Our Blogs

Inheritance? Here’s Why Not to Pay Off Your Mortgage

by Christie Whitney, CFP®We all know the stories of famous athletes who go broke. And then there is the infamous “lottery curse,” where winners end up bankrupt a few short years after hitting the jackpot. Most folks think that they’re smarter than that. They believe they will properly manage any inheritances that come their way. If only we… Continue reading

What Investors Should Know About Money-Market Funds and CDs

Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains. Source: The Wall Street Journal May 6, 2023. What Investors Should Know About Money-Market Funds and CDs Investors are turning to these cash-equivalent investments, some of which are yielding 5%… Continue reading

What is the worst time to hire a financial adviser?

Rebalance Managing Director Mitch Tuchman outlines in this column how one should take financial advice as seriously as they take medical advice. by Mitch Tuchman, January 31, 2024 If the number of digits on your retirement account balance surprises you, that might be a sign you need to get help with your financial decisions. The average… Continue reading

More Americans own stocks. This is great for their financial future.

For the first time since the stock market crash of 2008, consumer confidence with the stock market has returned. According to legendary Washington Post columnist, Michelle Singletary, investors have had a bumpy ride over the past decade. In the process, they have been rewarded with annual returns of approximately 12%. More Americans own stocks. This… Continue reading

What Investors Should Know About Money-Market Funds and CDs

Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains. Source: The Wall Street Journal May 6, 2023. What Investors Should Know About Money-Market Funds and CDs Investors are turning to these cash-equivalent investments, some of which are yielding 5%… Continue reading

With the Odds on Their Side, They Still Couldn’t Beat the Market

The Rebalance tried-and-true adage remains the same, echoed by this NYTs columnist: it is nearly impossible to beat the stock market. The most prudent long-term investing strategy is to “own” the entire stock market through low-cost, broad exposure index funds. Source: The New York Times April 14, 2023. With the Odds on Their Side, They… Continue reading

The 60-40 Investment Strategy Is Back After Tanking Last Year

With the perspective of time, the calls for the death of the 60%/40% investment strategy came too soon. The click-bait articles of 2022 did not deter the Rebalance long-term investors. Source: The Wall Street Journal April 12, 2023. The 60-40 Investment Strategy Is Back After Tanking Last Year The recovery has emboldened investors who didn’t… Continue reading

Secure 2.0: Wide-Sweeping Retirement Legislation Passed by Congress

by David RanneyAt Rebalance, we strive to make investing and saving for retirement smoother, safer, and easier for our small business owner clients and their employees with our BetterK solution. The recent passage of the new Secure Act 2.0 aims to expand access to retirement plants, increase retirement savings, help Americans preserve income, and streamline retirement plan… Continue reading

Inheritance? Here’s Why Not to Pay Off Your Mortgage

by Christie Whitney, CFP®We all know the stories of famous athletes who go broke. And then there is the infamous “lottery curse,” where winners end up bankrupt a few short years after hitting the jackpot. Most folks think that they’re smarter than that. They believe they will properly manage any inheritances that come their way. If only we… Continue reading

More Munger

Charlie Munger, the vice chairman of Berkshire Hathaway, left a significant legacy when he passed away last November, just shy of his 100th birthday. Charlie Munger, along with Warren Buffett, have always invested with the long-term in mind and advocated for investing practices that align with the Rebalance approach. You may want to check out… Continue reading

Target Date Funds: Smart Investment or Hidden Danger?

by Matt Jude, CFP®, ECAOver half of non-retired Americans have a defined contribution pension plan through their employer (source: Federal Reserve), with the most common types being 401(k) and 403(b) plans. These employer-sponsored plans can be an excellent vehicle for individuals to save on taxes and put money aside to create a secure retirement. Unfortunately, many people in… Continue reading

Roth IRAs Can Transform Your Retirement Planning

by Christie Whitney, CFP®Savers maxing out their 401(k) plans are likely to hear about one strategy preached endlessly: open a Roth IRA or get taxed to death in retirement. It can get overblown, but there is a kernel of truth here. Having tax flexibility in your later years is a gift that keeps on giving. That is because… Continue reading

