Blog Archive

More Munger

Charlie Munger, the vice chairman of Berkshire Hathaway, left a significant legacy when he passed away last November, just shy of his 100th birthday. Charlie Munger, along with Warren Buffett, have always invested with the long-term in mind and advocated for investing practices that align with the Rebalance approach. You may want to check out… Continue reading

Target Date Funds: Smart Investment or Hidden Danger?

by Matt Jude, CFP®, ECAOver half of non-retired Americans have a defined contribution pension plan through their employer (source: Federal Reserve), with the most common types being 401(k) and 403(b) plans. These employer-sponsored plans can be an excellent vehicle for individuals to save on taxes and put money aside to create a secure retirement. Unfortunately, many people in… Continue reading

Roth IRAs Can Transform Your Retirement Planning

by Christie Whitney, CFP®Savers maxing out their 401(k) plans are likely to hear about one strategy preached endlessly: open a Roth IRA or get taxed to death in retirement. It can get overblown, but there is a kernel of truth here. Having tax flexibility in your later years is a gift that keeps on giving. That is because… Continue reading

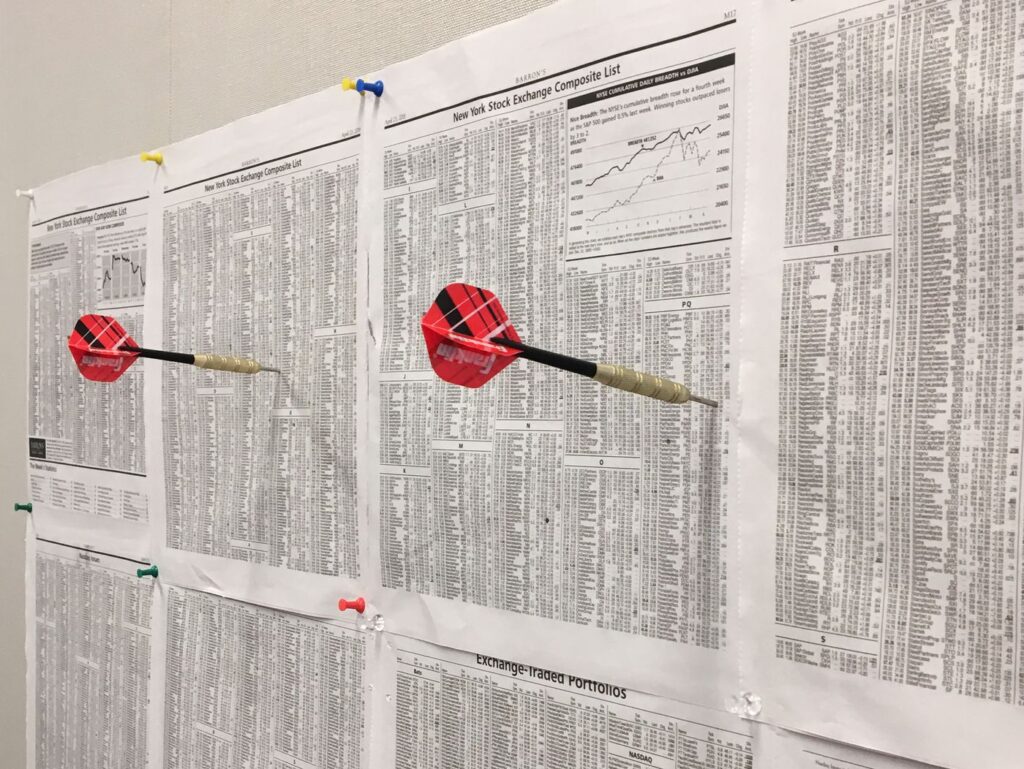

The Random Path to Stock-Market Riches

In his Wall Street Journal piece, Spencer Jakab explores how haphazard stock selection, inspired by Burton Malkiel’s ideas from “A Random Walk Down Wall Street,” demonstrates the surprising success of random stock picks over expert fund managers. The Random Path to Stock-Market Riches by Spencer Jakab, May 13, 2024 Words rarely heard from star fund… Continue reading

Backdoor Roth IRAs Are Promising — and Perilous

The “backdoor” Roth IRA presents a tantalizing solution for those keen on maximizing savings, offering tax-free growth and withdrawals. Read Laura Saunders’ article from the Wall Street Journal below to learn more. Backdoor Roth IRAs Are Promising — and Perilous by Laura Saunders, May 3, 2024 For determined savers, the backdoor Roth IRA is an… Continue reading

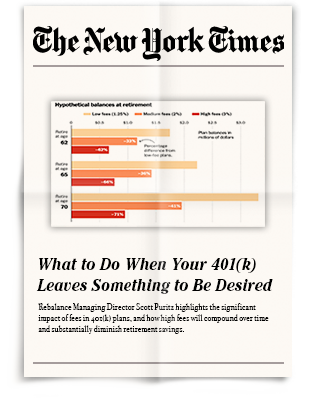

What to Do When Your 401(k) Leaves Something to Be Desired

by Scott PuritzOver the course of a career, the high fees and a lower-quality menu of investment options found in some plans can shrink your balance significantly. Chris Gentry is meticulous about his craft — he’s a professional woodworker at a small company in Brooklyn, N.Y., that makes custom dining and coffee tables, cabinets and interiors. He… Continue reading

Cash balance plans: Six-figure tax savings for dentists

Editor’s note: Originally published in November 2021 and updated with new financial information in April 2024. For dentists and practice owners, retirement investing tends to come in a few different forms. Often it’s a 401(k) plan, maybe a 401(k) plan with profit sharing, supplemental Roth IRA, or nonqualified taxable investments. While the broad popularity of 401(k)… Continue reading

Upsets Belong in Your March Madness Bracket – Not Your Stock Portfolio

by Scott PuritzHope springs eternal, especially in March. Like many firms, ours runs an informal NCAA basketball tournament pool for our employees. It is fun. This time of year, the NCAA Basketball Tournaments thrill fans and create so much interest that it is estimated one in four Americans fills out a bracket to predict who will win… Continue reading

The Psychologist Who Turned the Investing World on Its Head

Last week, the investing world lost a giant – Daniel Kahneman. A psychologist at Princeton University and winner of the Nobel Prize in economics, Kahneman may well have had more influence on investing than anyone else who was not a professional investor. Jason Zweig wrote a lovely tribute to Kahneman in his WSJ column. Check… Continue reading