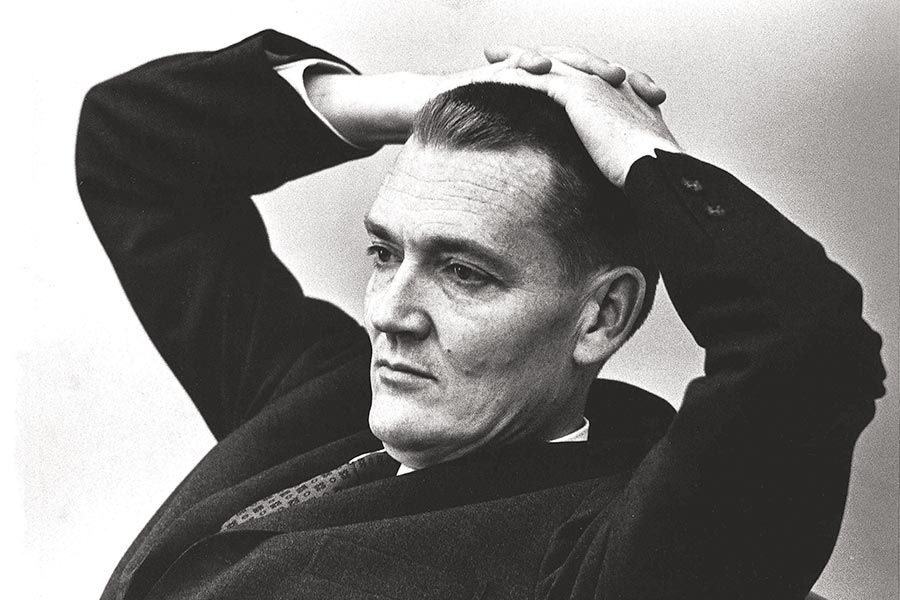

My partner, Mitch Tuchman, wrote a lovely tribute to the late John Bogle for MarketWatch.

It captures Bogle’s essential goodness and the mission that drove him his entire life: helping everyday people retire with more by dramatically lowering the cost of investing.

Please read this brief appreciation of Bogle’s life. We remain indebted to Bogle’s tireless commitment to better, safer retirement investing. His example will remain a beacon to the financial advising business for generations to come.

A statue for Jack Bogle? I’ll do you one better

Warren Buffett, the multi-billionaire behind Berkshire Hathaway and one of the world’s great investors, is famous for his praise of the late John Bogle.

The Vanguard founder and longtime promoter of index fund investing passed away Wednesday at age 89.

Writing in his annual letter to Berkshire investors a few years back, Buffett said of Bogle:

“If a statue is ever erected to honor the person who has done the most for American investors, the hands down choice should be Jack Bogle.”

The reason was index funds. Buffett, who once said that his own heirs should stick to index funds, lauded Bogle’s lifelong drive to lower investment costs.

He knew, Buffett wrote, that so-called active management is an entrenched, high-cost sham.

“In his early years, Jack was frequently mocked by the investment-management industry,” Buffett wrote.

“Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

Bogle’s impact

Bogle deserves a statue for sure. But he left behind things that are far more enduring and meaningful.

The Vanguard Group, for one. The company Bogle started in 1975 now has 190 funds, $5.3 trillion in assets, and an average expense ratio of 0.11%.

Compare that to actively managed funds which blithely charge more than 1% and you can begin to understand Bogle’s impact.

It was Burt Malkiel, the Princeton professor who wrote A Random Walk Down Wall Street, who evangelized early on for a low-cost fund that would track the whole market, instead of trying to pick stocks.

Malkiel, a member of the investment committee of my firm Rebalance, famously wrote in the bestselling book, now in its 12th edition: “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

Bogle made that monkey analogy real, launching the first index fund and facing down the obviously self-interested, high-fee mutual fund industry. Trillions of dollars have moved from costly active funds into index funds and index ETFs over the years.

And that’s the other big monument left behind by this giant of American investing: Billions of dollars in additional returns back to investors’ pockets.

Irreducible truths

As Bogle himself wrote in an essay just a few years ago, there are some irreducible truths about investing — one of them being math.

“Basic arithmetic works,” he wrote. “Net return is simply the gross return of your investment portfolio less the costs you incur. Keep your investment expenses low, for the tyranny of compounding costs can devastate the miracle of compounding returns.”

Put another way, as Bogle wrote, “in mutual funds you don’t get what you pay for. You get what you don’t pay for.”

Bogle was a tireless campaigner for ordinary investors, all of his life. My partner Scott Puritz was thrilled recently to join Bogle in the fight to make retirement investment safer for all Americans in the pro-consumer Campaign for Investors.

Bogle will be greatly missed, but no need to start building statues. Millions upon millions of investors are better off today thanks to his dogged efforts to steer them right.

Thanks to index funds and Bogle, millions today live better retirements. Millions of college funds are fuller, millions of charities are better funded, and millions of aging grandparents have better resources in their old age.

I’m sure Bogle would agree that’s memorial enough.