Blog Archive

How Money Grows

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on the simple math of retirement compounding. Continue reading

Charles Schwab’s Daughter Wrote A Book, And You Should Read It

by Mitch TuchmanIt’s easy — extremely easy — to overestimate your audience. The key to great public speaking is not simply to make eye contact and move around the room but to study your listeners before you speak, before you even write your remarks. Financial advisors miss this a lot. They take hundreds of hours of licensing… Continue reading

Portfolio Rebalancing Keeps You On Track

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on how rebalancing is as easy as driving. Continue reading

A “Back to the Future” Retirement Idea Returns

by Mitch TuchmanYou don’t need a time-traveling DeLorean to see the value in a good idea from the past. A great “back to the future” type of 401(k) plan popular in the ’80s is being revived, one that promises to take a lot of pressure off small business owners and their employees. Known as pooled 401(k)s, these… Continue reading

Mutual Fund Performance — Buyer Beware

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on how mutual fund performance can be manipulated. Continue reading

Why IBM Moved To Index Investing

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains why IBM moved to index investing over active management. Continue reading

The Lessons of 2008

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains the lessons of 2008 to retirement investors. Continue reading

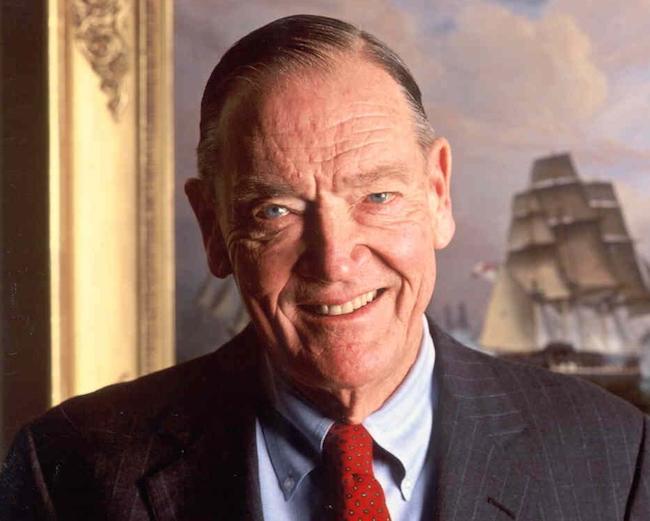

John Bogle’s Legacy: Returns That Trounce Active Investing

by Mitch TuchmanThe debate about the value of active vs. passive management, whether investors should try to “beat the market” return or instead simply replicate it cheaply, can seem never-ending. I find the passive vs. active debate misleading. You could argue endlessly about how active funds underperform eventually, even if some outperform from time to time. There… Continue reading

IRAs and Tax-Advantaged Investing

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains the power of IRAs and tax-deferred investing. Continue reading