Investment Advisors Archive

Legendary Stock Picker Blows Lid Off Pricey Fund Tactics

by Mitch TuchmanBill Miller is not a household name to most people, but he certainly earned his keep over the years as a fund manager at Legg Mason Capital Management. Miller made his name by beating the S&P 500 Index for 15 consecutive years, a nifty feat and one that is remarkably difficult to repeat. But it… Continue reading

Why Buy Index Funds If Someone Can Beat Them?

by Mitch TuchmanIt’s a question you hear over and over in the investment business: Why buy low-cost index funds when there are active managers out there beating the market silly? And there are, absolutely, some managers and funds that have long and amazing track records. Warren Buffett is the obvious example, but there are also funds with… Continue reading

Warren Buffett Has A Simple Rule: Bad News First

by Mitch TuchmanWant people to trust and admire you, maybe even fall in love with you? Never pull your punches. It’s a contrarian approach to life, and possibly the hardest thing to do when it comes to money and investing, but owning up to what’s going wrong is crucial, say an expert who studies the investing style… Continue reading

Stock Pickers Win Battles And Lose Wars

by Mitch TuchmanJuly was a bright spot for mutual fund managers who insist that stock picking is the way to make money. Sixty-seven percent of large-cap stock pickers beat their benchmarks while small-cap managers did their best so far this year, with 43% of them beating their index. Deal me in, right? Except that those July numbers were… Continue reading

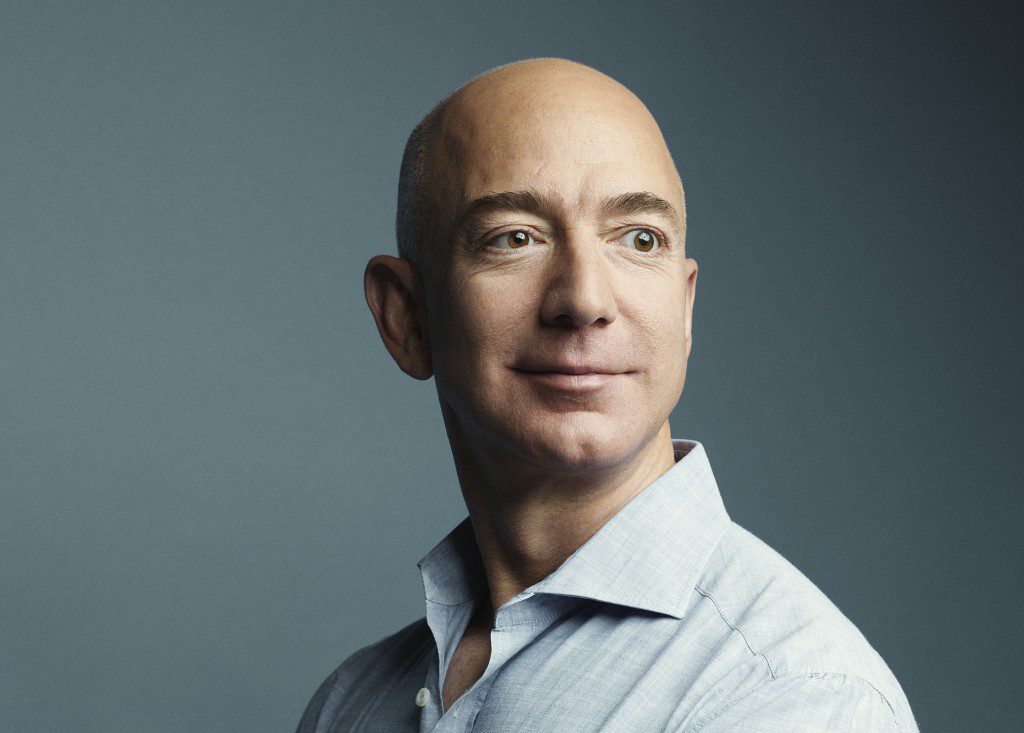

Buffett, Bezos and Hedge Fund Guesswork

by Mitch TuchmanFunny how obvious things can be in the rear-view mirror. Jeff Bezos, founder of online retail giant Amazon, recently saw his wealth surpass that of investing legend Warren Buffett. Separately, Buffett’s own wager on the broad stock market index against a collection of hedge funds continues to embarrass the supposed “smart money” at those funds. There are some very… Continue reading

