Blog Archive

John Bogle’s Advice On Stocks Proven Again — By Science

by Mitch TuchmanA new study of our innate human biases reinforces the value of diversification when it comes to stock investing. Short version: We just can’t help ourselves when we think we know something. Scientists call this confirmation bias, the unconscious way we seek out information that proves we are “right” about closely held ideas. The problem is… Continue reading

Careful! “Robo” Advice Isn’t Necessarily Conflict-Free

by Mitch TuchmanWalk down the aisles of your local grocery store. If you’ve been shopping for a few decades, you know a few things almost without thinking. Fresh foods are along the walls, dry goods in the center aisles. Store brands are usually just fine and cheaper. Now look at the shelves. Some products (say, fancy ground… Continue reading

5 Lessons learned from HBO’s Bernie Madoff biopic, “Wizard of Lies”

by Scott PuritzRecently, Rebalance hosted a screening and panel discussion of HBO’s Bernie Madoff biopic, The Wizard of Lies. The main question I posed as moderator to our panel of retirement safety experts was simply, “What can we learn from the Bernie Madoff saga?” Panelists Phyllis Borzi, Congressman Jamie Raskin, and Elizabeth Kelly each weighed in with their… Continue reading

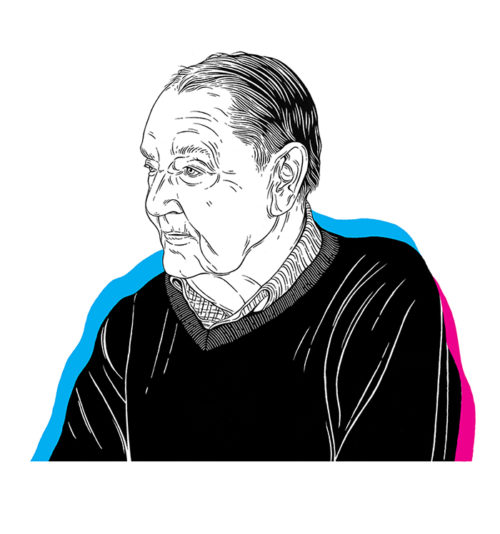

Jack Bogle Is Right: Don’t Be A Passive Investor, Be A Frugal Investor

by Mitch TuchmanThe money manager and columnist Barry Ritholtz makes a timely and important point in his most recent opinion piece for Bloomberg: Passive investing is an illusion. Nobody is truly a passive investor because all investing involves selection. Even if you choose the broadest possible global stock index fund, you’ve still chosen some stocks and ignored… Continue reading

What Should You Do With Your 401(k) Plan When You Retire?

by Mitch TuchmanAn interesting new analysis of the retirement business points out that, more than ever, people are stepping away from trading and into automated, low-cost portfolios. Three cheers for that, we say, but it raises an interesting question. Once you retire, should you stay in your set-it-and-forget-it company plan or do something different? How does “investing… Continue reading

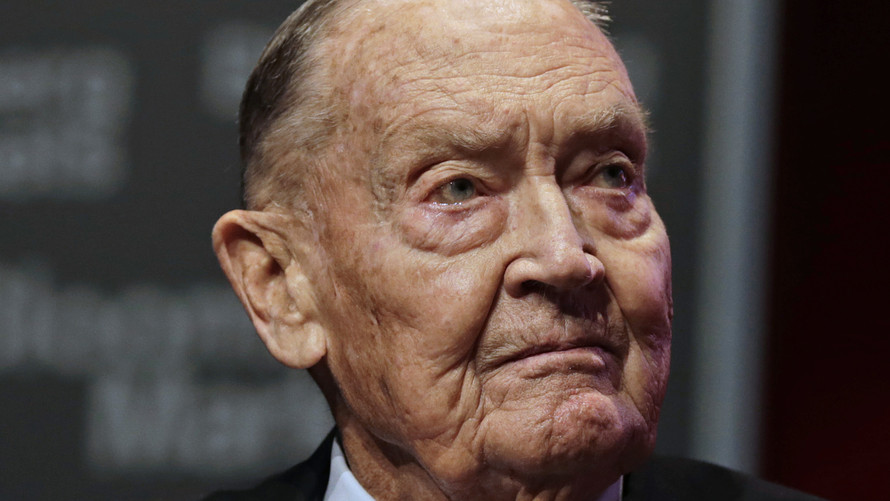

Big Data Explains Warren Buffet’s Disarmingly Simple Investment Strategy

by Mitch TuchmanIn a fascinating new book, a former Google data scientist offers a whole chapter about his brief misadventures in trying to apply big data — what we know from massive amounts of Internet searches — to investing. The chapter, part of the book Everybody Lies: Big Data, New Data, and What the Internet Can Tell Us… Continue reading

Report: ‘Closet Indexers’ Massively Overpay For Investment Advice

by Mitch TuchmanA friend of mine was complaining recently about the price of apples, specifically a variety marketed as a “Honeycrisp” apple. He would go to the grocery store to buy a bag of apples and find Honeycrisps at $7.99 a three-pound bag. Right next to them would be Gala apples at $3.99. “Why are Honeycrisp apples… Continue reading

John Bogle’s Enduring Insight On Investment Risk

by Mitch TuchmanBack in the 1980s, stock picking gurus such as Peter Lynch at Fidelity offered small investors a strikingly simple mantra: “Invest in what you know.” The idea was intuitive and highly attractive for a number of reasons. Essentially, if you noticed a small coffee chain with a line out the door, you bought that stock.… Continue reading

Five Common Mistakes People Make When Paying for College

by Christie Whitney, CFP®In her recent Wall Street Journal column, Chana R. Schoenberger details the many pitfalls that families with college-bound children face, and the simple steps you can take to prevent and/or remedy these mistakes. Read the article, in full, below. As the school year ends, summer vacation offers parents and students alike the opportunity to focus on what… Continue reading