Bogle: A Clear Sign A Fund Will Lose Big

by Mitch TuchmanJason Zweig, The Wall Street Journal’s “Intelligent Investor” columnist, recently wrote about a curious trend among financial advisors — holding index-style exchange-traded funds. That’s right, owning the index, yet still charging a premium for advice because, well, why not? The argument from the managers is disarmingly simple: While they still make some bets on specific stocks, it’s getting… Continue reading

Think Like Buffett, Buy What’s Ugly

by Mitch TuchmanHere are a pair of seemingly random investment news headlines. See if you can spot the connection. Warren Buffett, the iconic billionaire investor, has invested nearly $1 billion into the oil business since the start of 2016. Meanwhile, oil market experts are warning that 99-cent gasoline is a real possibility. Do you see the clear… Continue reading

New Rules Designed To Make Retirement Investing Safer

by Mitch TuchmanIf you book a hotel online, you expect to see the prices first. When you go to take a trip by airplane or rent a car, same thing. Why not the same with retirement investing costs? Is there something special about investing for retirement that requires secrecy, obscurity, a lack of simple disclosure? Of course… Continue reading

John Bogle Dismisses Index Fund ‘Danger’

by Mitch TuchmanRetirement investors likely have read about active investment managers and hedge fund chiefs who warn of the growing “danger” of index fund investing. Indexing does well in bull markets, they charge, but stumbles in bear markets. You’ll make more trading against indexers in downturns, they claim. Further, they argue, index funds foster complacency among investors. To which John Bogle, founder… Continue reading

John Bogle: Never Play A Loser’s Game

by Mitch TuchmanJohn Bogle, the father of passive investing, has this very simple piece of advice for anyone seeking to make their money grow. Don’t try so hard. When you make investing into work, inevitably you run the risk being wrong and losing big money. In fact, he uses the same words as Charley Ellis, a member… Continue reading

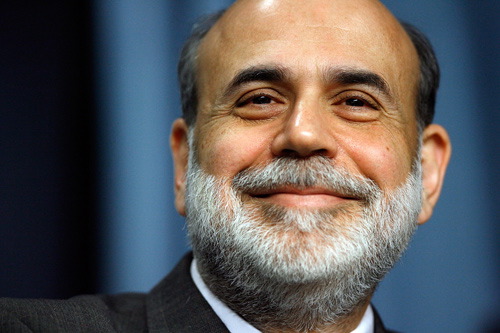

Ben Bernanke Nails The Case For Passive Portfolio Investing

by Mitch TuchmanIt’s always tricky when the past holder in a major office — say, a former U.S. president — gets interviewed. You can’t second-guess your successor, nor can you offer fluffy non-answers to pointed questions. Ben Bernanke, the recent former head of the U.S. Federal Reserve, found himself on the hot seat recently, answering very pointed questions about… Continue reading

The Gold And Oil Crash Doesn’t Matter

by Mitch TuchmanGold is falling like a rock (which it is), preparing to bust through $1,000 an ounce and possibly headed lower. Oil could hit $20 a barrel before the dust settles, energy analysts warn. What the heck is going on? Nothing unusual at all. Commodities are volatile. That’s because prices for so-called “real assets” are driven entirely by… Continue reading

Jim Cramer: Profit From This Market Drop

by Mitch TuchmanJim Cramer, the CNBC host known for doling out advice to active traders, is read by millions. Many of them, for better or worse, are not traders but long-term retirement investors. Thus his otherwise logical approach to stock investing sometimes can turn out to be exactly backwards. Cramer himself has extolled the virtues of index… Continue reading

Beware: Stock Broker Fraud Is Rampant

by Mitch TuchmanYou probably have at least a minimal expectation that financial regulators in Washington are looking out for you. And you’d be wrong — and a lot poorer in retirement as a result of that misplaced trust. While the fight continues to enact clearly written and fair rules of engagement for investors, stock broker fraud cases… Continue reading