The debate about the value of active vs. passive management, whether investors should try to “beat the market” return or instead simply replicate it cheaply, can seem never-ending.

I find the passive vs. active debate misleading. You could argue endlessly about how active funds underperform eventually, even if some outperform from time to time.

There have been tons of studies done over the years. Whole books on it.

But, for a retirement investor with a 5- to 25-year time horizon, there is one method that clearly gets the best result.

That’s using a variety of investments in a tax-deferred retirement account, owning low-cost index funds, and rebalancing at least once a year.

It’s incredibly simple. The real driver of long-term value is not stock picking. And it’s not just about being utterly passive, as in doing nothing at all.

Rather, it’s actively working to keep costs low, diversification, and rebalancing.

Focus on cost

We know real value comes from rebalancing, selling gainers and reinvesting in parts of a portfolio that have declined in comparison.

Princeton Professor Burton Malkiel, a member of the Rebalance Investment Committee, found that just rebalancing a basic stock and bond portfolio annually added 1.5% in return above the straight stock-market over a 15 year period.

I would go farther and suggest, as Malkiel does for our clients, that it’s important to own multiple types of investments.

Not solely the S&P 500 Index of big U.S. stocks but also small-cap, foreign large-cap, and emerging-market stocks. Not just bonds but real estate, too.

As you can imagine, the relative values of these investments will vary over time. That’s why rebalancing is such a powerful tool.

Finally, keep focused on low cost. It is patently clear that every dollar you keep continues to work for you and not for the active manager.

Rather than give away a third to half of your potential return to a financial advisor, you get to keep it for your retirement.

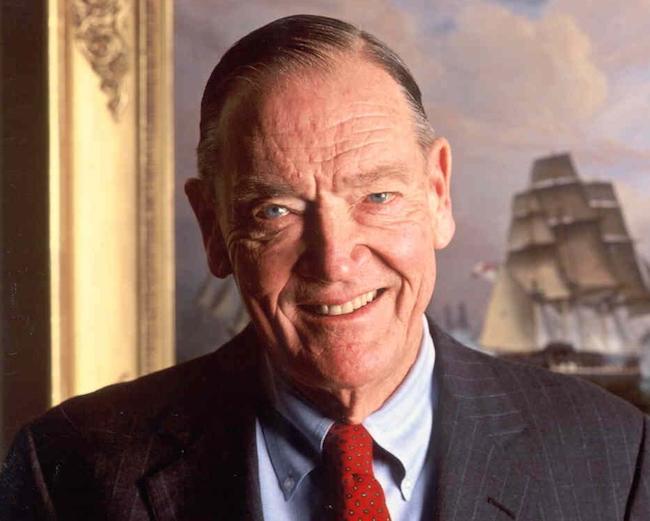

As Vanguard Founder Jack Bogle once explained, in what other industry can you put zero dollars at risk and earn up to 80% of the gains?

That’s what happens over a lifetime of active investing. Over the long run, the active investment manager gets 80 cents of the returns you make and you get 20 cents — and it’s your money at risk!