Blog Archive

How Do You Stay In Touch With Clients At Rebalance?

by Sally BrandonSally Brandon, Vice President of Client Services, shares how to ensure that clients have a clear understanding of how their portfolio is invested. More on how Rebalance keeps fees low. transcript Initially when a client comes on board with Rebalance, we’ll reach out to them by phone and talk to them to make sure that… Continue reading

Donald Trump Rich? Just Own Index Funds

by Mitch TuchmanWhatever you think of Donald Trump the presidential candidate, Donald Trump the TV personality or Donald Trump the businessman, there’s little doubt he is rich — private-jet-and-helicopter rich. A lot of smart people have tried to nail down exactly how rich. The consensus seems to be somewhere between almost $3 billion (the estimate from Bloomberg News)… Continue reading

Yale, Vanguard Board Alum: Wall Street Rips You Off

by Mitch TuchmanDoes $17 billion sound like a lot of money to you? It should. That’s how much in profits Wall Street stands to lose if a proposed rule in Washington is enacted. All that has to happen to stop the rule…is nothing. The defenders of the status quo need only drag their feet hard enough. If… Continue reading

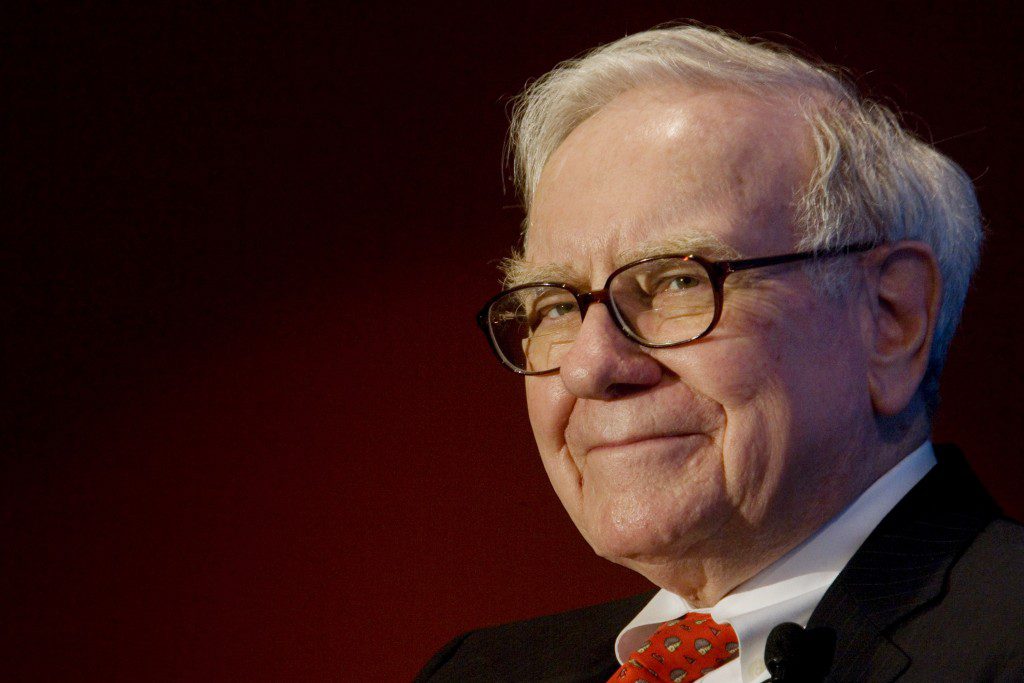

Buy Like Buffett In A Stock Downturn

by Mitch TuchmanYou’ve probably seen the many glib online articles which purport to explain how billionaire investor Warren Buffett became one of the world’s richest men. You know, “three stocks Buffett loves” and so on. It’s not that simple and you know it. While Buffett’s methods are public knowledge, adopting his approach to investing is no walk… Continue reading

Investment Risk Has Changed, So Should Your Portfolio: Burton Malkiel

by Mitch TuchmanInvestment risk has changed dramatically in the past few years, so much so you might not even recognize the risks implied by owning a “standard” stock-and-bond portfolio, warns Burton Malkiel, the Princeton professor who wrote the investing classic A Random Walk Down Wall Street. Malkiel literally wrote the book on long-term stock investments. Random Walk is in its… Continue reading

Why Is Retirement Investing So Emotional?

by Mitch TuchmanManaging Director, Mitch Tuchman explains why retirement investing is so emotional. Continue reading

What If I Have A 401(K) Plan With My Current Employer?

by Sally BrandonSally Brandon, Vice President of Client Services, talks about understanding the right type of investment vehicle for Rebalance clients. Continue reading

Stock Correction An Opportunity: John Bogle

by Mitch TuchmanWhen is a stock correction good news? Almost always — if you’re a long-term investor, says John Bogle. The Vanguard Group founder offers this simple advice for anyone thinking of selling as stocks declined earlier this week: Don’t fall for it. “I’ve seen turbulence in the market,” he told CNBC. “This is not real turbulence.” That doesn’t mean… Continue reading

Why Did You Co-Found Rebalance?

by Scott PuritzScott Puritz, Managing Director, explains why he and Harvard Business School classmate, Mitch Tuchman created Rebalance-IRA. Continue reading