Investment Advisors Archive

‘Going In Style’ Toward Retirement, Without Robbing A Bank

by Mitch TuchmanEvery 10 years or so, Hollywood tries to latch onto the economic angst of the country with a comedy. Think of the Eddie Murphy and Dan Aykroyd classic, “Trading Places,” which skewered the misplaced values of 1980s traders. Or “Fun with Dick and Jane,” which had Jim Carrey and Téa Leoni resorting to an escalating… Continue reading

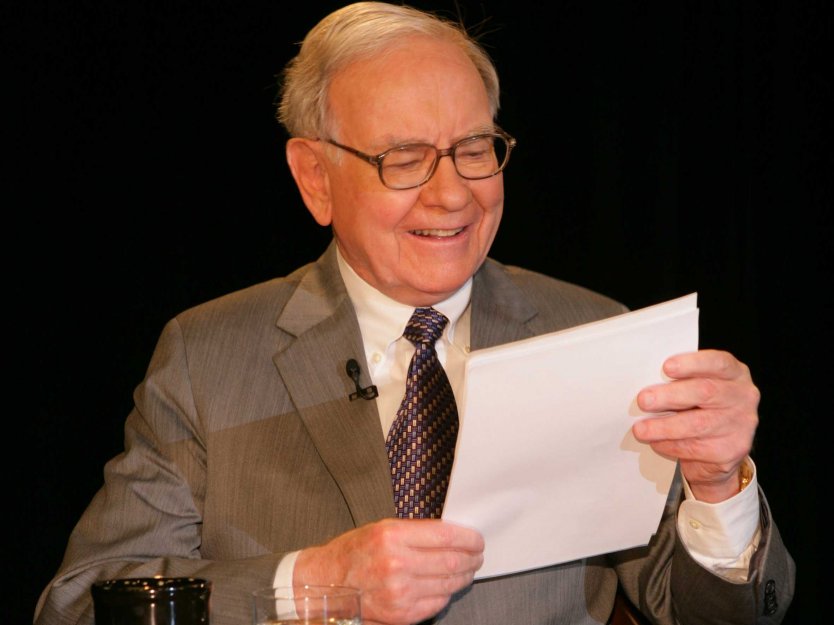

Buffett, Bogle and Berkshire: 5 Amazing Numbers

by Mitch TuchmanBy now you’ve likely seen billionaire investor Warren Buffett’s latest effusive praise of Vanguard Group founder John Bogle. “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle,” Buffett wrote in his latest letter to investors in Berkshire Hathaway, Buffett’s… Continue reading

Seth Klarman Has Concerns About Indexing. We Don’t.

by Mitch TuchmanSeth Klarman is one of the few hedge fund managers praised by Warren Buffett. His Boston-based Baupost Group is famously tight-lipped and extraordinarily successful, currently managing around $30 billion. That puts him on par with the endowments of schools such as Harvard and Yale. As it happens, my business partner Scott Puritz and I were… Continue reading

Jack Bogle: Despite Trump, ‘Clients First’ Fiduciary Rule Here To Stay

by Mitch TuchmanJack Bogle, the visionary founder of Vanguard Group and father of index investing, has this to say about rumblings that the incoming Trump administration could kill the fiduciary rule: Don’t bet on it. Far from shrinking back, the Department of Labor’s fiduciary rule protecting retirement savers — which takes full effect in April — is likely… Continue reading

Buffett’s Advice When Markets Slip: Skimp On McDonald’s

by Mitch TuchmanIconic billionaire Warren Buffett is sitting in the driver’s seat of a Buick SUV, talking to the drive-through cashier at a McDonald’s. “I’ll have a Sausage McMuffin with an egg and cheese,” he tells the grinning young woman, who clearly recognizes him and spots a documentary camera operator in the passenger seat. He probably orders… Continue reading

Rebalance’s Charley Ellis: A Money Champion of 2016

by Scott PuritzRecently, Time’s Money Magazine crowned Rebalance Retirement Investment Committee member one of their “Money Champions” of 2016. Find out why, and how Rebalance clients benefit from Charley’s expertise. Continue reading

Legendary Stock Picker Blows Lid Off Pricey Fund Tactics

by Mitch TuchmanBill Miller is not a household name to most people, but he certainly earned his keep over the years as a fund manager at Legg Mason Capital Management. Miller made his name by beating the S&P 500 Index for 15 consecutive years, a nifty feat and one that is remarkably difficult to repeat. But it… Continue reading

Why Buy Index Funds If Someone Can Beat Them?

by Mitch TuchmanIt’s a question you hear over and over in the investment business: Why buy low-cost index funds when there are active managers out there beating the market silly? And there are, absolutely, some managers and funds that have long and amazing track records. Warren Buffett is the obvious example, but there are also funds with… Continue reading

Warren Buffett Has A Simple Rule: Bad News First

by Mitch TuchmanWant people to trust and admire you, maybe even fall in love with you? Never pull your punches. It’s a contrarian approach to life, and possibly the hardest thing to do when it comes to money and investing, but owning up to what’s going wrong is crucial, say an expert who studies the investing style… Continue reading