John Bogle: Investors Face This Highly Negative Trend

by Mitch TuchmanWhat’s going to hurt investors the most over the coming years? You might come up with any number of investment trends to worry about — inflation, debt, politics or terrorism, to name just a few. John Bogle, the founder of investment giant Vanguard, sees another trend, one he calls “highly negative” for investors and worth… Continue reading

3 Signs Your 401(k) Or IRA Costs Too Much

by Mitch TuchmanLawsuits are piling up on the desks of HR directors around the country, all with a common theme: The employee retirement plan was too costly and the company should have known better. Retirement investing is not an expensive process. There are only a few variables and the marketplace is fairly transparent. Unless, of course, you are… Continue reading

5 Investment Themes Bigger Than Brexit

by Mitch TuchmanA lot of ink is being spilled over a close but clear vote among Britons to leave the European Union, known as Brexit. You’ve probably seen lengthy explainers on why the vote matters to investors and what you should do about it. Hogwash, plain and simple. Sure, it’s a big deal — if you’re British. It’s important,… Continue reading

John Oliver, A Comedian, Might Just Save Your Retirement

by Mitch TuchmanYou might not know John Oliver. He’s British, first of all, and his comedy program “Last Week Tonight” airs on late-night cable. The segments on the show are long (22 minutes long!), very wonky and tend to tackle subjects most of us actively avoid — international affairs, payday lending, the downside of the U.S. energy boom, infrastructure spending.… Continue reading

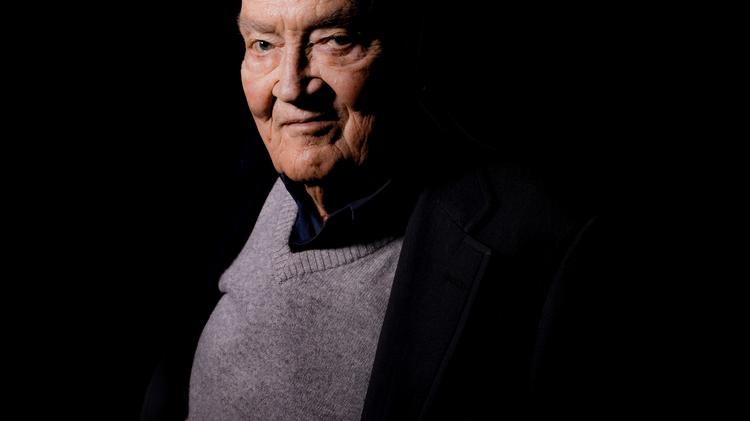

For Bogle Wall Street Is The Problem, Not Stocks

by Mitch TuchmanJohn Bogle, founder of passive investing giant Vanguard, believes that the animating force behind the stock market is to make money — just not for investors. In a recent interview and a separate letter to the editor, Bogle makes the case that virtually all stock trading benefits the handlers of that money and not retirement savers.… Continue reading

Jim Cramer’s Wealth Strategy: Almost Right

by Mitch TuchmanJim Cramer, the CNBC host known for his stock-trading “shock jock” TV personality, has some advice for young savers on how to grow wealthy. Thing is, his advice holds true for older savers and investors retirement, too. Here are three major takeaways from a recent segment: First, you need time. A lot of time. Investments double… Continue reading

John Bogle: Extend ‘Clients First’ Fiduciary Rule To All Investors

by Mitch TuchmanJohn Bogle, the longtime champion of low-cost investing and founder of the Vanguard Group, is not one to rest on his laurels. You would think that the recent Department of Labor “clients first” fiduciary standard ruling — earned after decades of fighting an investment industry focused on profits over people — would qualify as a big win. Don’t get me wrong, it… Continue reading

John Bogle: How To Lose 66% Of Your Retirement Return

by Mitch TuchmanThe “tyranny of compounding costs” is hardly a headline anyone wants to read. Yet people truly need to understand what Vanguard Founder John Bogle means when he says that cost is the major driver in how long-term retirement investing turns out. Most people assume that picking the investments matters. And in a sense it does.… Continue reading

The Single Biggest Risk To Your Retirement

by Mitch TuchmanIf you’re like most investors, you likely believe that stockbrokers with checkered pasts get drummed out of the industry. Certainly, out-of-work stockbrokers would like you to believe that. But the data tells a different story: Of brokers fired for misconduct, 44% are back at work within a year. That’s the conclusion of researchers at the… Continue reading