Working with a financial advisor is priceless in more ways than one might think.

Why Financial Advice Is Growing More Valuable Than Ever

By Danny Noonan, Oct. 20, 2025

Apollo CEO Marc Rowan recently shared his view on the future of investing, saying, “We’re moving on from a three-flavor ice cream world.”

For decades, stocks and bonds have been the vanilla and chocolate of investor portfolios, with private markets as the occasional scoop of strawberry for a smaller group of investors.

That’s changing. Rowan envisions a future that looks more like Baskin-Robbins—many flavors, with multiple variations of stocks, bonds, and private markets.

This shift means more choice and more complexity—but also the potential for better outcomes, whether through diversification or higher returns, if investors can put the pieces together effectively.

That’s where financial advice comes in.

In a more complicated world, guidance that helps clients navigate complexity and personalize it to their investment goals will likely become more valuable than ever.

And the complexity doesn’t stop with the investment menu. People are also living longer, which brings a new set of challenges.

Ric Edelman—founder of Edelman Financial Engines, one of the largest advisory firms in the country—recently cited his work with MIT AgeLab:

“If you’re alive in 2030, forget about your age—odds are good you’ll live to 100.”

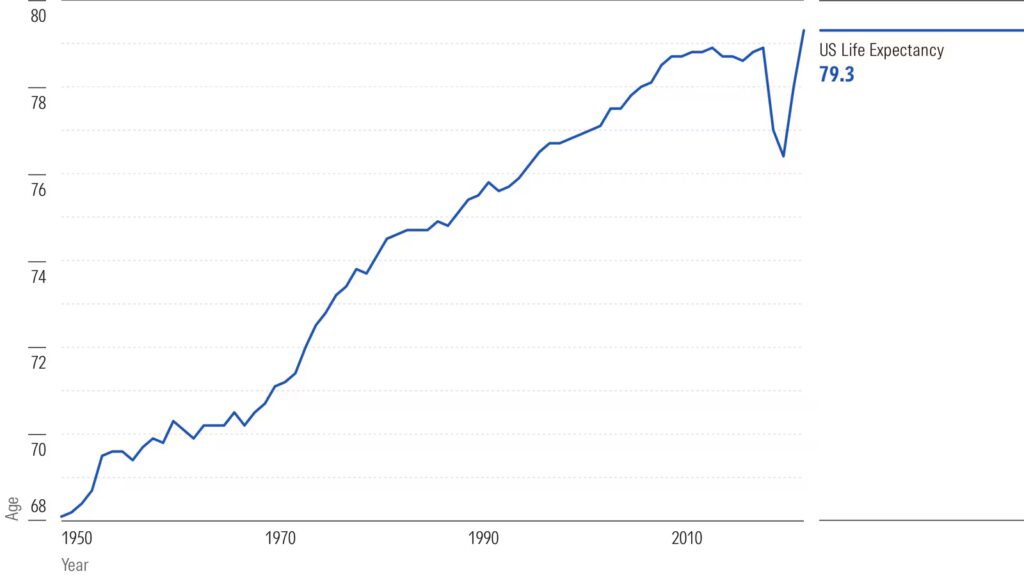

That may be overly optimistic, but the broader point holds. Since 1950, US life expectancy has risen from 68 years to 79 years.

US Lifespans Continue to Increase

The trendline is unmistakable—higher.

What’s driving this? Advances in modern medicine continue to compound. Seventy-five years ago, tuberculosis was the leading cause of death; today, it has been eliminated. Now, similar progress is being made against heart disease, cancer, diabetes, and other chronic illnesses.

The implication is clear: advisors will play a critical role in helping people plan for longer lives. Retiring in your 60s and living to your mid-80s is one thing; retiring in your 60s and living to nearly 100 is another.

In many cases, money may not last as long as clients do. That means some combination of:

- Working longer: helping clients determine the right retirement age for their lifestyle and savings.

