Blog Archive

Lessons From The 2008 Stock Market Crash

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on how the 2008 stock market crash tested his beliefs but, ultimately, confirmed his approach toward portfolio indexing for retirement. Continue reading

Why Your Retirement Trails The Market By 45%

by Mitch TuchmanOrdinary retirement investors earn a return that pales in comparison to the stock market itself — more than 45% off the benchmark. Why is that, and can you do anything about it? We’re talking about trillions of hard-earned dollars, money that should be growing on behalf of millions of Americans and just isn’t. The results… Continue reading

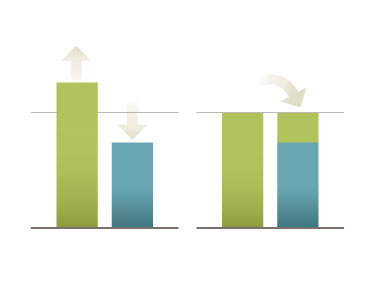

How Diversification Lowers Risk In Your Portfolio

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains how diversification protects a retirement investor from the chance that any given investment will fail in time. Continue reading

Danger: Everybody Wants To Beat The Market

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on the human temptation to strive for outperformance despite evidence that consistently beating the benchmarks is close to impossible. Continue reading

3 Reasons I Don’t Care About Michael Lewis’s ‘Flash Boys’

by Mitch TuchmanThe media storm over Michael Lewis and his new book about high-frequency trading is fascinating to watch — and of remarkably little consequence. Serious retirement savers are not affected by flash trading and, quite possibly, benefit from its existence. Lewis is a great writer. I suppose his publisher welcomes the attention the book has gotten… Continue reading

Market Timing Is Dangerous

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee explains how market timing leads to emotional trading and, all too often, portfolio crushing mistakes that diminish retirement investment returns Continue reading

Do Investors Trade Too Often?

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, talks about how the urge to trade is our own worst enemy, even if we think we know what will happen next in the markets. Continue reading

You Can’t Time The Market

by The Rebalance TeamInvestors are always in search of special techniques they can use to maximize their returns and save more for retirement. And who can blame them? A person’s retirement savings represents years of hard work as well as their hopes and dreams for the future. One common misconception is that investors can somehow save more by… Continue reading

Yale’s Robert Shiller: Stock-picking A Mistake for Most

by Mitch TuchmanIt’s possible to successfully pick stocks, says Nobel Prize winner and Yale economist Robert Shiller in a new interview, but like any game it’s competitive and hard — and best left alone by most. Shiller himself favors value investing, buying the stocks of “boring” companies whose valuations seem temporarily depressed. Nevertheless, he admits that he… Continue reading