Index Funds & ETFs Archive

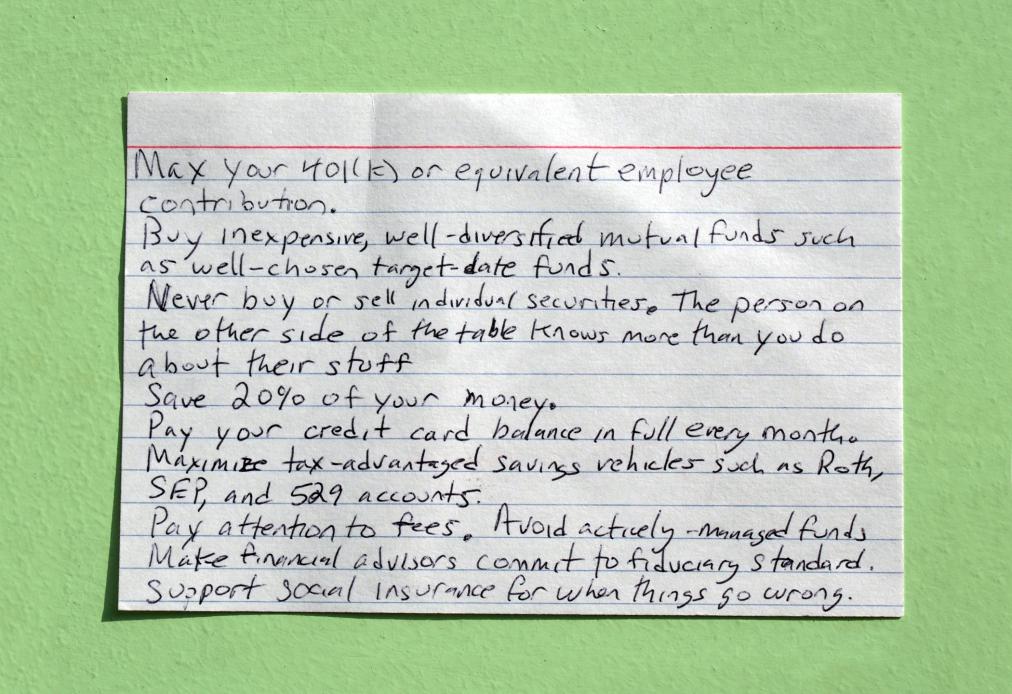

You’re Not Warren Buffett, But You Can Be

by Mitch TuchmanA professor at the University of Chicago, Harold Pollack, made a big splash recently with a pretty simple idea: What if all you needed to know about personal finance could fit on a single index card. Not reams of stock charts. Not years of study in some business school. Not even a book from the… Continue reading

Bogle, Buffett Agree: Don’t Watch Stocks

by Mitch TuchmanYou won’t find two people with more different approaches to long-term investing than Warren Buffett and John Bogle. Buffett has made billions selecting stocks (even while strongly endorsing index funds for retirement). John Bogle, the founder of Vanguard Group, built his name on not selecting stocks. He didn’t invent passive index funds, but he sure has… Continue reading

Think Like Buffett, Buy What’s Ugly

by Mitch TuchmanHere are a pair of seemingly random investment news headlines. See if you can spot the connection. Warren Buffett, the iconic billionaire investor, has invested nearly $1 billion into the oil business since the start of 2016. Meanwhile, oil market experts are warning that 99-cent gasoline is a real possibility. Do you see the clear… Continue reading

John Bogle Dismisses Index Fund ‘Danger’

by Mitch TuchmanRetirement investors likely have read about active investment managers and hedge fund chiefs who warn of the growing “danger” of index fund investing. Indexing does well in bull markets, they charge, but stumbles in bear markets. You’ll make more trading against indexers in downturns, they claim. Further, they argue, index funds foster complacency among investors. To which John Bogle, founder… Continue reading

John Bogle: Never Play A Loser’s Game

by Mitch TuchmanJohn Bogle, the father of passive investing, has this very simple piece of advice for anyone seeking to make their money grow. Don’t try so hard. When you make investing into work, inevitably you run the risk being wrong and losing big money. In fact, he uses the same words as Charley Ellis, a member… Continue reading

Buffett Stock Portfolio Idea Spot On

by Mitch TuchmanMy partner and Rebalance Managing Director Scott Puritz recently gave an interview to USA Today sure to raise the hackles of thousands of retirement advisors: The typical 60/40 stock-and-bond portfolio is fast becoming a problem for millions of American savers. The idea, which dates back decades, is to hold about 60% of your retirement portfolio in stocks and… Continue reading

Warren Buffett Snowball Retirement Advice

by Sally BrandonYou’re a recent college graduate. Now that you’ve started your first job, you’re probably wondering how to spend some of that new salary. A vacation? A car? Maybe you should be thinking instead about saving for retirement. That’s right. It’s time to put money away — ideally 10% to 20% of your annual take-home pay… Continue reading

Donald Trump Rich? Just Own Index Funds

by Mitch TuchmanWhatever you think of Donald Trump the presidential candidate, Donald Trump the TV personality or Donald Trump the businessman, there’s little doubt he is rich — private-jet-and-helicopter rich. A lot of smart people have tried to nail down exactly how rich. The consensus seems to be somewhere between almost $3 billion (the estimate from Bloomberg News)… Continue reading

A Bogle Insight That Triples Retirement Returns

by Mitch TuchmanWhat’s the difference between speculating and investing? For millions of people, it’s the real-world difference between retiring on time or working years longer than they had expected. J.P. Morgan recently published data that shows a diversified portfolio over two decades returning a solid 8% annually to the investor. Yet the typical small investor in that same time… Continue reading