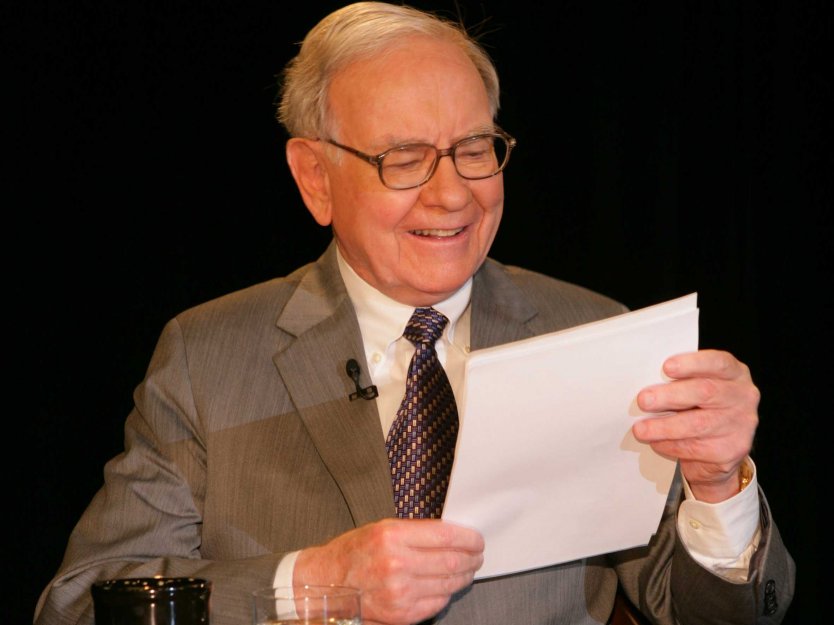

By now you’ve likely seen billionaire investor Warren Buffett’s latest effusive praise of Vanguard Group founder John Bogle. “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle,” Buffett wrote in his latest letter to investors in Berkshire Hathaway, Buffett’s holding company.

Buffett went on: “In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

High praise indeed. Yet lost in the analysis I’ve read so far is just how well-earned that praise is. In fact, Buffett himself supplies fascinating and concrete examples of Bogle’s legacy throughout the letter.

Here are those numbers:

$100 billion

Buffett argues that over just the past 10 years supposedly “elite” investors have wasted more than $100 billion on useless investment advice. By elite he means wealthy individuals, pension funds, college endowments and similar large pools of money.

Buffett gets this number by multiplying the assets they control, several trillion dollars, by the typical active management fee of 1% of assets. As Buffett notes, it’s an estimate but probably a conservative one. For starters, hedge funds charge far more than 1%.

Why do smart people throw away money? Buffett admits to being befuddled but his guess is it comes down to ego: “Wealthy individuals, pension funds, endowments and the like will continue to feel they deserve something ‘extra’ in investment advice. Those advisors who cleverly play to this expectation will get very rich. This year the magic potion may be hedge funds, next year something else.”

$90 trillion

This figure comes from Buffett’s long section on why he thinks it’s a mistake to bet against America. He is not being merely patriotic. Like Bogle, Buffett profoundly believes in democratic capitalism and argues that investing in U.S. stocks is the key to financial success. America’s wealth, he says, is no accident of history.

“You need not be an economist to understand how well our system has worked. Just look around you. See the 75 million owner-occupied homes, the bountiful farmland, the 260 million vehicles, the hyper-productive factories, the great medical centers, the talent-filled universities, you name it — they all represent a net gain for Americans from the barren lands, primitive structures and meager output of 1776,” he writes. “Starting from scratch, America has amassed wealth totaling $90 trillion.”

17,320%

If you have a hard time understanding how democratic capitalism has created such wealth, consider the Dow Jones Industrial Average during the 20th Century, he says. The Dow posted a 17,320% capital gain over those 100 years, a gain fueled in part by rising dividends, money returned to the hands of investors. “The trend continues: By yearend 2016, the index had advanced a further 72%, to 19,763,” Buffett writes.

You need only glance at any financial news site on the web to see where we stand to the minute. Indexing is the low-cost way investors capture that growth.

$500,000

Buffett fully expects to be writing a $500,000 check this coming January to a charity in his home state of Nebraska, Girls Inc. of Omaha. By then, Buffett believes he will have won a public “long bet” that investing in the stock market through an S&P 500 Index Fund over 10 years will have beaten a collection of hedge funds selected by a manager who took the other side of the bet.

As of Buffett’s letter the index funds had returned 7.1% per year while the hedge funds returned 2.2%, each compounded annually.

“I estimate that over the nine-year period roughly 60% — gulp! — of all gains achieved by the five funds-of-funds were diverted to the two levels of managers,” Buffett writes. “That was their misbegotten reward for accomplishing something far short of what their many hundreds of limited partners could have effortlessly — and with virtually no cost — achieved on their own.”

John Bogle essentially invented the consumer index-fund industry. It’s no wonder that Buffett loves Bogle so much, and no surprise that Buffett has instructed his executors to put his heirs’ money into index funds.

1,000

This is the number of investment managers Buffett suggests could make a prediction on the final value of the stock market over the course of a year, of whom perhaps one will get it right — by accident.

Or monkeys, if you prefer. “Of course, 1,000 monkeys would be just as likely to produce a seemingly all-wise prophet. But there would remain a difference: The lucky monkey would not find people standing in line to invest with him.”

Yes, Buffett just compared stock-pickers to monkeys, but in the same breath he compared investors who use stock-pickers to monkey followers. At a minimum, he draws little distinction.

The balance of Buffett’s letter talks about a lot of other numbers. In-depth discussions of book value, accounting practices and the insurance industry. It’s assigned reading at business schools and investment houses worldwide for those very reasons.

If you are not in the investment business and just want to retire with more, you would learn just as much from these five numbers. You will likely come out way ahead of Wall Street as well.