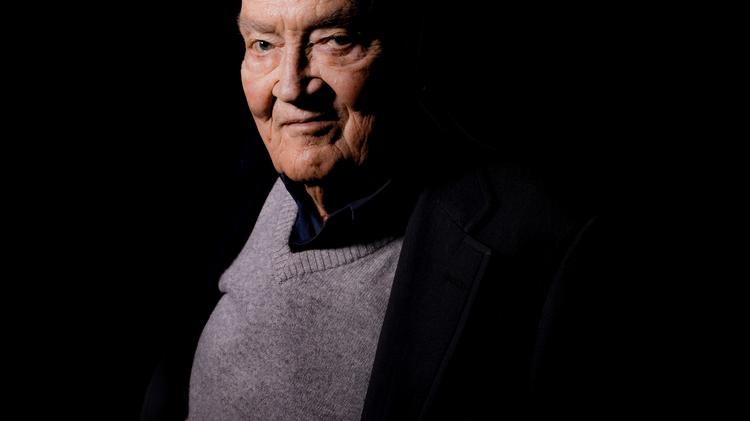

John Bogle: Investors Face This Highly Negative Trend

by Mitch TuchmanWhat’s going to hurt investors the most over the coming years? You might come up with any number of investment trends to worry about — inflation, debt, politics or terrorism, to name just a few. John Bogle, the founder of investment giant Vanguard, sees another trend, one he calls “highly negative” for investors and worth… Continue reading

3 Signs Your 401(k) Or IRA Costs Too Much

by Mitch TuchmanLawsuits are piling up on the desks of HR directors around the country, all with a common theme: The employee retirement plan was too costly and the company should have known better. Retirement investing is not an expensive process. There are only a few variables and the marketplace is fairly transparent. Unless, of course, you are… Continue reading

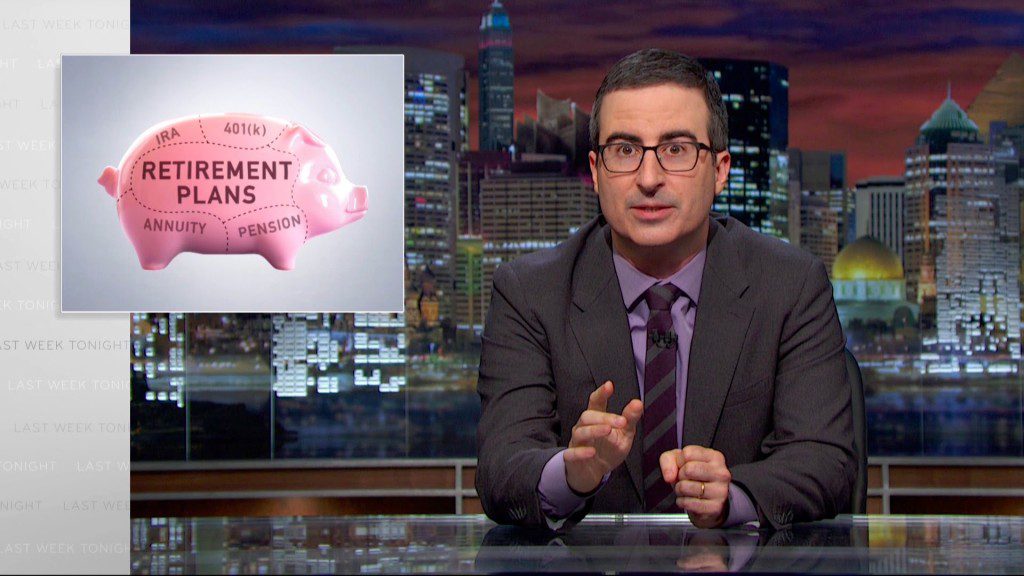

John Oliver, A Comedian, Might Just Save Your Retirement

by Mitch TuchmanYou might not know John Oliver. He’s British, first of all, and his comedy program “Last Week Tonight” airs on late-night cable. The segments on the show are long (22 minutes long!), very wonky and tend to tackle subjects most of us actively avoid — international affairs, payday lending, the downside of the U.S. energy boom, infrastructure spending.… Continue reading

For Bogle Wall Street Is The Problem, Not Stocks

by Mitch TuchmanJohn Bogle, founder of passive investing giant Vanguard, believes that the animating force behind the stock market is to make money — just not for investors. In a recent interview and a separate letter to the editor, Bogle makes the case that virtually all stock trading benefits the handlers of that money and not retirement savers.… Continue reading