In this piece for The Philadelphia Inquirer, journalist Erin Arvedlund reports on whether or not there is a direct correlation between a recession and stock market drop.

In addition, Erin Arvedlund reminds investors the impending SECURE Act of 2019 goes back before Congress on Oct. 1st.

The Setting Every Community Up for Retirement Enhancement Act (SECURE), contains significant legislation that impacts everyday Americans saving for retirement and if passed by Congress, key provisions will allow employer-sponsored 401(k) plans to add annuities as investment options.

My colleague, Scott Puritz, warns investors that adding this annuity provision would put consumers saving for retirement in danger and could add confusion not to mention hidden and over-sized fees.

At Rebalance, our firm is committed to transparent fees and a fiduciary standard that always places our client’s interests ahead of our own.

Do recessions and stock market drops go hand-in-hand? Surprisingly, not always.

by Erin Arvedlund, September 16, 2019

Good question, and yes, everyone’s asking.

An economic recession is defined as two consecutive quarters of negative economic growth. The U.S. economy has experienced 10 recessions since 1950, according to the National Bureau of Economic Research.

Does this mean stock prices drop also? Not necessarily.

The most severe was the Great Recession of 2008-2009, and the mildest was 2001, according to Dan Roccato, president of Quaker Wealth Management in Moorestown, N.J.

On average, the market declines 5.3% during an economic recession. The worst drop totaled a loss of -36.4% and the stock market’s best gain totaled +16.6%.

“We won’t know we are in a recession until we have been in for six months. Hence, predicting one is a fool’s errand,” he said. “A genius would know exactly when to “sell” just before the recession and when to buy at the bottom. We don’t know any geniuses. A savvy investor would hold on through the recession because the ensuing market recoveries were epic. Our clients did this” in the recession years between 2007 and 2009.

“The question I’m hearing more frequently is ‘how do you recession-proof your portfolio?’ First, it presumes that a recession is coming — and soon. I know a recession is coming, but I don’t know when, nor does anyone else. So, specifically rejiggering your portfolio to ‘recession proof,’ it is silly,” said Dan Wiener, editor of the Independent Adviser for Vanguard Investors.

Second, “the question assumes a portfolio protects you in a recession but won’t leave you high and dry if the recession comes and goes and you mistime its ending, or the recession takes longer to arrive than expected.”

Wiener examined the last three U.S. recessions, which occurred in the early 1990s, the year 2001, and the most recent Great Recession ending in 2009.

During 1990-1991, the best performing Vanguard fund was Vanguard Health Care, which rose 23.4%. Meanwhile, the S&P 500 Index gained 7.8%, and the average Vanguard fund gained 4.5%, including bond funds.

In the 2001 recession, which lasted only eight months, Vanguard Global Capital Cycle (formerly a gold fund) rose 28.3%, while the average fund gained 1.8%. The S&P 500 Index fell 1.0%.

Finally, during the Great Recession, Vanguard GNMA Fund, a bond fund, led the way with a 9.9% gain while the average Vanguard fund declined 22.2%. The S&P 500 Index dropped 35.0% during the same period.

SECURE Act Update

Congress has to pass a budget to keep the lights on as of Oct. 1, and it’s possible that the long-awaited Senate version of the SECURE Act will be tacked on to that bill.

We wrote a detailed piece on the SECURE Act in July, calling it the most significant legislation in years affecting Americans’ savings for retirement. Key provisions include:

- More time in IRAs and 401(k)s. The bill would push back the age for required minimum distributions (RMDs) from 70½ to 72 years old.

- Grant part-time workers benefits. Long-term part-time employees would be able to participate in their company’s 401(k) plans.

- Boost small-business 401(k)s. Small businesses could band together in group plans.

- 529 plans. 529 plans would be expanded to pay for expenses related to an apprenticeship or to pay back as much as $10,000 in student loans.

- Annuities. Would allow employer-sponsored 401(k) plans to add annuities as investment options.

Annuities are an expensive way to save for retirement, so beware of these products in your 401(k), some experts say.

