Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains.

Source: The Wall Street Journal May 6, 2023.

What Investors Should Know About Money-Market Funds and CDs

Investors are turning to these cash-equivalent investments, some of which are yielding 5% or more. But it pays to have a strategy beyond fear.

By Lori Ioannou

Investors are rushing into cash, fearful of a recession later in the year.

In addition to having emergency cash on hand, individual investors are pouring billions of dollars into cash-equivalent investments such as money-market funds and certificates of deposit that are yielding 5% or more—far more than a traditional low-yielding bank savings account.

Some analysts say concerns about stability in the banking sector after the collapse of Silicon Valley Bank and Signature Bank, and most recently First Republic Bank, could help propel the trend in the weeks to come.

“Investing in these vehicles is a short-term hedge. It’s a way for investors to capture some low-risk returns without having to worry about the wild swings in the stock and bond markets,” says Bryan Cannon, CEO and chief portfolio strategist at Cannon Advisors in Charlotte, N.C.

For investors, however, the key question is whether they have a cash strategy beyond fear. How much one should allocate to cash or cash equivalents, for instance, depends on an individual’s financial goals, risk tolerance and anticipated expenses, financial advisers say.

“It’s important not to be seduced by the higher rates these products have to offer,” says Andy Smith, executive director of financial planning at Edelman Financial Engines. Instead, he says, investors should make sure their portfolios are invested in a broad cross-section of stocks, bonds, real estate, commodities and other alternative asset classes to balance risk during these turbulent economic times.

“Cash or cash equivalents should represent just a small percentage of your asset allocation, often ranging from 5% to 10%, depending on your goals and risk tolerance,” says Mr. Smith. “There is a cost of being out of the market. It could be a headwind that prevents you from reaching your long-term retirement goal.”

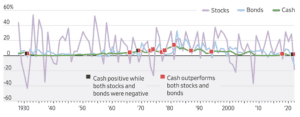

If history is a guide, putting too much of one’s portfolio in cash is a strategy that can backfire and be a drag on portfolio performance. According to Angelo Kourkafas, senior investment strategist at Edward Jones, “Cash has outperformed both stocks and bonds only 12 times over the course of a year since 1929. Last year was one of those times.”

Stocks and Bonds and Cash, ‘Oh My!’

Since 1928 cash has outperformed both stocks and bonds over the course of a calendar year 12 times (just 13% of all instances). The only three times that cash was positive while both stocks and bonds were negative was in 1931, 1969 and 2022.

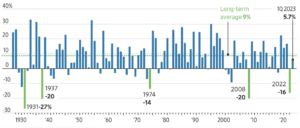

The highs and lows of stronger returns often follow declines of 10% or more

Note: Stocks represented by the S&P 500 TR USD Index and by the IA SBBI US Large Stock TR USD Index prior to 1988. Bonds represented by the Bloomberg US Agg Bond TR Index and by the IA SBBI US IT Govt TR Index prior to 1976. Cash represented by the BBgBarc US Trsy Bellwethers 3Mon TR Index. Sources: Morningstar Direct; Edward Jones

There is another market variable that investors must consider as well: the Federal Reserve’s actions on interest rates in the months ahead. The Fed on May 3 approved another quarter-percentage-point interest-rate rise, bringing its benchmark federal-funds rate to a target range between 5% and 5.25%, a 16-year high.

“If the Fed decides to cut interest rates instead of raising them, yields on CDs and other cash-equivalent instruments may decline, while equities rebound. No one can predict the future or time the market, so know the trade-offs,” Mr. Kourkafas says.

Here is a look at the pluses and minuses of money-market funds and certificates of deposit, the typical havens for cash.

Money-Market Funds

About $488 billion has poured into money-market mutual funds this year through April 27, according to Crane Data. These funds now hold a record $5.687 trillion in assets, up from $4.941 trillion a year ago.

“Investors have been lured by the attractive rates they offer,” says Peter Crane, president of Crane Data. The Crane 100 Index of the largest taxable money-market funds has an average yield of 4.65%, up from 0.02% on Jan, 1, 2022. “Money-market funds haven’t looked this good in their 50-year history except in 1979 when they were yielding double digits,” he says. “Recent inflows are among the strongest they have ever been.”

These funds—which are different than money-market savings accounts offered by banks—invest in short-term debt instruments such as U.S. Treasury bills and are considered “cash equivalents,” offering investors liquidity with extremely low levels of risk. They work like a typical mutual fund and issue redeemable units or shares to investors. But a key difference is that these funds aim to maintain a net asset value of $1 a share, and earnings generated through interest on portfolio holdings are distributed to investors in the form of dividends.

