Frequently Asked Questions

Methodology & Expertise

How have Rebalance portfolios performed?

We would be happy to discuss portfolio performance, but we find that this topic is often confusing, in part because returns must be evaluated in the context of inherent risk. Please schedule a time to speak with one of our advisors so that we can show you our performance in a way that is relevant to you and your situation.

Are you a financial planner?

Yes, Rebalance is an investment management firm and we have highly qualified Certified Financial Planners (CFP) on our team. We can create a personalized financial plan for you to ensure that you are on track for retirement. If you are, great! If not, we’ll recommend adjustments to either the plan or…ahem…your spending habits.

Why do I need an investing expert?

Retirement investing is tricky. The U.S. government gives you a tax break on your contributions, but it wants its share of the gains, in the form of income taxes, once you begin withdrawing at retirement. There are more than 100 pages of IRS code on IRAs alone, and there are many traps along the way. We specialize in optimizing your IRA to so that you end up with more when you need it, in retirement. We also specialize in managing trusts and taxable investment accounts.

Can you customize a portfolio for me?

Unfortunately, we are unable to offer this level of service. But our portfolios offer a range of risk tolerances and are designed to fit a wide variety of retirement investors. We use them ourselves.

What is an ETF and why do you use them?

ETF stands for “exchange-traded fund.” These funds trade on the stock exchange just like any stock. ETFs are no secret, but investment professionals such as brokers can’t earn fees from most of them, so they go ignored. Each ETF is a “basket” of stocks that represents a particular index. For example, if you wanted to own every stock in the S&P 500 Index, you would buy one of several ETFs that follow that index. One example is the State Street Global Advisers SPDR S&P 500 (the ticker is SPY). By owning one share of SPY, you own 500 stocks in one.

Mutual funds are six to 10 times more expensive than ETFs because they hire pros, who attempt to select a few stocks within the index that they believe will beat the entire index. By owning the ETFs we use—funds which are widely held and used by millions of investors every day—you get nearly the exact return of the index that fund tracks. Since computers manage the stock buying, rather than a highly paid fund manager, the fees are very low.

Why is your methodology different than any other broker?

An educated investor is our best client. We urge you to read our methodology section and ask us any questions so that you understand and become comfortable with how we manage money. We have adopted the same investment approach used by the world’s most effective college endowments, foundations, and pension funds. They have achieved their well-earned reputations by focusing on asset allocation, not stock picking, by driving down fees, and by sticking with disciplined portfolio rebalancing.

Rebalance Service

What types of accounts does Rebalance manage?

Our team of financial advisors and Certified Financial Planners (CFPs) manage IRAs, Trusts, and Taxable Investment Accounts. Our BetterK service offering provides small business 401(k) plans.

How Do Required Minimum Distributions (RMDs) Work?

In the year you turn 70 ½ years old, the IRS looks at the balance of your retirement accounts (IRAs, 401k, 403b but not Roth IRAs) and calculates an amount that you are required to distribute as taxable income (called RMD – required minimum distribution). It starts at a little under 4% of the account balance and grows every year. If you inherit an IRA from someone other than your spouse you also have to take the RMD.

(Note: Recent legislation changed the age minimum to begin RMDs to 72. Per the IRS, if you turned 70 ½ in 2019 you should have taken your first RMD by April 1, 2020. If you reached age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.)

We have a process for simplifying and automating this RMD process, making it predictable and easy for you. There is one-time set-up where we connect your IRA to your bank account and then set up a date where the RMD automatically transfers from your IRA to your bank account. You can also choose to have taxes withheld from RMD and that will be done for you.

