One of the more successful tech startups on Wall Street these days is Robinhood, a phone app that allows inexperienced investors to jump into stock trading.

The come-on is that the trades are free. Naturally, there is no free lunch in investing, aside from diversification, as investing legend Burt Malkiel explains.

As the saying goes around Silicon Valley, if a service is free that means the user — your behavior online, your data — is the product.

Facebook and Google are two obvious examples. In exchange for a useful good, such as social connection or information retrieval, users allow these tech giants to track their every move, on and off the platform, for advertising purposes.

The Robinhood model is arcane, but clearly it works. The more people trade, the more money Robinhood makes by selling those trades to Wall Street. Wall Street takes those big blocks of trades and makes money arbitraging around order execution.

Big trading houses have done this for years, but Robinhood takes it to an extreme. The New York Times found that app-crazy traders are worth nearly $19,000 in payments from Wall Street for each dollar in an account. TD Ameritrade was a distant second, at just over $1,800 per dollar.

In December, the Securities and Exchange Commission fined Robinhood $65 million for failing to properly inform its users how it makes money while charging nothing for trades and, in the SEC’s words, for “failing to satisfy its duty to seek the best reasonably available terms to execute customer orders.” Robinhood neither admitted nor denied wrongdoing in the settlement.

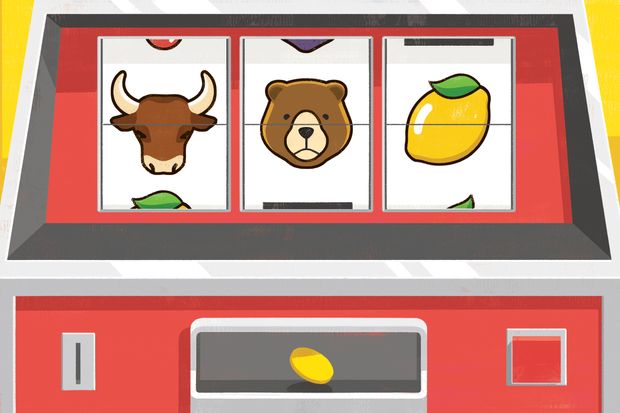

Robinhood has a clear incentive to get its users to trade often. But how does it encourage more trades? By using another time-honored tech industry tactic — gamification.

Now, my background is in tech. I admire how gamification can make learning easier. Respected business schools research and teach gamification theory.

Think about software that teaches piano or a foreign language. Information is dribbled out in bite-sized chunks and the user gets a reward for completing levels of knowledge and practice. Learning becomes a fun pastime rather than a slog.

Robinhood gamified trading by rewarding users for making trades with fun emojis and eye-pleasing graphics. Behind the scenes, young investors increasingly take part in complex, high-risk orders, sometimes using options and even trading on margin. Yet it all comes off as just having fun with your phone.

Wall Street wins on every trade. Robinhood wins on every trade. Investors? Well, as you can guess, it’s likely mixed. Robinhood won’t share results of its customers, but the company recently installed security barriers at its Menlo Park, Calif. headquarters, reports The New York Times. One disillusioned young trader committed suicide over hundreds of thousands in paper losses.

The true cost of high fees

Free is an enticing idea. Retail stores often sell attractive items at cost, so-called loss leaders that get you to enter the store or click an online ad. BOGO offers are a variation of this idea.

As an investment advisor I am staunchly on the side of lowering cost. The data on this is irrefutable. The more you spend doing your investing the less you have to invest and thus the less you make. High fees, over time, inevitably lead to poor performance.

We use index funds for our client portfolios precisely because they are low cost. Some of them are very low cost. But none are free.

The reasonable goal is to pay only for what brings you better returns over time. Often, that’s proper risk management based on your long-term needs. It can be financial planning advice that helps you avoid poorly timed decisions.

To get a bit technical, you also can win by making modest moves within a portfolio toward appropriate levels of risk and reward, such as choosing income alternatives to the typical low-yielding government bond funds found in many retirement plans.

What doesn’t add return, in my view, is leveraged trading with limited client understanding, egged on by an app that urges nonstop action. It might be fun for a while, but eventually you run out of chips and the casino goons kick you to the curb.

If you want to blow your cash in fabulous style, you’d probably have more fun in Vegas and make better memories. Trading stocks on your phone is no way to build a solid financial future. Investing steadily at a lower overall cost absolutely is.