Blog Archive

Why I Joined Rebalance

by Burt MalkielTranscrcipt I joined Rebalance because what it does is everything that I believe in. It believes in broad diversification. That’s just something I have believed in all of my life. It believes in low expenses. And low expenses not only in the funds that are bought, but in the overall fund. You know, one of… Continue reading

You’re Paying Too Much For Investment Help

by Burt MalkielFrom 1980 to 2006, the U.S. financial services sector grew from 4.9% to 8.3% of GDP. A substantial share of that increase represented increases in asset-management fees. Excluding index funds (which make market returns available even to small investors at close to zero expense), fees have risen substantially as a percentage of assets managed. In… Continue reading

Better Value When It Comes to Retirement Investing Advice

by Mitch TuchmanMost folks are savvy about prices, at least when it comes to inconsequential purchases, say, paper towels at the grocery store. Retirement investing advice? That’s more complicated. Consider paper towels. Brand A is your standby, you’ve used it for years and it gets the job done. But Brand B is new on the market and… Continue reading

An Intelligent Approach to Lowering Investment Risk

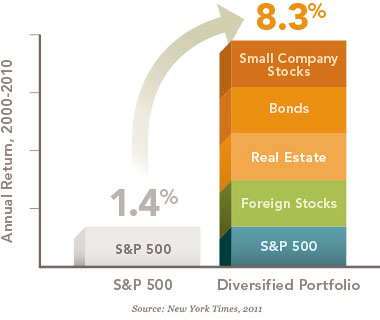

by Scott PuritzPeople understand diversification in principle. It is as simple as “don’t put all your eggs in one basket.” In practice, however, lowering investment risk is a bit more complex. For instance, some want to believe that owning a stock mutual fund is diversification, at least in comparison to owning the stocks of just four or… Continue reading

Don’t Fall Into the Market Timing Trap

by Scott PuritzOne of the more interesting reactions to the Rebalance approach is hearing the ideas people have of “passive” investing and “market” returns, especially investors who still believe in market timing. “Oh, I would never be a passive investor. There is too much money to lose that way,” some argue. They feel a primal urge to… Continue reading

Understand the True Cost of Investment Advice

by Mitch TuchmanThe interesting thing about pricing is that people almost always want to spend as little as possible — unless they think the product is special, different or rare. Then the sky’s the limit. The cost of investment advice is no different. Consider perfume. It’s one of those products that retailers simply can’t discount. Department stores… Continue reading