Cash Balance Plans: A Dentist's Secret Weapon for a Secure Retirement

Educational debt, debt from starting a practice, and additional expenses lead many practice owners to fall behind in retirement investing. The cash balance plan is another great option for providing dental practice owners a secure retirement.

Prior to the COVID-19 crisis you may have thought, “I’m making plenty of money now, but am I going to work until I die?” Educational debt, debt from starting a practice, and additional family and other expenses lead many practice owners to fall behind in retirement investing.

For many of these practice owners, retirement may rely on them selling their practices. But there is no guarantee that someone will want to buy the practices at the prices the sellers want 20 years down the line.

Dentists looking for reliable retirement investment options can always trust a 401(k) plan. However, a lesser known approach—the cash balance plan—is another great option for providing dental practice owners a secure retirement. Depending on your cash flow and personal financial goals, either combining a 401(k) with a cash balance plan or going entirely to a cash balance plan can open doors to financial possibilities that seemed decades away, all the while providing powerful incentives that will help you retain staff.

Cash balance plans are a type of retirement savings and investment plan that allow dental practice owners who have high incomes, but who may have started saving for retirement later in life, to catch up. These plans also allow owners or partners to greatly increase retirement savings today by deferring tax on far larger amounts than traditional 401(k) plans allow, up to $300,000 annually.

So, is a cash balance plan something that you should consider?

Defined benefit versus defined contribution plans

In general, there are two types of company-sponsored retirement plans—defined benefit plans and defined contribution plans. Defined contribution plans include the 401(k)-type plan. These cover employees who choose to participate in the plan, while other employees may choose not to participate. An employer may match contributions made by employees, and their participation and contributions are a must if matching is to happen. In these plans, participants are able to choose their contribution levels and make their own investment decisions.

Defined benefit plans, on the other hand, do not require contributions from participants and operate more like traditional pension plans. Cash balance plans are a type of defined benefit plan. An employer provides a specific (defined) monetary benefit at retirement for eligible employees and the business owners. For example, an employer might credit a participant’s account each year with a fixed percentage of the employee’s compensation, typically between 5% and 8%. This type of plan rewards long-term employees and encourages retention. At retirement, the employee can take an income annuity or a lump sum that can be rolled over into an IRA and managed on their own.

Advantages of cash balance plans

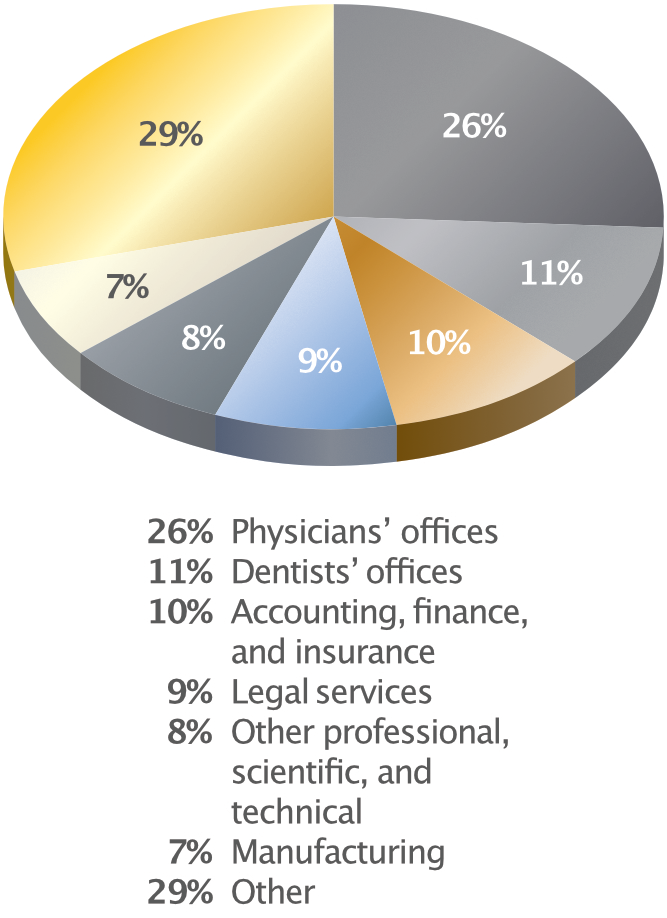

Figure 1: What business types use a cash balance plan? For a variety of reasons, cash balance plans have become increasingly popular in the last few years.1 Of all the cash balance plans established throughout the United States, more than one in 10 are used in dental practices. Physicians also tend to use them in greater numbers. See Figure 1.

