Warren Buffett Has A Simple Rule: Bad News First

by Mitch TuchmanWant people to trust and admire you, maybe even fall in love with you? Never pull your punches. It’s a contrarian approach to life, and possibly the hardest thing to do when it comes to money and investing, but owning up to what’s going wrong is crucial, say an expert who studies the investing style… Continue reading

You Can Retire With Less Than $1 Million

by Mitch TuchmanRetirement investing is a difficult topic for many of us, and not just because of complexity. Rather, our emotions tend to get the better of us. Like starting up a huge mountain, the work of creating a retirement nest egg seems impossible. So we tend to shut down and think about other things instead. Kids,… Continue reading

Bruce Springsteen Isn’t Planning To Retire

by Mitch TuchmanIconic performer Bruce Springsteen is out with a memoir of his life in music, unsurprisingly entitled Born to Run. It’s his first attempt to capturing his own story, although many others have written it before, some even writing him off. One biographer joked that he was “too old to rock” in 1989 — 27 years… Continue reading

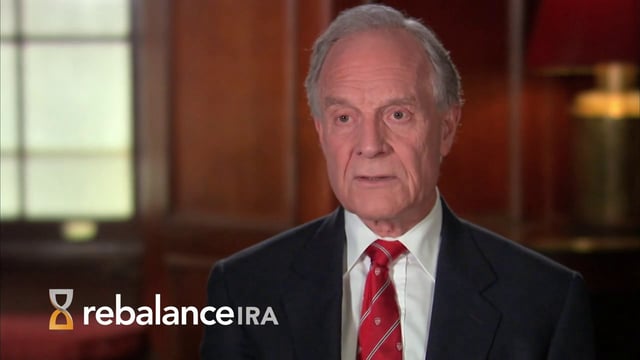

Ellis, Bogle Agree: Investing Fees Are The Problem

by Mitch TuchmanIn an interview with Bloomberg TV, Vanguard Group Founder Jack Bogle lowered the boom on critics of index investing and low investing fees. “Idiotic” is how he characterized one research analyst’s viewpoint. “Totally wrongheaded.” I can only imagine how that poor analyst must feel about now, having the dean of American investing call him out… Continue reading

The Stock Market Doesn’t Care About Clinton or Trump

by Mitch TuchmanAs the cooler air of fall sets in, a lot of us are feeling a mixture of dread and relief over our strange and seemingly endless presidential campaign season. We have only a couple of months to go before voters settle on either Hillary Clinton or Donald Trump. The dread comes from not knowing how much more intense things… Continue reading

Charley Ellis: The Simple Reasons Index Investing Wins

by Mitch TuchmanIt always amazes me when people make the case for actively managed investment funds. If you understand the evidence against active trading — and in favor of index investing instead — it takes a heap of willful ignorance to keep believing. I understand why, though. Often, proponents of active management are investors of a certain… Continue reading

John Bogle: ‘Fight On’ For Retirement Investing Fairness

by Mitch TuchmanTransparency is a fancy word you hear a lot when it comes to corporations and government, but it just means being clear with people. Say what you do, then do what you say. It couldn’t be simpler, but nothing is simple once money is involved. And the more money at stake, it seems, the less… Continue reading

Stock Pickers Win Battles And Lose Wars

by Mitch TuchmanJuly was a bright spot for mutual fund managers who insist that stock picking is the way to make money. Sixty-seven percent of large-cap stock pickers beat their benchmarks while small-cap managers did their best so far this year, with 43% of them beating their index. Deal me in, right? Except that those July numbers were… Continue reading

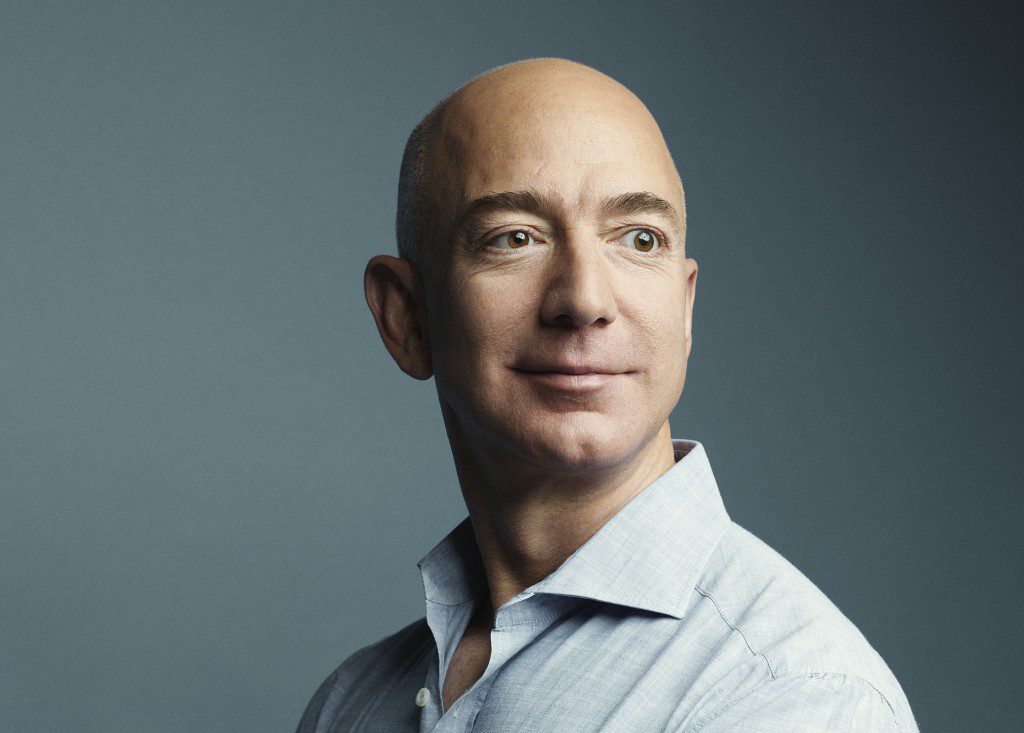

Buffett, Bezos and Hedge Fund Guesswork

by Mitch TuchmanFunny how obvious things can be in the rear-view mirror. Jeff Bezos, founder of online retail giant Amazon, recently saw his wealth surpass that of investing legend Warren Buffett. Separately, Buffett’s own wager on the broad stock market index against a collection of hedge funds continues to embarrass the supposed “smart money” at those funds. There are some very… Continue reading