Nobel Winner Fama: Active Management Never Works

by Mitch TuchmanMany smart people have spent years trying to explain exactly why active management can’t keep up with the investment indexes. Leave it to Eugene Fama, the University of Chicago researcher and Nobel Prize winner, to make things painfully simple. It’s nothing more than slicing a pie. If I get a bigger piece, everyone else is… Continue reading

Charles Schwab’s Daughter Wrote A Book, And You Should Read It

by Mitch TuchmanIt’s easy — extremely easy — to overestimate your audience. The key to great public speaking is not simply to make eye contact and move around the room but to study your listeners before you speak, before you even write your remarks. Financial advisors miss this a lot. They take hundreds of hours of licensing… Continue reading

A “Back to the Future” Retirement Idea Returns

by Mitch TuchmanYou don’t need a time-traveling DeLorean to see the value in a good idea from the past. A great “back to the future” type of 401(k) plan popular in the ’80s is being revived, one that promises to take a lot of pressure off small business owners and their employees. Known as pooled 401(k)s, these… Continue reading

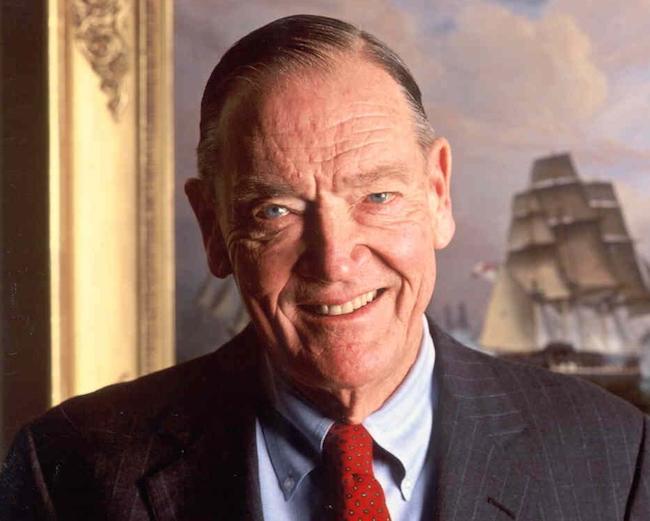

John Bogle’s Legacy: Returns That Trounce Active Investing

by Mitch TuchmanThe debate about the value of active vs. passive management, whether investors should try to “beat the market” return or instead simply replicate it cheaply, can seem never-ending. I find the passive vs. active debate misleading. You could argue endlessly about how active funds underperform eventually, even if some outperform from time to time. There… Continue reading

Retirement Investing Lightning Round

by Mitch TuchmanDo you know someone who has been hit by lightning? Do you know anyone who knows anyone who has been hit by lightning? Exceedingly unlikely, right? But it turns out to be roughly the same chance as knowing someone — anyone — whose mutual fund consistently stays ahead of the pack. Put another way, your… Continue reading

Return Envy: Are Managers ‘Drifting’ With Your Money?

by Mitch TuchmanA great retirement portfolio owns precise measures of specific investment types, depending on your age and personal tolerance for the ups and downs of the market. But what if the mutual funds you buy don’t hold the investments you think they do? Known as “style drift” in the finance world, the more accurate word for it… Continue reading

Retirement Gut Check: 5 High-Risk Behaviors To Avoid

by Mitch TuchmanMuch like elite sports and other high-reward pastimes, professional investing is incredibly hard work. People train for years, take tests to earn licenses and then subject themselves to long days and nights just to make it to Wall Street. Among the thousands who do, at least a few succeed — some wildly so. The out-sized… Continue reading

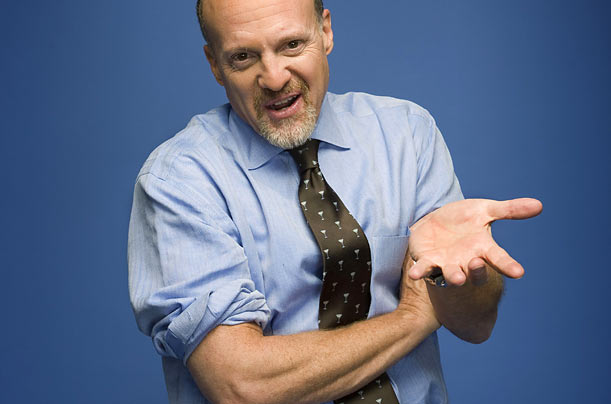

Jim Cramer: Mutual Funds Lose Money By Design

by Mitch TuchmanJim Cramer, the “Mad Money” cable TV host known for using his perch to preach stock-picking to the masses, has a simple message for retirement investors: Don’t buy stock-picking mutual funds. Yes, he still believes that picking stocks is time well-spent for some, but in a recent episode of his hugely popular show Cramer launched… Continue reading

Stock Meltup? Meltdown? Be Ready For Anything

by Mitch TuchmanA lot of ink has been spilled over the huge rise in equities in 2013. The year so far has been less surprising but not at all bad. The S&P 500 put on nearly 32% in the last calendar year and more than 5% year-to-date, despite the sharp dip in late January. The inflation-adjusted S&P… Continue reading