Every investor wants to know the secret to getting above average returns in their retirement portfolio. After all, an individual’s IRA is the product of decades of hard work and careful planning. Deciding on an investment strategy is one of the most important financial and life decisions a person can make.

Research has shown that the real secret to above average returns is a portfolio of diverse index funds comprised of several different asset classes. This strategy not only shields investors from volatility, but also greatly reduces their exposure to compounding fees that erode account growth.

Our Investment Committee member, Princeton economist Burton Malkiel, discusses the advantages of index funds as the core of an investment portfolio

This secret catches many investors by surprise. After all, an entire industry is built on selling the concept that actively managed mutual funds and “hot stocks” are the right choice for everyday investors saving for retirement.

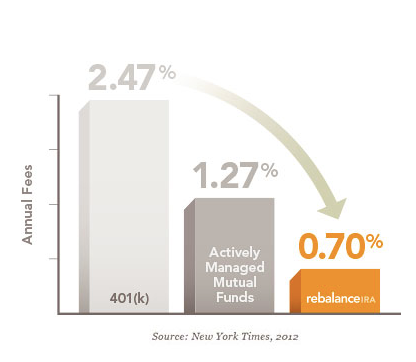

The reality is that the average actively-managed mutual fund doesn’t outperform index funds and exposes investors to higher fees that quickly eat away at the returns on investors’ nest eggs. We’ve learned that many people are shocked to find hidden fees as high as 2% or greater, often hidden in the fine print of their retirement account.

If you are ready to discuss your retirement goals and learn more about how you can lower fees and increase returns, click here to schedule a no-obligation, in-depth consultation with a qualified retirement expert. We’ll review your financial goals and provide easy next steps to simplify the process. To receive more investment tips from us in the future, click here to subscribe to our newsletter.