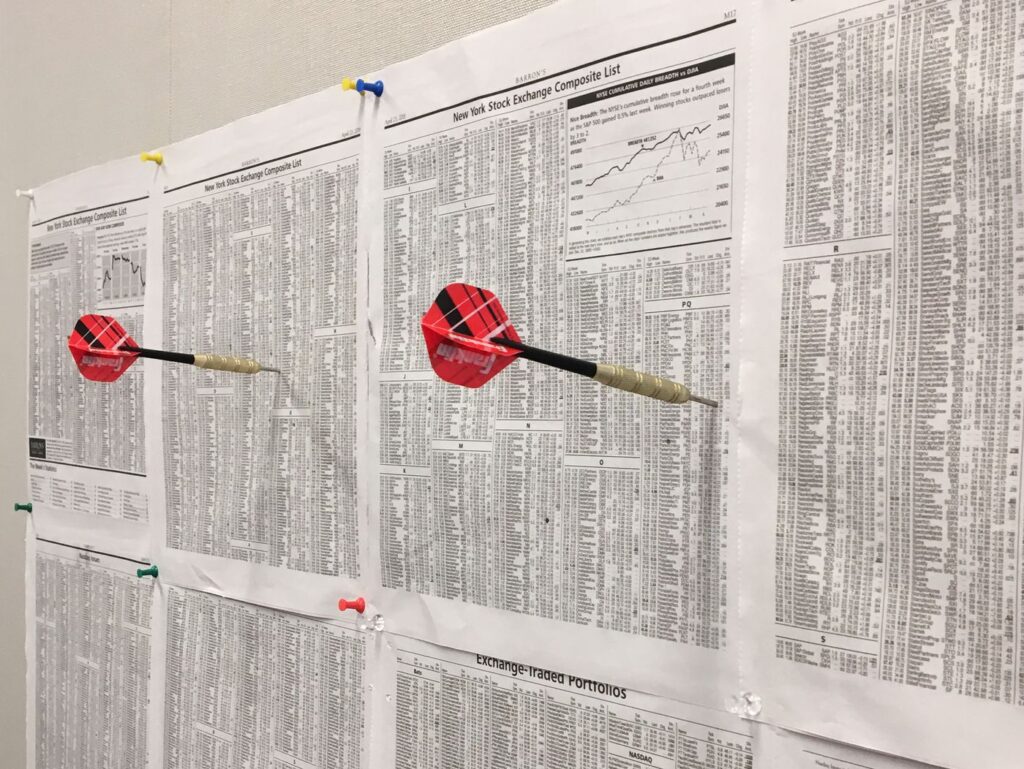

The Random Path to Stock-Market Riches

In his Wall Street Journal piece, Spencer Jakab explores how haphazard stock selection, inspired by Burton Malkiel’s ideas from “A Random Walk Down Wall Street,” demonstrates the surprising success of random stock picks over expert fund managers. The Random Path to Stock-Market Riches by Spencer Jakab, May 13, 2024 Words rarely heard from star fund… Continue reading

Backdoor Roth IRAs Are Promising — and Perilous

The “backdoor” Roth IRA presents a tantalizing solution for those keen on maximizing savings, offering tax-free growth and withdrawals. Read Laura Saunders’ article from the Wall Street Journal below to learn more. Backdoor Roth IRAs Are Promising — and Perilous by Laura Saunders, May 3, 2024 For determined savers, the backdoor Roth IRA is an… Continue reading

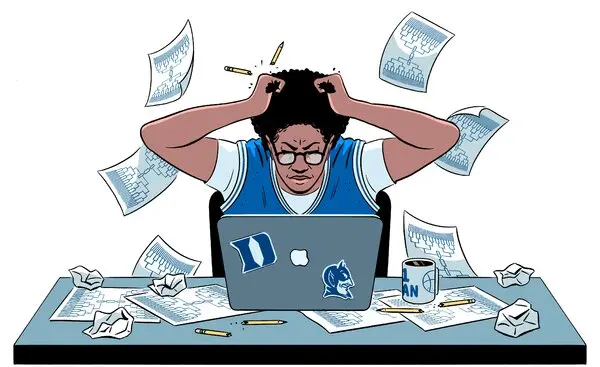

Upsets Belong in Your March Madness Bracket – Not Your Stock Portfolio

by Scott PuritzHope springs eternal, especially in March. Like many firms, ours runs an informal NCAA basketball tournament pool for our employees. It is fun. This time of year, the NCAA Basketball Tournaments thrill fans and create so much interest that it is estimated one in four Americans fills out a bracket to predict who will win… Continue reading

The Psychologist Who Turned the Investing World on Its Head

Last week, the investing world lost a giant – Daniel Kahneman. A psychologist at Princeton University and winner of the Nobel Prize in economics, Kahneman may well have had more influence on investing than anyone else who was not a professional investor. Jason Zweig wrote a lovely tribute to Kahneman in his WSJ column. Check… Continue reading

Redesigning Retirement

Learn strategies for organizations to leverage the experience of older workers and address skill gaps in the workforce. The below article offering invaluable insights into navigating pressing issues such as talent shortages and shifting demographics. Written by Ken Dychtwald, Robert Morison, and Katy Terveer, this article is a must-read for anyone interested in the future… Continue reading

Artificial Intelligence and the Rise of the Machines (in Your Portfolio)

by Drew Pratt, CFAThe era of Artificial Intelligence is here, and boy are people freaking out. AI is the application of mathematics and software code to teach computers how to understand, synthesize, and generate knowledge in ways similar to how people do it. AI is a computer program like any other – it runs, takes input, processes, and… Continue reading