Jeremy Siegel: Stocks Could Rise By 10%

by Mitch TuchmanJeremy Siegel, the Wharton finance professor best known for the investment bestseller Stocks for the Long Run, sees no reason why the stock market can’t go up by 10% during 2016. Wait, you might say, Siegel is a famous stock bull. Of course he would say that. But his reasoning is more sound than you might… Continue reading

Yes, Ignore That ‘Sell Everything’ Call

by Mitch TuchmanThe U.S. Federal Reserve has begun to raise the interest rate, generally a sign of a strong recovery and a growing economy, and often a trailing indicator of growth. The Fed typically only acts late in the process, arguably too late at times. Meanwhile, one European bank’s economists are making waves with a note to clients… Continue reading

Bogle’s Legacy: Falling Prices Everywhere

by Mitch TuchmanIn case you missed it, a chart making the rounds in financial circles puts a fine point on what happens when a $3 trillion gorilla walks into a room. That’s the level of assets under management at Vanguard, the low-cost fund giant created by the legendary John Bogle. In short, when Bogle’s crew comes into… Continue reading

Buffett Stock Portfolio Idea Spot On

by Mitch TuchmanMy partner and Rebalance Managing Director Scott Puritz recently gave an interview to USA Today sure to raise the hackles of thousands of retirement advisors: The typical 60/40 stock-and-bond portfolio is fast becoming a problem for millions of American savers. The idea, which dates back decades, is to hold about 60% of your retirement portfolio in stocks and… Continue reading

John Bogle: Big Funds Rip Off Investors

by Mitch TuchmanWhat makes an investment fund cheap to own? Low fund fees, of course. But investors completely misunderstand what “low” means, charges Vanguard Group founder John Bogle. The problem comes with using percentages, specifically percentage expense ratios, to gauge the value of a fund relative to its cost of doing business. Consider something you buy every week,… Continue reading

Annuity Kickbacks A Huge Conflict: Senator Warren

by Mitch TuchmanElizabeth Warren, the hard-charging Senator from Massachusetts, has new questions for financial advisors who sell annuity products to folks nearing retirement age: If an annuity company gives advisors rewards and incentives such as resort vacations, iPads and jewelry, isn’t that a huge conflict of interest? Warren recently made headlines in an important Senate Committee hearing at… Continue reading

Warren Buffett: Why Hedge Funds Fail

by Mitch TuchmanYou might be surprised to see occasional headlines bemoaning the poor performance of hedge funds compared to the market indexes. Not Warren Buffett. Hedge fund managers serve two masters: their clients and themselves. That sounds like a solid alignment of interests, but it’s not, the billionaire investor says. That’s because hedge fund chiefs get paid win… Continue reading

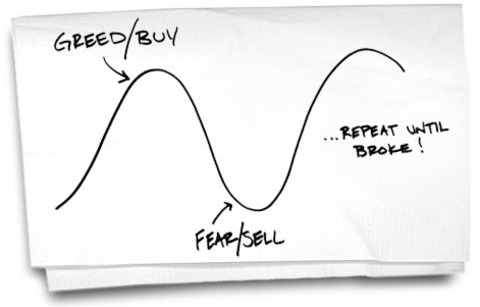

How Stock Volatility Quadruples A Portfolio

by Mitch TuchmanIt’s that time of the trading year when nobody seems to know what to make of the numbers. Stocks are down, bonds feel high, the economy sends mixed signals. Desperate for direction — any direction — investors attempt to guess the next move of the Federal Reserve (raise rates at last? stick to nearly zero?)… Continue reading

What Should I Expect In My Initial Interview With My Rebalance Advisor?

by Mitch TuchmanMitch Tuchman, Managing Director, describes the initial interview that every client has when they first sit down with their financial advisor. More on the Rebalance approach to retirement investing. transcript In our initial interview with a client, we’re trying to figure out a few things. What is the end result? In other words, what does retirement… Continue reading