Investment Advisors Archive

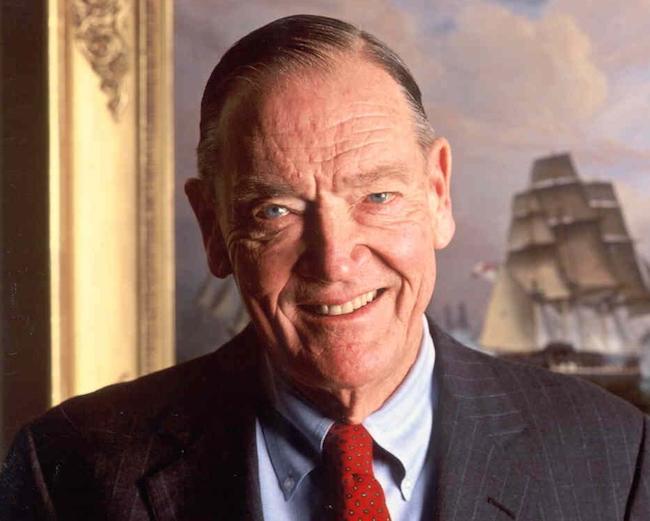

John Bogle’s Legacy: Returns That Trounce Active Investing

by Mitch TuchmanThe debate about the value of active vs. passive management, whether investors should try to “beat the market” return or instead simply replicate it cheaply, can seem never-ending. I find the passive vs. active debate misleading. You could argue endlessly about how active funds underperform eventually, even if some outperform from time to time. There… Continue reading

Beware Of The Investment ‘Expert’

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, cautions retirement investors when it comes to investment advice. Continue reading

How Mutual Funds Misrepresent Performance

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee explains how mutual funds use selective data to market their services. Continue reading

Morningstar Takes Stock Pickers Out Behind The Woodshed

by Mitch TuchmanA rising tide lifts all boats, or so they say. That’s the inherent promise of indexing for retirement. But an important corollary should be mentioned: A leaky boat sinks in any tide. Investment fund expenses will kill your retirement plan, no matter what kind of market is ahead. That’s the takeaway from the latest study of… Continue reading

Why Is It So Hard To Beat The Stock Market?

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on the difficulty of trying to beat the stock market. More investing advice for a solid retirement. TRANSCRIPT If you go back 60 years ago, maybe even 50 years ago, active, aggressive, imaginative, go-for-it investing had a terrific opportunity because the competition wasn’t very tough. Over… Continue reading

How To Retire With 79% More Money

by Mitch TuchmanIf given a choice, would you prefer to retire with 79% more money than the typical investor? Easy question, right? Many retirement savers are given exactly this choice, yet only a third end up enjoying the extra cash. What’s the difference? Prudent, high-quality advice that helped them avoid the roller coaster of emotionally driven decisions. Aon Hewitt, the… Continue reading

How Target Date Funds Work

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains target date funds. Continue reading

How Advisors Take More Than 10% Of Your Retirement Gains

by Mitch TuchmanDid you know that if you start early and save diligently, you could easily finance the retirement of a total stranger? That’s right. A total stranger. If you pay the big fees charged by mutual funds and high-priced active money managers, those costs can total up to more than $400,000 over your working life, according… Continue reading

How Financial Advisors Help

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee explains how volatility in the markets can cause investors to make emotional decisions and why access to a financial advisor is crucial in tough markets. Continue reading