Investment Advisors Archive

Retirement Victory: The End Of Hidden Fees

by Mitch TuchmanIt has taken years of effort, but this week the playing field finally was leveled for Americans saving and investing for retirement. Stock brokers now have to act in the interests of their clients, and they can no longer fail to disclose how they are paid and by whom. Hidden fees must end. Known as… Continue reading

John Bogle’s Long Overdue Fiduciary Dream

by Mitch TuchmanIf anybody has the truly long view on retirement investing, it’s Vanguard Group Founder John Bogle. He has retired from his own firm but definitely is still in the fight, by his reckoning well over a quarter century now trying to get retirement investment advisors to do what they say and be legally bound to… Continue reading

Bogle: A Clear Sign A Fund Will Lose Big

by Mitch TuchmanJason Zweig, The Wall Street Journal’s “Intelligent Investor” columnist, recently wrote about a curious trend among financial advisors — holding index-style exchange-traded funds. That’s right, owning the index, yet still charging a premium for advice because, well, why not? The argument from the managers is disarmingly simple: While they still make some bets on specific stocks, it’s getting… Continue reading

New Rules Designed To Make Retirement Investing Safer

by Mitch TuchmanIf you book a hotel online, you expect to see the prices first. When you go to take a trip by airplane or rent a car, same thing. Why not the same with retirement investing costs? Is there something special about investing for retirement that requires secrecy, obscurity, a lack of simple disclosure? Of course… Continue reading

Beware: Stock Broker Fraud Is Rampant

by Mitch TuchmanYou probably have at least a minimal expectation that financial regulators in Washington are looking out for you. And you’d be wrong — and a lot poorer in retirement as a result of that misplaced trust. While the fight continues to enact clearly written and fair rules of engagement for investors, stock broker fraud cases… Continue reading

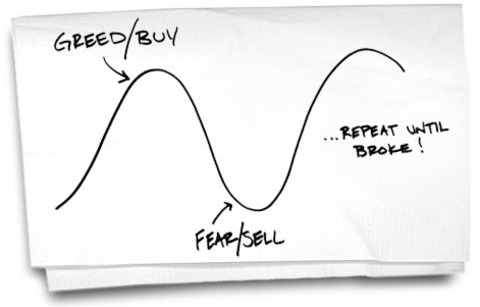

Yes, Ignore That ‘Sell Everything’ Call

by Mitch TuchmanThe U.S. Federal Reserve has begun to raise the interest rate, generally a sign of a strong recovery and a growing economy, and often a trailing indicator of growth. The Fed typically only acts late in the process, arguably too late at times. Meanwhile, one European bank’s economists are making waves with a note to clients… Continue reading

Bogle’s Legacy: Falling Prices Everywhere

by Mitch TuchmanIn case you missed it, a chart making the rounds in financial circles puts a fine point on what happens when a $3 trillion gorilla walks into a room. That’s the level of assets under management at Vanguard, the low-cost fund giant created by the legendary John Bogle. In short, when Bogle’s crew comes into… Continue reading

John Bogle: Big Funds Rip Off Investors

by Mitch TuchmanWhat makes an investment fund cheap to own? Low fund fees, of course. But investors completely misunderstand what “low” means, charges Vanguard Group founder John Bogle. The problem comes with using percentages, specifically percentage expense ratios, to gauge the value of a fund relative to its cost of doing business. Consider something you buy every week,… Continue reading

Annuity Kickbacks A Huge Conflict: Senator Warren

by Mitch TuchmanElizabeth Warren, the hard-charging Senator from Massachusetts, has new questions for financial advisors who sell annuity products to folks nearing retirement age: If an annuity company gives advisors rewards and incentives such as resort vacations, iPads and jewelry, isn’t that a huge conflict of interest? Warren recently made headlines in an important Senate Committee hearing at… Continue reading