- Making savings work harder: portfolios may need greater equity exposure—or potentially more equitylike alternatives—to support longer lifespans. Withdrawal rates will also need to be tailored to each client’s situation to reduce the risk of running out of money.

These are the kinds of conversations advisors will increasingly need to guide clients through.

Representing Your Fee

Many industries are increasingly fighting the force of commoditization—and investment management is no different. The rise of exchange-traded funds, some priced so low they round to zero, has made one thing clear: Investors can access basic market exposure for almost nothing.

Because of that, there’s probably never been a better time to be a do-it-yourself, or DIY, investor. These dynamics have put more pressure on advisors to define their value beyond performance or product selection. Unlike lawyers or accountants, whose fees are rarely questioned, a 1% advisory fee does get attention—at least in some financial media circles.

A common refrain: “Why would you pay 1% for a standard 60/40 portfolio?”

The best advisors can often say with confidence that this isn’t what brings clients in the door.

A simple analogy? Many advisors make the case that investments (the portfolio) are the gasoline that makes the car go, but many other factors matter—the passengers in the car, the road ahead, and the time to your destination.

Advisors need to clearly communicate to clients what they’re paying for, which is usually some combination of comprehensive financial planning, behavioral coaching, tax strategy, estate planning, and possibly more. Most advisors can’t provide all these services in-house, but many build networks of trusted professionals to fill gaps.

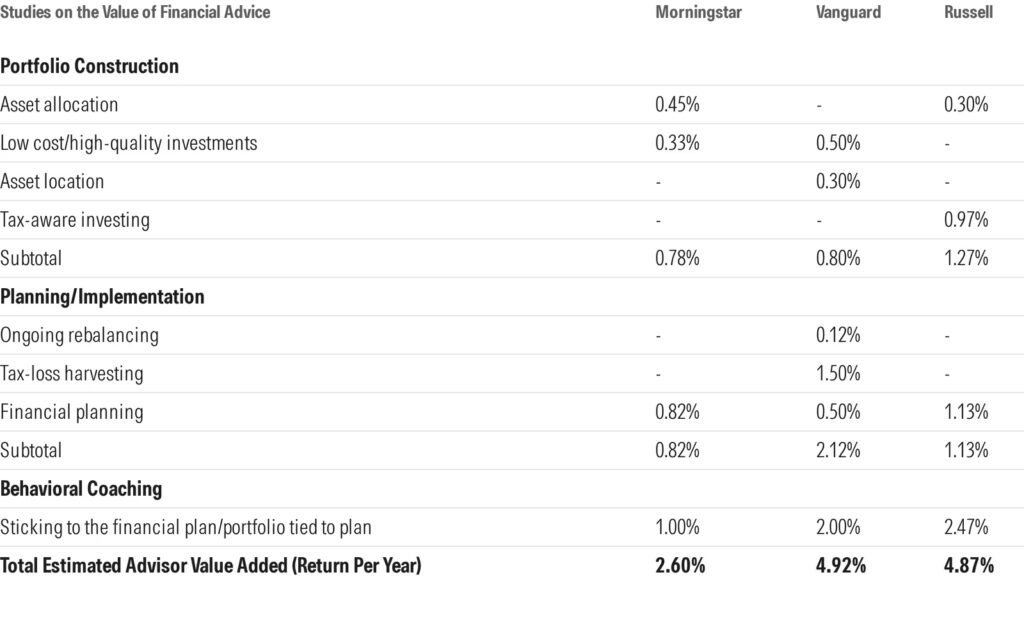

Industry research helps quantify some of this value. Studies from Morningstar, Vanguard, and Russell Investments collectively suggest that financial advice—delivered through its component parts—can add roughly 2% to 5% per year.

Research on the Value of Financial Advice

Does this data perfectly capture an advisor’s value? Absolutely not. It’s a wide range, and pinning down an exact figure is impossible. But one topic consistently stands out: behavioral coaching.

