What’s going to hurt investors the most over the coming years? You might come up with any number of investment trends to worry about — inflation, debt, politics or terrorism, to name just a few.

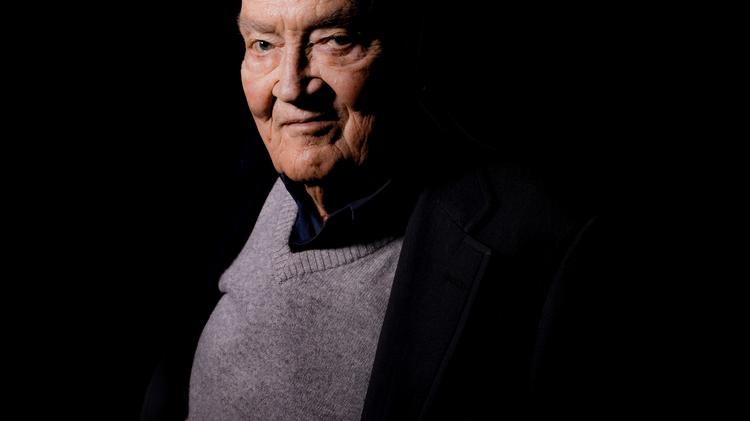

John Bogle, the founder of investment giant Vanguard, sees another trend, one he calls “highly negative” for investors and worth worrying about: We’ve given up on holding investments and instead trade them nonstop.

Bogle made these comments in a webcast to 40,000 Vanguard clients, among the 10 million for whom Vanguard manages $3 trillion in assets.

He spoke directly to the problem of “turnover,” the technical term for how often the investments in a portfolio or mutual fund are sold and replaced over 12 months. For a truly long-term investor, the lower the turnover the better in general.

Yet the opposite has happened, in Bogle’s view a disturbingly negative trend.

“Turnover in the stock market has gone from maybe 25% a year to 250% a year. And so people are doing more and more swapping back and forth with one another creating value for Wall Street and subtracting value from themselves,” Bogle said.

“The same thing — very few people I think have thought about this — the same thing is happening in the mutual fund business. When I was in this business at the beginning, the typical redemption rate was, let me just take a slight guess at this, was about 8% a year.

“And that meant if you had 100 shareholders in the beginning of the year, 8 would leave during the year. And now that redemption rate is up to 25% a year.”

The implication of high turnover is that average holding periods for given investments are falling fast, Bogle continued.

“So the holding period the way we do it in this business, an 8% redemption rate suggests the average holding period is 12½ years, and a 25% redemption holding period suggests that, the redemption rate suggests that the holding period is four years,” Bogle said. “That makes no sense, none, nada, nil.”

Consider for a moment what a 25% turnover rate means. If you ran a small business, say a coffee shop, and had 8 employees, that would mean losing two of them every year. In the space of four years, you would have an entirely new crew.

Billions in fees

Kick that rate up to 250%, where Bogle says the stock market investor is now in terms of turnover in a portfolio. Now you’re replacing people 10 times faster, basically hiring and training new faces nonstop. A business isn’t likely to survive long if the boss spends all of his or her time on that!

In terms of stocks, a 250% turnover rate that means you have sold every one of your positions and replaced with new ones two-and-half times in 12 months. You’re holding investments on average for a few months. Some maybe longer, some drastically shorter.

Wall Street loves this kind of behavior. See, stock brokers really don’t make money unless there is activity on your account. The last thing they want is to be the caretaker of a big boring portfolio that buys and sells once or twice a year to rebalance. No commissions for them.

So stock brokers have perfected the argument for actively trading, and their clients have gone along with it. It’s costing retirement savers billions in unnecessary fees and untold billions more in missed gains.

As Bogle says, when it comes to investments the best course of action by far — a strategy supported by decades of data — is literally doing nothing. Own investments, don’t trade, and retire with more.