Figure 1: What business types use a cash balance plan? For a variety of reasons, cash balance plans have become increasingly popular in the last few years.1 Of all the cash balance plans established throughout the United States, more than one in 10 are used in dental practices. Physicians also tend to use them in greater numbers. See Figure 1.

There are some distinct advantages to implementing a cash balance plan in your workplace. First, cash balance plans allow business owners to “catch up” in their personal retirement plans. Many practice owners take on huge expenses for their educations and starting their own practices. Naturally, this means many dentists begin saving for retirement later in their professional lives. A cash balance plan allows annual contributions of more than $300,000 (for those over age 60), and tax deferral on large amounts of income—up to 45%. Contributions can be made up to the deadline of the company’s tax return, which gives practice owners another level of flexibility.

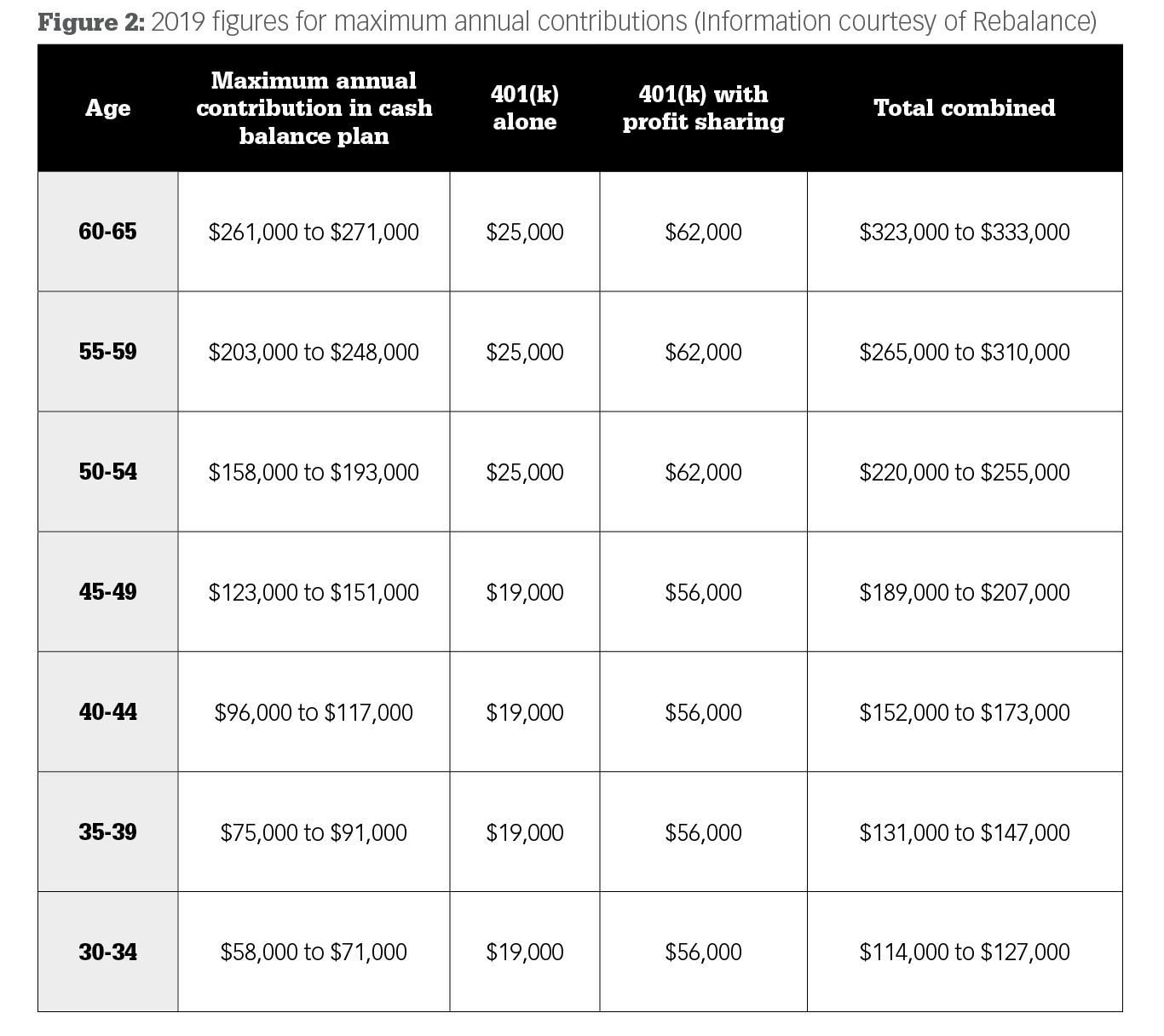

Figure 2 shows the 2019 figures for maximum annual contributions available for different plan types.

Cash balance plans can also be used alongside a defined contribution plan, as detailed in Figure 2. Combining a cash balance plan with a 401(k) provides even more opportunity to defer taxes and can really boost retirement savings. Furthermore, those accounts can be rolled over into an IRA later.

Figure 2Another huge advantage of a cash balance plan is that it can be offered to a limited number of staff. It is possible, for instance, to include just the owner, or the owner and partners. Retirement plans for other employees do not have to impact a cash balance plan. Both 401(k) plans and 401(k) profit sharing plans can still be used as a staff benefit. This ability to combine plans and select who is eligible for each can be used to retain high-value hourly employees, such as hygienists and collections.