Estimates show this can add up to more than 2% annually—an edge that has the potential to compound dramatically over decades.

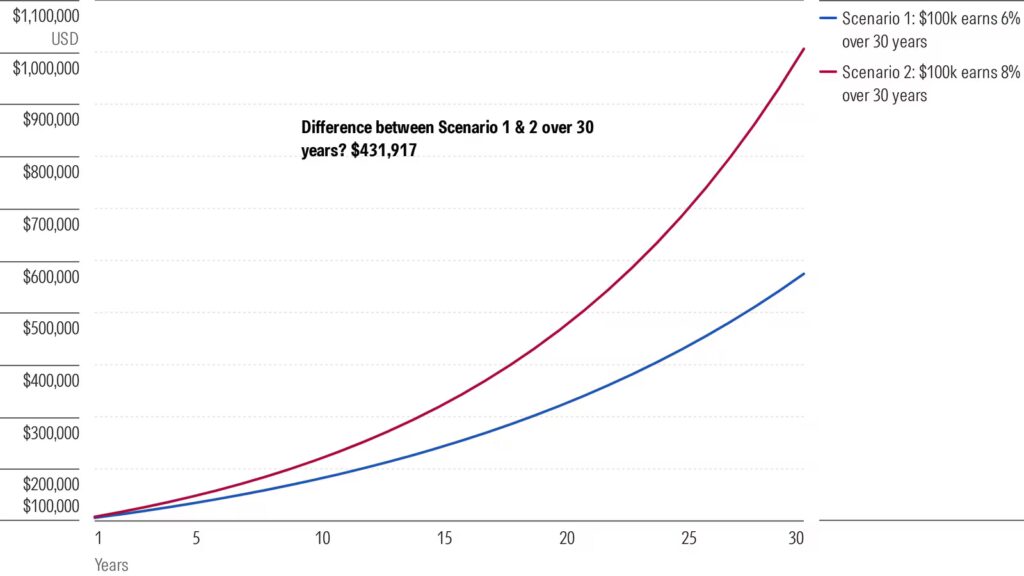

A one- or two-point gain doesn’t feel significant in any given year, but compounded over 30 years, it makes a huge difference. For example, a hypothetical $100,000 investment earning 6% versus 8% annually shows only a small difference in the first few years—just a few thousand dollars. But after 30 years, that 2% difference grows to more than $400,000.

Small Edges Compound Over Time

Giving “small edges” the chance to compound is a big part of what advisors do for clients. Morningstar’s Mind the Gap study underscores this idea: Investors can often be their own worst enemy, as poor behavior frequently causes them to underperform the very funds they invest in.

