informative, which is what online content should be.… Continue reading

New ‘Random Walk’ Wisdom From Burton Malkiel

by Mitch TuchmanEvery year in the investing business a load of flashy new books comes out, each penned by a young money manager or market observer looking to make his or her mark. Some sell well, often in direct relation to the author’s appearances on financial TV shows. Some disappear in short order and end up in… Continue reading