Figure 2Another huge advantage of a cash balance plan is that it can be offered to a limited number of staff. It is possible, for instance, to include just the owner, or the owner and partners. Retirement plans for other employees do not have to impact a cash balance plan. Both 401(k) plans and 401(k) profit sharing plans can still be used as a staff benefit. This ability to combine plans and select who is eligible for each can be used to retain high-value hourly employees, such as hygienists and collections.

Disadvantages of cash balance plans

There are also a number of disadvantages that may offset the advantages of using a cash balance plan.

Cash balance plans are more expensive to maintain than regular plans because they require actuarial reviews. Setup fees for a typical cash balance plan can be between $2,000 and $5,000. Annual administrative fees fall between $2,000 and $10,000, plus investment-management fees between 0.25% and 1% of assets. A traditional 401(k) plan alone has annual management fees between 1.0% and 3.5% of assets under management; however, low-cost “modern” 401(k) providers are entering the marketplace.

Cash balance plans are permanent in nature unless there is a change in the business, such as a significant downturn in the company’s finances or the closing or sale of the business. These must offer a lifetime annuity option to employees or a lump sum at retirement. Cash balance plans are complex, so many small-business owners don’t fully understand them.

Is a cash balance plan right for you?

So, is a cash balance plan right for you? The ideal candidate for a cash balance plan is a practice that has consistent cash flow and steady profitability, that is closely held by a small number of partners, and that has highly compensated employees in need of a way to shelter income from tax. Practices that offer less competitive compensation but need to retain experienced staff and avoid costly turnover should also consider a cash balance plan. If you own a practice that has inconsistent cash flow, a cash balance plan is still an option. But it may be better to restrict the cash balance plan policy to a small number of highly compensated staff members or even just the owner.

Reference

1. 2017 National Cash Balance Research Report. Kravitz, Inc. https://cdn.cashbalancedesign.com/wp-content/uploads/2017/08/NationalCashBalanceResearchReport2017.pdf