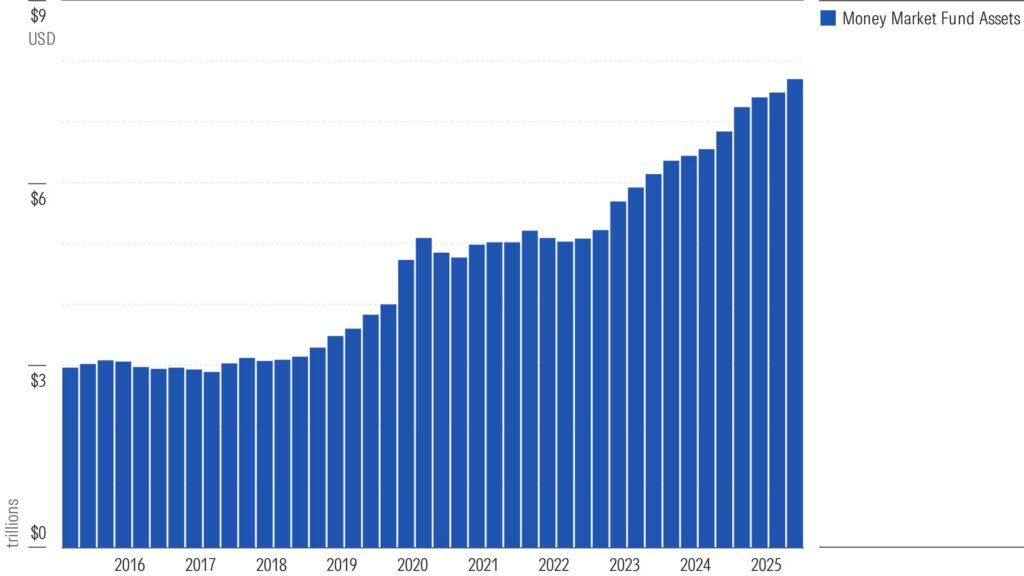

A timely example? Helping clients manage their cash allocation and avoid holding too much of it. Today, money market funds hold a record $7.7 trillion in assets.

Record Levels of Cash

Fidelity’s State of the American Investor study also shows that cash is the most favored holding among DIY investors.

There are good reasons to hold cash, such as emergency funds or short-term liquidity needs. But there are also poor reasons, like “waiting for a correction,” “valuations are too high,” or any other market-timing rationale.

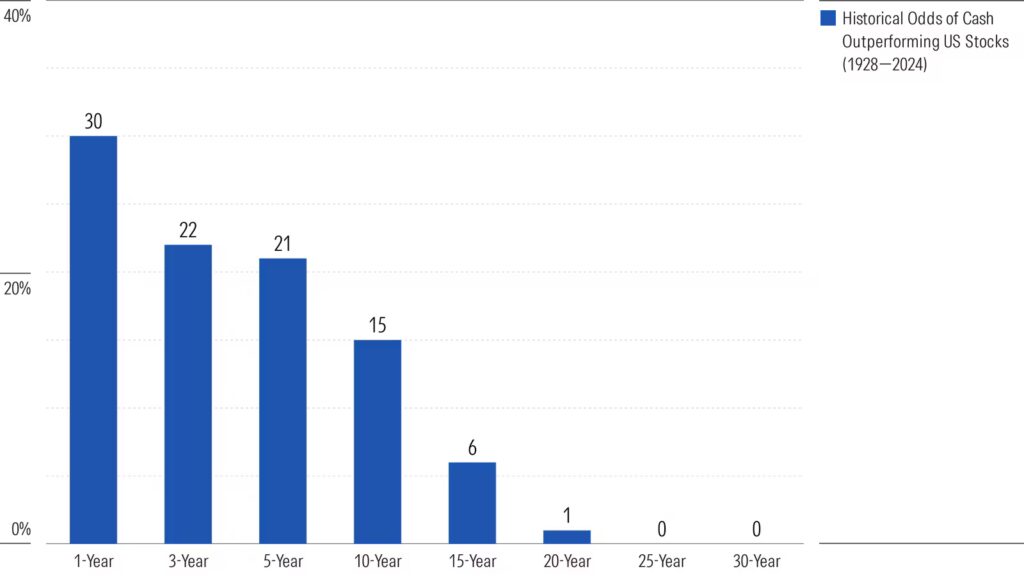

Over 20 years, the probability of cash outperforming stocks is virtually zero.

Cash vs. Stocks

To put it further into perspective: Over one year, cash underperforms stocks by about 8% on average—meaningful but not life-changing. But over 30 years, that gap stretches out to more than 2,000%.

Cash vs. Stocks (Average Underperformance)

Advisors can help clients distinguish between real cash needs and opportunity costs—guiding excess cash into productive investments.

This is just one example, but every advisor’s value is unique. It’s a bit like measuring the value of a quarterback—the gap between Patrick Mahomes and the backup quarterback for the Chicago Bears is miles wide.

What’s clear is that today’s investing landscape—defined by greater complexity and longer lifespans—is making quality advice more valuable than ever. Clients will increasingly need someone who can help them make sense of it all and personalize it on their behalf.

As that need grows, so too should the value of financial advice.