Money-market funds come in several varieties. Treasury money-market funds invest in short-term U.S. Treasury-issued securities such as Treasury bills. Other types may invest in federal agency notes, repurchase agreements, certificates of deposit or commercial paper.

According to Mr. Crane, “These funds have become increasingly popular with mom-and-pop investors, and there has been a surge in inflows into these funds since the blowup with Silicon Valley Bank in mid-March.”

He says the retail funds that have seen the biggest net inflows year-to-date through April 27 are the $240.7 billion Vanguard Federal Money Market Fund (VMFXX), with inflows of $25.1 billion, and the $117.2 billion Schwab Value Advantage Money Fund-Investor Shares (SWVXX), with inflows of $24.2 billion.

When assessing these funds, advisers suggest looking at the seven-day SEC yield, which is annualized and net of fees and is the standard measure of performance for money funds.

Also check if the fund is taxable or tax-exempt. That will depend on the type of securities the fund invests in, says Mr. Crane. Then decide if you want the extra safety of a government fund, or if you’ll take the extra yield in a “prime” fund that invests in corporate commercial paper, repurchase agreements, certificates of deposit and other bank debt securities, he says.

Pros: Money-market funds are highly liquid, more so than CDs and other similar investments. They offer higher yields than traditional savings accounts, and are considered safe and stable.

Cons: These funds typically aren’t insured by the FDIC like bank deposits and CDs. They are sensitive to interest-rate fluctuations, and some have high minimum-investment requirements.

Certificates of Deposit

Balances in CDs skyrocketed to about $577 billion in March from $36.6 billion in April 2022, according to the Federal Reserve. The accounts, insured by the FDIC up to $250,000, have a fixed interest rate and require savers to commit to saving money for a set period, typically six months or a year.

While the average yield on a 12-month CD is around 1.66%, according to Bankrate, many banks are offering CDs with yields of 5% or more. “Yields are the best they have been in 15 years, and now investors are taking action,” says Greg McBride, chief financial analyst at Bankrate.

“When shopping for any CD, check the minimum deposit required and be sure you can live without the money for the full term,” says Mr. McBride. “Shop around to find the best rates and terms.”

Among the possibilities: a six-month CD yielding 5% offered by Synchrony Bank that has no minimum deposit requirement, and a one-year CD offered by BMO Harris Bank yielding 5.10% that has a $1,000 minimum deposit requirement.

Many financial advisers suggest using a ladder approach when investing in CDs. This is a savings strategy that involves buying CDs with staggered maturities to take advantage of higher rates, while keeping some funds accessible in the short term.

“What’s great is that a CD ladder works in environments when interest rates are going up, and when they are going down,” says Jan Holman, director of adviser education at Thornburg Investment Management.

The mechanics of setting one up is simple. Let’s say you wanted to build a one-year ladder with four rungs. If you have $20,000 to invest, then you might divide the funds equally in four CDs with maturity dates of three, six, nine and 12 months. As each CD matures you can cash out if interest rates are falling, or you can continue to build your ladder by reinvesting in new CDs with higher yields when interest rates are rising.

One type of CD that is getting attention these days is the brokered CD. These instruments are issued by banks but sold through a broker or brokerage firm.

Many offer higher yields and longer terms than traditional bank CDs. There also is a secondary market for them, meaning investors can sell them before the term is up.

Buying brokered CDs may require opening a brokerage account. Investors can purchase CDs from more than one bank via the broker and hold them in a single brokerage account. Since federal insurance covers $250,000 for each bank, someone who buys CDs from different banks and keeps them in a brokerage account will have separate insurance for each CD.

“Interest in brokered CDs has been growing since late last year as investors look for new ways to deploy their cash,” says Alvin Carlos, a certified financial planner and CEO of District Capital Management in Washington, D.C.

Still, these vehicles have some downsides. Some brokered CDs can be called back by the issuing bank before their maturity date, meaning investors will lose out on the full earnings potential they were expecting. This is most likely to happen when interest rates drop. Advisers say investors can check the offering materials to see if a brokered CD has a call option.

Pros: CDs are currently offering higher rates of interest on deposits than many traditional bank-savings accounts. They have guaranteed returns. CDs are covered by FDIC insurance.

Cons: Your money typically is locked up until the CD matures. Some come with early withdrawal penalties, which can be a flat fee or percentage of interest earned. They carry interest-rate risk. Some brokered CDs have call options.