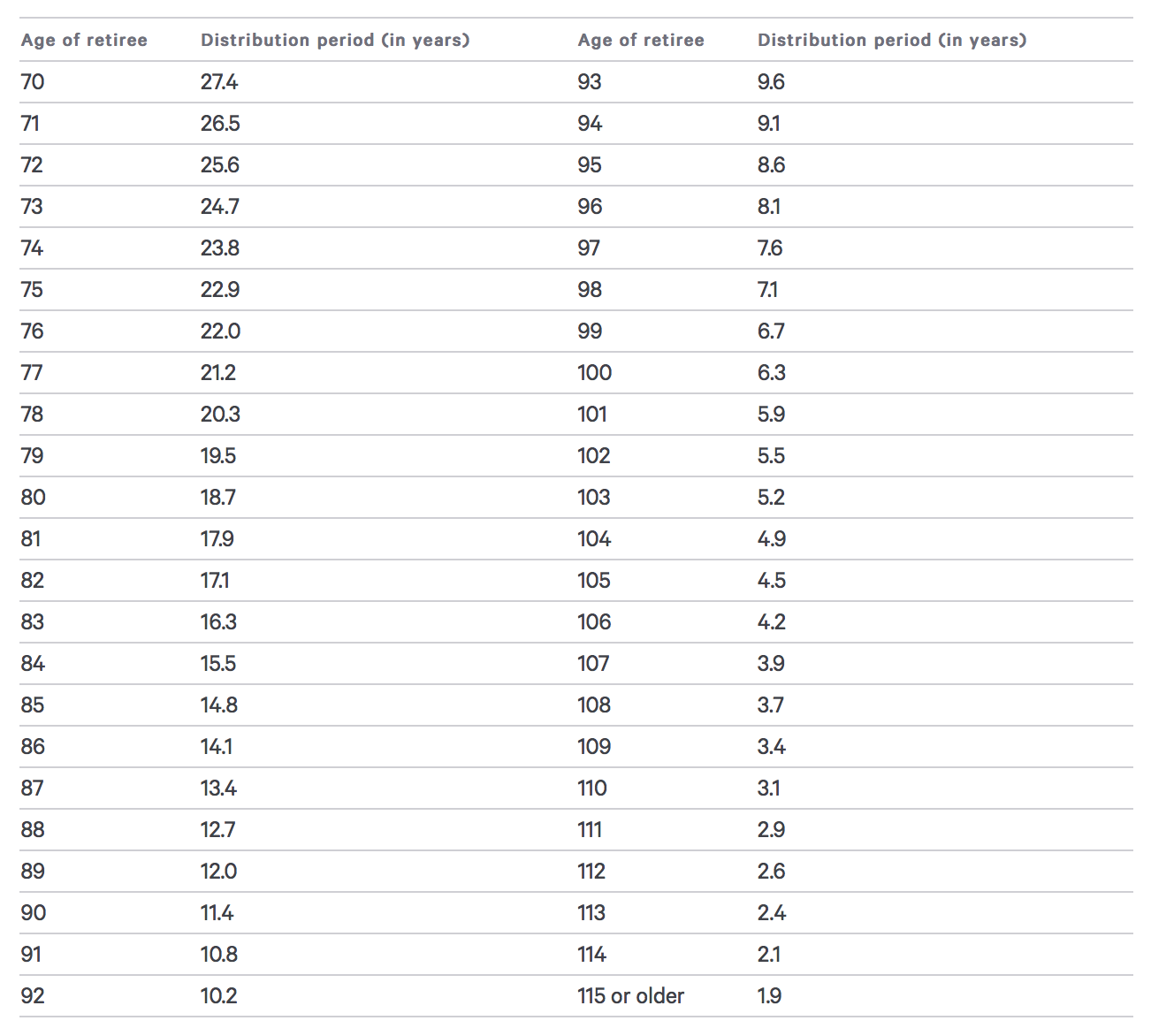

Every year, in early October, your broker (Fidelity or Schwab) gives us your current RMD amount calculated for each account we manage for you. That amount is based on published longevity tables* (see below) applied to your account balance as of the prior December 31st. We email you the amount and confirm that you do not want to distribute more than the amount.

In late October, when we rebalance all client portfolios, we make sure the cash required for your RMD is left over after rebalancing your individual portfolio. Why October? History shows that more years the market is up instead of down so by rebalancing and distributing near the end of the year, your money is working for you as long as possible.

Our process is flexible too. For example some clients prefer to have a check mailed to them or transferred to another Rebalance brokerage account and reinvested.

The process will automatically complete – well ahead of tax time. Please see the table below for further clarification on RMDs for IRA accounts.

*Required Minimum Distributions for IRAs

How long does it take to get started?

