“Never bet on the end of the world, it only happens once and the odds are long.” — Unknown

“The way to make money in the market is not by timing the market but by your time in the market.” — Unknown

The war in Ukraine is creating an environment that is unpredictable and full of humanitarian and economic consequences. Our hearts go out to the people of Ukraine, and we hope that a diplomatic solution will emerge soon.

While Vladimir Putin wages a conventional war on Ukraine, the U.S., its European allies, and some of the world’s largest corporations are waging a punishing economic war against Russia.

We wanted to express a few thoughts on how this difficult situation impacts the current investment environment, the global economy, and stock markets:

- Inflation. It appears that inflation will be longer-lasting than originally thought. Sources of commodity supplies, and the supply chain in general, are still recovering from the pandemic. The sanctions on Russia further complicate the situation. Given that the war and related sanctions may drag out for weeks, months, or even years, expect higher prices for food and energy to be with us for a while. The Rebalance Investment Committee anticipated rising inflation risk nearly two years ago, as the pandemic began. The firm enhanced inflation protection in our clients’ portfolios by adding Treasury Inflation Protected Securities (TIPS) and high dividend paying U.S. stocks.

- Growth. Prior to the beginning of the war, the U.S. economy was going strong, with a healthy job market and strong consumer spending fueled by the continued post-pandemic reopening of the economy. Higher gasoline prices will have a negative impact on economic growth. Economies outside of the U.S. are more vulnerable to higher prices, and to the price of oil in particular. Europe and Asia are more dependent on imported oil, gas, and grains, which are the major exports of Russia and Ukraine. This could slow global growth and corporate earnings.

- Interest rates. The U.S. Federal Reserve’s rate-setting committee on March 16 enacted a 0.25% hike in short-term interest rates. While this is lower than the 0.50% that the market had feared pre-war, it is a signal that the Fed still believes it necessary to quell inflation, irrespective of the war.

- Volatility. This is a tricky situation for political leaders and central bankers to navigate. The geopolitical situation could turn on a dime. Given the uncertainty and fluidity of the situation, capital markets are likely to remain volatile. There will be extra scrutiny of economic data releases, corporate earnings reports, commodity prices, and news from Ukraine. Buckle up and expect some wild swings in markets.

We thought that it might be helpful to consider some historic perspective.

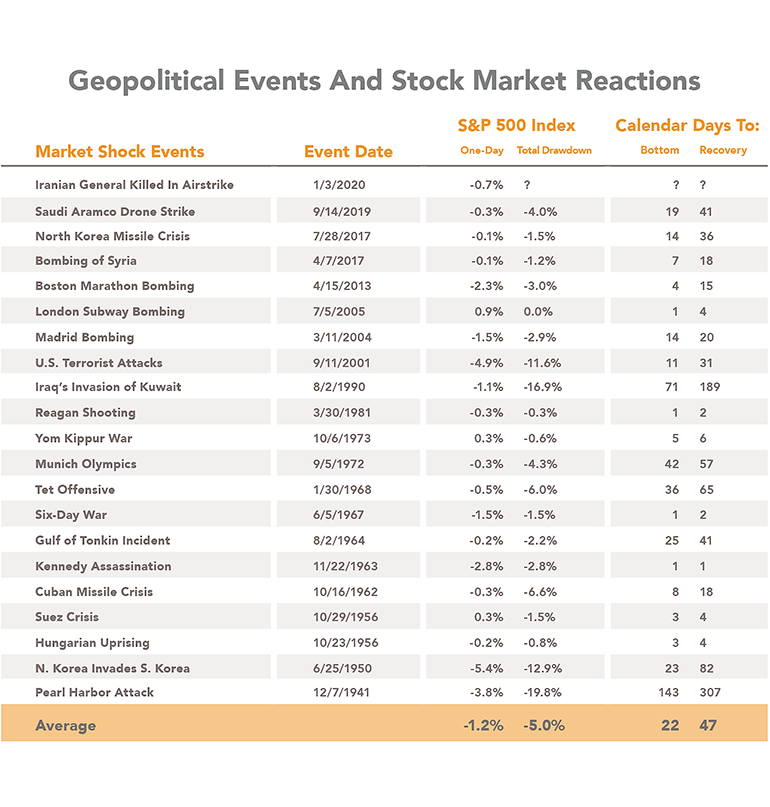

Geopolitical conflicts often create sharp stock market sell-offs followed by rapid recoveries (see table below). This is, of course, a selected historical view and may not be representative of the current situation with Russia and Ukraine.

It does, however, illustrate the risk of reacting in the short term to stock markets that may already have priced in fears common among investors during troubled times.

The Rebalance investment approach anticipates global disruptions and does not seek to change the composition of client portfolios based on current market events.

Rather, our firm builds portfolios with a long-term strategic view. Portfolios are rebalanced twice annually, in late April and October. This is purely a mathematical exercise meant to help mitigate portfolio risk over time.

Proven philosophy

Similar to what we all experienced during the early stages of COVID-19, volatile markets can make investors more emotional. While this certainly is a time to be aware of your emotions, it is not a good time to change one’s long-term investment plan or to act on predictions.

Capital markets already have adjusted to some degree in the face of this unfolding tragedy. Our advice is that, as difficult as things might appear now, you can take comfort in the proven and durable long-term investment philosophy we have long espoused here at Rebalance.

We remain focused on the idea that staying with your investment plan during difficult periods is the wisest approach. We continue to hope for world peace and calmer stock markets going forward.