When Markets Tumble, Be Like Bogle — ‘Don’t Peek’

by Mitch TuchmanWill there be a Santa Claus rally this year? The hedge funds better hope so. Just owning the market in an index fund is set to demolish active managers once again, according to data from the University of Pennsylvania. Importantly, this is not just a game in which the clock has run out and managers get to… Continue reading

Warren Buffett On Track To Win Against Hedge Fund

by Mitch TuchmanThere’s just three years left in the 10-year bet between billionaire Warren Buffett and a New York hedge fund firm, and it seems clear that Buffett will win handily. More investment magic from one of the world’s richest men? Not at all. Buffett’s side of the bet was one anybody could have taken: Buy the… Continue reading

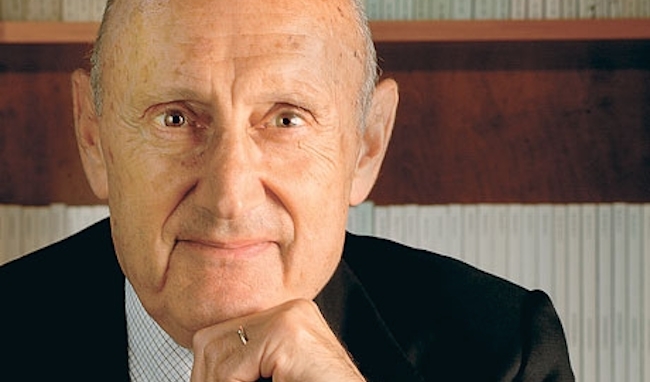

Burt Malkiel On Active Management’s Big Miss

by Mitch TuchmanBillions of dollars in retirement assets have been leaving active managers’ hands in favor of index funds. New data from Bank of America shows why: So far this year, just 17.7% of active managers have bested the large-cap index benchmark. Last year, the percentage of “winning” managers was 40.5%, reports the bank. As a result,… Continue reading

Warren Buffett’s Most Disarmingly Simple Advice

by Mitch TuchmanBillionaire investor Warren Buffet and his partner Charlie Munger get a lot of investment ideas thrown at them. And every idea ends up in one of three boxes: One box is marked “In.” Those are the ideas the duo feels might work. A second box is marked “Out.” That’s for ideas Buffett and Munger agree… Continue reading

John Bogle: Why Your Retirement Plan Stinks

by Mitch TuchmanHow important are fees to your retirement plan’s success? As Vanguard founder John Bogle pointed out in a recent discussion with analysts, it’s really all that matters. Fees easily wipe out a huge portion of the yield on stocks, he said, more than 63% of your money. That’s the real danger to retirement savers, especially… Continue reading

Burton Malkiel On October’s Rough Ride: Hang On

by Mitch TuchmanIt has been a rough October, the kind of month that has many retirement investors stopping to take stock of their assumptions. Too often, though, they react to “down” months like this one by making wholesale changes to their investments. Can you make the right move at the right time? Can anybody? Princeton’s Burton Malkiel, author… Continue reading

Warren Buffett Is Not Worried About This Market

by Mitch TuchmanAmid all the of doomsday predictions and fearful hand-wringing about the stock market, the knowing chuckle of billionaire investor Warren Buffett once again puts panic into context. Of course he’s buying stocks. Prices are falling, so why not? Like with his famous “hamburger quiz,” the best time to buy any asset is when it’s cheaper,… Continue reading

Bogle’s ‘Scary Math’ Shows Up In Retirement Balances

by Mitch TuchmanJohn Bogle, founder of the Vanguard Group, recently explained the unavoidable mathematical reason why passive wins over active in retirement investing: You keep more of your own money invested, and it compounds in your favor, not Wall Street’s. Fees paid to active managers end up equaling a huge amount of lost return, up to 80% of your gains over… Continue reading

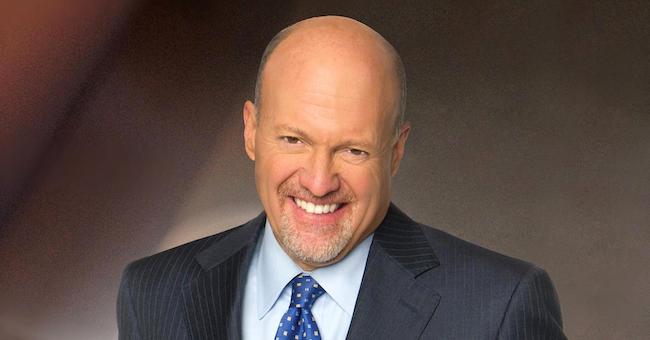

How Jim Cramer Called The Big Bond Shakeup

by Mitch TuchmanThe reason “bond king” Bill Gross was destined to depart from his own company, Pimco, isn’t so hard to understand. His Total Return fund had some good years and some great years, sucked in hundreds of billions in assets and got very, very big. Bigger than the economies of developed countries kind of big. As Jim… Continue reading