We can usually have your account(s) set up and a portfolio purchased within 5-7 business days.

What is the minimum size portfolio I need to get started?

The minimum size portfolio that you need to get started is $500,000.

Trusting Rebalance

How do I cancel your service?

If you wish to cancel service, there is no need to be embarrassed or to feel uncomfortable. The process takes a day. We simply remove ourselves from your account and pro-rate and deduct any accrued fees. There is no cost to terminate service and you may do so at any point in time and for any reason.

What’s the catch? How else do you make money from my account?

There is no catch. In fact, the U.S. Securities and Exchange Commission (SEC) requires that we disclose our fees completely in our ADV II. We encourage you to review this document.

What will my total investment fees be?

Rebalance fees are 0.7% per year for the first $1 million of assets under management per household and 0.5% on assets above $1 million and 0.25% on assets above $5m. There is a one-time set-up charge of $250 for each account. In addition to the investment management fee, there are ETF fund fees that average 0.15%. Client accounts are rebalanced twice a year, with an average cost between $35 and $50 per account.

How can you only charge a 0.75% management fee?

At Rebalance, we know that for you to live well and retire with more, you must pay less in investment fees. Most investment managers charge fees of at least 1% per year. Because of our unique approach to investing, our technology, and our focus on keeping overhead low, we can offer personalized, high-quality service at half the price.

Why should I trust Rebalance over a well-known broker?

There are two kinds of investment managers: an Investment Advisor, which we are, and brokers, such as those you will find at Merrill Lynch, Goldman Sachs, or UBS. As a Registered Investment Advisor under the Securities Act of 1940, we are required to act as a fiduciary, that is, to put your interests above our own and to declare any conflicts of interest that may arise. You can be assured that we construct portfolios to meet your goals and put your interests above all else.

Comparatively, a broker, or Registered Representative, is required only to recommend investments that are “suitable” for you. Legally, he or she can put his or her own interests above yours when recommending investments.

Where is my money held?

Your money will be at either Schwab or Fidelity in an account under your name. You will be able to log on to their site any time, day or night, and to check your account balance, and to download statements. Because of our partnerships with these firms, we are able to open accounts and buy and sell securities on your behalf, with your agreement, as part of our service. These firms have ample government and private insurance covering your account.

How safe is the data you have about me?

All personal information given to us is held in the strictest confidence and protected under our written privacy policy. We are fully committed to safeguarding your information using state-of-the-art data security and encryption services. Our partners help us to maintain these security levels. We are also required by the SEC to comply with privacy laws.

Privacy Policy. As an investment advisor, we comply with strict, federally regulated privacy policies.

Form ADV 2A. We file an updated version of this document with the SEC each year. It describes our services, fees, and all practices which relate to our role as your fiduciary. The SEC requires that it be written in “plain English” so that it is easily understood by the average investor.

Investment Advisory Agreement. This is a one-page agreement that we sign with clients who wish to have us manage their IRA.

Account Operations

Is Rebalance affiliated with Charles Schwab or Fidelity?

No. Rebalance is not affiliated with these companies, nor are we compensated by them in any way! No fees, commissions, or incentives. These firms do offer us indirect support in running our business more efficiently with software, seminars, and occasional consultation.

How will I get statements and reports?

Schwab and Fidelity will send you monthly statements through email or via U.S. mail. In addition, you can access your account with them online 24 hours per day, 7 days per week, providing account balances, trades, cash flows, and past statements.

401(k) Education

Cash Balance Plan Fact Sheet

A cash balance plan is a qualified (tax-favored) retirement plan that combines the high contribution amounts of a defined benefit plan with the look, feel and portability of a defined contribution plan. For that reason, it’s called a “hybrid” plan. Cash balance plans resemble 401(k) plans in terms of offering individual, portable retirement accounts. But they allow significantly higher contribution levels and use different investment principles. A cash balance plan communicates the promised benefit to employees as an account balance rather than an annual amount payable for life.

You may want to consider a cash balance plan if…

- You currently sponsor a 401(k) for your company and would like to defer more than $58,000, or $64,500 annually if 50 years of age or older.