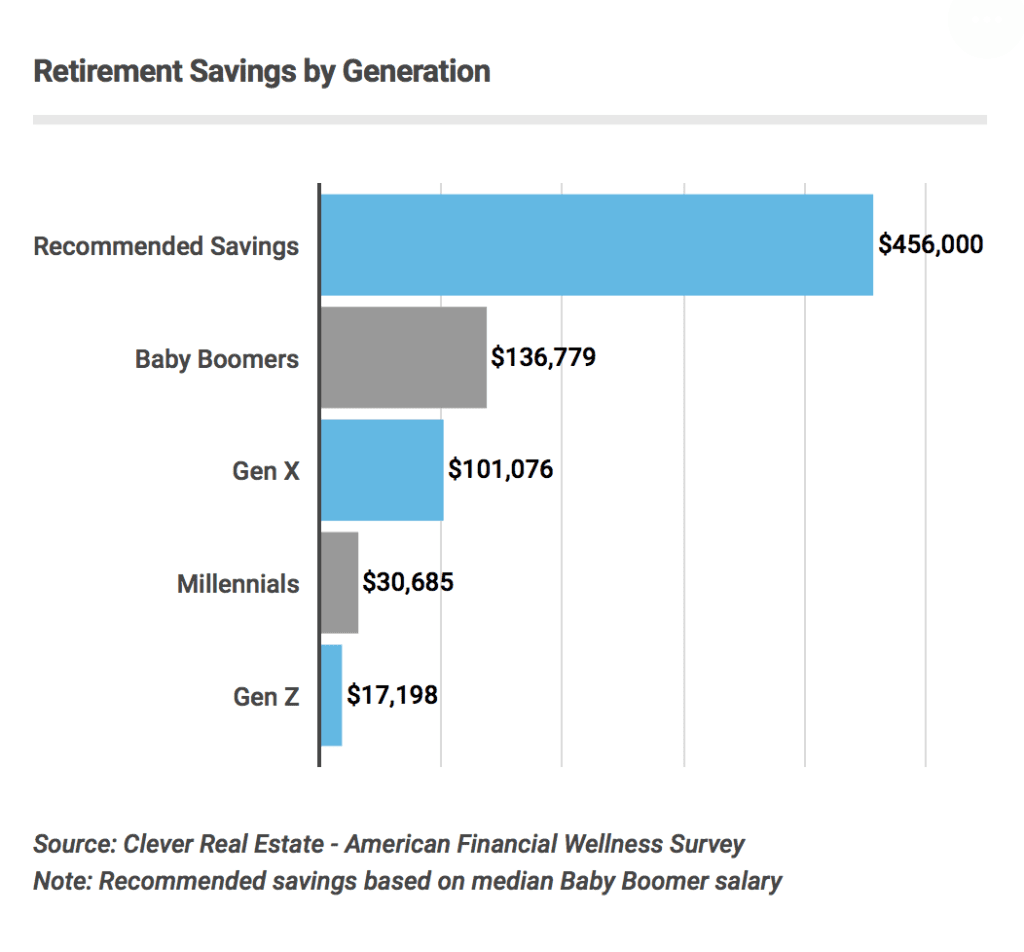

“We welcome attempts by lawmakers to encourage Americans to save more for retirement. But the SECURE Act, which will enable firms to market confusing annuity plans with over-sized hidden fees, would place many investors in peril, and at the mercy of high-pressure sales,” said Scott Puritz, Managing Director at Rebalance, which seeks to give investors endowment-quality advice at lower cost.

Under the proposed rules, retirement companies wouldn’t need to recommend the most cost-effective products, he added.

“At a time when not enough people have enough saved for their old age, this initiative is counterproductive. Congress is poised to lead thousands of everyday investors into trouble,” he said.

There’s always a risk that the “guaranteed lifetime income” could turn out to be a mirage if an insurance company goes belly-up (Penn Treaty American went under in this fair state). Fears they could be left on the hook have prompted many 401(k) providers to steer clear of annuities.

Under the SECURE Act, retirement plans now have “safe harbor” from being sued if annuity providers went out of business or stopped making payments. If they’re less likely to get sued, employers may offer annuities.

Consumer advocates warn that 401(k) investors and plans would turn to high-cost, lower-quality annuity providers.

Still, the bill could help people manage income in retirement more effectively. Wharton professor Olivia Mitchell noted in a research paper that the SECURE Act would encourage retirees to convert a portion of their 401(k) accounts at retirement into deferred annuities, her preferred insurance product. But she and her colleagues suggest that retirees put only 10 percent of their savings into those products.

Congress is pondering two versions of this legislation — a House and Senate version — that must be hashed out. The hope is passage takes place before 2019 ends. We’ll keep you posted.

This article was originally published in the Philadelphia Inquirer on September 16, 2019