I just pulled a Rip Van Winkle—and maybe you should, too.

I’m back at my regular post at The Wall Street Journal after being away on book leave. That long hiatus disengaged me from the daily hubbub of markets so I could frame investing ideas in a longer historical and broader psychological perspective.

Like the character in the Washington Irving story who woke up after a 20-year nap, I’ve returned to a world both transformed and hauntingly familiar. The best part about coming back after this market sabbatical is noticing how silly so many forecasts seem to be—including my own. The second best part is the contentment that comes from never having been remotely tempted to act on any of those forecasts.

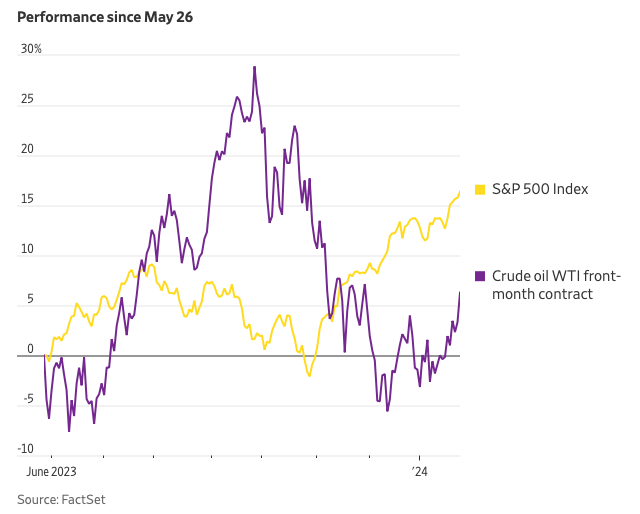

When my last regular column ran last May 26, the S&P 500 was already up 10.3% in 2023—right in line with the long-term average annual return of U.S. stocks. “Let’s just call it a year right here,” I recall muttering to myself.

That was the last thing I remember. From that day to this week, I tuned out the daily noise of fluctuations in stocks, bonds, commodities and economic indicators.

What’s that you say? The S&P sank more than 10% and the Nasdaq Composite Index fell more than 12% between July and October? Then, in three wild weeks, they roared right back out of their declines?

I never noticed.

You say the yield on the 10-year Treasury, 3.8% when I left, shot up to 4.99% in October, then promptly reversed and sank almost all the way back, to 3.9% by year end?

On a chart, it looks like the cross-section of a volcano. I was oblivious.

When I left, investors and analysts were obsessed with guessing when and how many times the Federal Reserve would finally cut interest rates.

They still are.

Their guesses were largely wrong—and will probably continue to be.

It’s a good thing the market gods ignored me, as they always do. Even though I thought a 10.3% return in five months was plenty for an entire year, the S&P 500 finished 2023 up more than 26%, including dividends.

When you don’t watch the market every day, you can finally see with unquestionable clarity that what you would have expected to happen didn’t. The unexpected did.

Had you told me war would break out in the Middle East in October and last for months, I would have been sad but unsurprised. Had you added that crude oil would—after a fleeting surge—finish 2023 at a lower price than the day I left, I would have been amazed.

In May, I already wondered whether

—then up 167% in 2023—had risen too far too fast. The computer-graphics giant at the forefront of the artificial-intelligence boom has since gained another 58%.

I’m not saying that the news doesn’t matter or—heaven forbid—you should stop reading the Journal.

I am saying that reacting to the news—or even feeling you’re supposed to—can poison your portfolio and sour your life.

If you’re tempted to make drastic changes to your portfolio in response to the headlines, then you could benefit from simulating my market sabbatical.

You probably can’t disappear for seven months, but you can pretend you did. Hal Hershfield, a psychologist at the University of California, Los Angeles and author of “Your Future Self: How to Make Tomorrow Better Today,” urges investors to “use the tools of mental time travel to escape the tyranny of the present.”

He means that envisioning how you will feel about your actions tomorrow can help prevent you from overreacting today.

One tool of mental time travel is to write a letter to—and from—your future self.

Let’s say you can’t stop reading about artificial intelligence, believe it has even greater potential than most investors think, and want to go from having 5% of your money in Nvidia to 25%. Conversely, let’s say the headlines have you so worried your preferred presidential candidate will lose that you want to move all your money to cash.

In the letter to your future self, detail what you’re planning to do, why you think it makes sense and what results you foresee.

In the letter from your future self, imagine it’s one year from now and you’re living with the consequences of the decision. Has Nvidia’s stock price taken your happiness hostage? Do you face a colossal tax bill from shifting your portfolio into cash? Are you concerned about running out of money for retirement? How would your life be different if your earlier self hadn’t reacted—or overreacted—to the news?

For general templates of such letters, see the “Future Self Tool” at consumerfinance.gov.

Research suggests this technique can help you avoid making decisions you might later regret—and can reduce the anxiety stirred up by negative news.

I’ve long thought financial advisers should encourage this approach to help clients make deliberate and durable decisions. Now I think it’s worth trying on yourself, too.