- You want to rapidly accelerate retirement savings with annual pre-tax contributions from $100,000 to $200,000 or more, depending on age.

- The owners and executives are, on average, older than the non-highly compensated employees.

- Your 401(k) plan is safe harbor. Companies already making a 3% or higher contribution to staff within an existing retirement plan typically see a great benefit from cash balance.

- You own a family business. A cash balance plan can be used as a component of succession planning.

- The principals or sole proprietors earn more than $150,000 annually.

- Several owners want to benefit from a greatly enhanced retirement plan.

- You need to squeeze 20 years of savings into 10.

- You would like protection from creditors. ERISA protects cash balance plan assets (and assets of all qualified retirement plans) from creditors in the event of bankruptcy or lawsuit.

- You want to attract and retain high-caliber talent.

How much can be contributed in a cash balance plan?

Employer contributions are determined by an actuary and specified in the plan document. It can be a percentage of pay or a flat dollar amount.

What are the advantages of a cash balance plan?

Employer contributions are determined by an actuary and specified in the plan document. It can be a percentage of pay or a flat dollar amount.

1. Reduces taxes. Funds are tax deductible and earnings grow tax-deferred until withdrawn. This benefit is enormous and can have a dramatic impact on savings accumulation.

2. Accelerates retirement savings. Squeeze 20 years of retirement savings into 10.

3. Attracts and retains top talent. Money that would otherwise have gone to the IRS now enriches both the employer and employee retirement savings, helping attract, reward and retain talented tenure employees.

4. Shelter from creditors. In volatile economic times, preserving profits from both taxes and creditors is increasingly important.

5. Protect retirement savings from market volatility. Cash balance plans grow primarily through high contribution amounts earning interest rates that stay ahead of inflation without taking on major risk.

If you’re interested in learning more about how a cash balance plan can help your business – pick a time to speak with us at the link below.

401(k)/Profit Sharing vs. Cash Balance Plans

401k/Profit Sharing Plan— A 401(k) plan is a tax-advantaged, defined-contribution retirement account offered & sponsored by most employers to their employees. Workers can make contributions to their 401(k) accounts through an automatic payroll withholding. Matching is optional, but often offered & the investment earnings are not taxed until the employee withdraws that money, typically in or after retirement.

Cash Balance Plan — A cash balance plan is a qualified (tax-favored) retirement plan that combines the high contribution amounts of a defined benefit plan with the look, feel and portability of a defined contribution plan. For that reason, it’s called a “hybrid” plan.

Cash balance plans resemble 401(k) plans in terms of offering individual, portable retirement accounts. But they allow significantly higher contribution levels and use different investment principles.

A cash balance plan communicates the promised benefit to employees as an account balance rather than an annual amount payable for life.

Most Common 401(k) Violations

Despite all the work that goes into setting up a 401(k) plan, what many trustees don’t know is just how little it takes to lose your plan’s tax-qualified status. Think about your 401(k) plan management process for a minute. If you’re like most employers, every pay period you generate information or a report with deductions, loans, demographic updates, and ultimately “push the button” to transfer the necessary data and funds to your retirement plan vendor. This ultimately begs the question: What’s your back-up plan if your plan administrator happens to be unavailable on the day when your 401(k) contribution files are due? Who’s knowledgeable and qualified enough to fill in during that time? And if someone else cannot handle the process, what is the impact of not getting these updates to your 401(k) provider on time? We have created a 401(k) Violations Whitepaper to help you answer these questions and avoid costly 401(k) violations.

Your Role as a Fiduciary

Offering a retirement plan can be one of the most challenging, yet rewarding, decisions an employer can make. The employees participating in the plan, their beneficiaries, and the employer benefit when a retirement plan is in place. Administering a plan and managing its assets, however, require certain actions and involve specific responsibilities. We have compiled a fiduciary checklist to help you make sure you are meeting your fiduciary responsibilities, and if not, we can help.

The BetterK Advantage

Why choose BetterK over other plans? Because we tackle each area of retirement plan optimization (and do so with lower fees than many of our competitors). If you’d like to read more about how BetterK by Rebalance can help your small business, check out this complimentary brochure that provides all the details on why BetterK is the right choice for your business.