Index Funds & ETFs Archive

John Bogle’s Legacy Has Only Just Begun

by Scott PuritzI had the privilege of joining John Bogle, and other industry leaders, in the continued fight against unfair investment practices at the launch of the groundbreaking initiative ‘Campaign for Investors.’ I hope to honor Bogle’s legacy by continuing to advocate for investment industry reform and consumer safety. Watch this video to learn more about the… Continue reading

Wargaming The ‘Stock Picker’s Market,’ According To Morningstar

by Mitch TuchmanCharley Ellis, one of the members of our esteemed Investment Committee here at Rebalance, once explained that beating the market used to be easy — so easy that anybody paying attention could probably do it. It truly was a “stock picker’s market.” He told Rebalance Managing Director Scott Puritz that, back in the 1960s, only… Continue reading

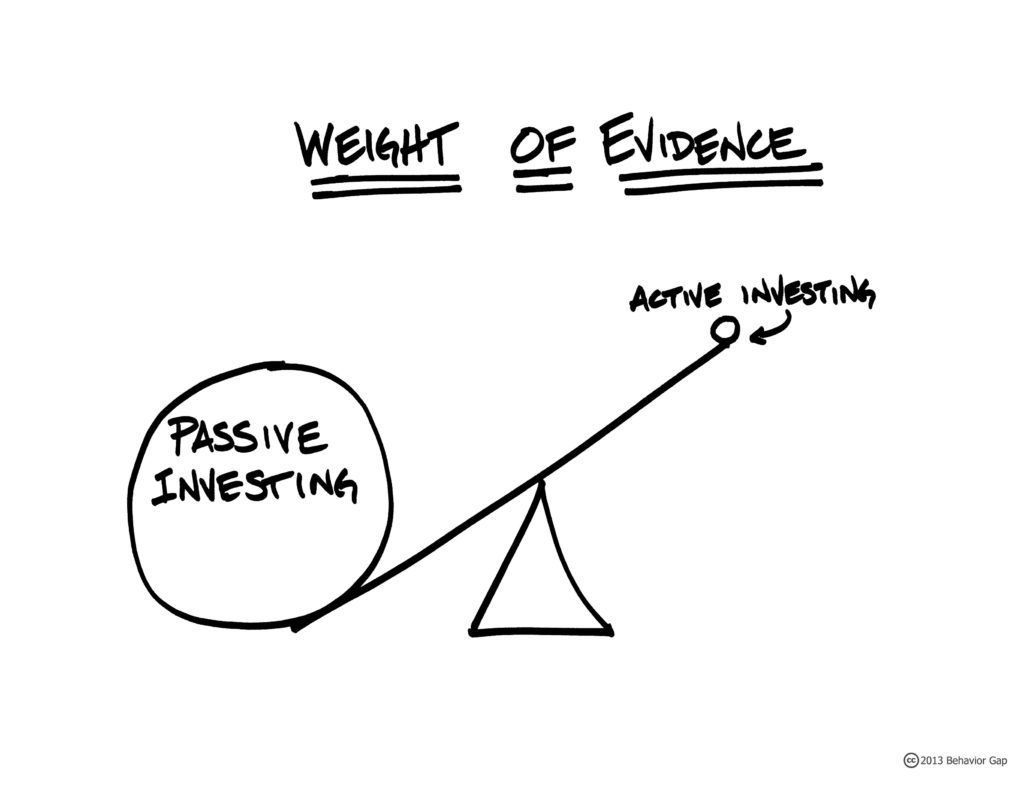

Decades Old Debate Put to Rest: Active vs. Passive Investing

by Scott PuritzI was honored and thrilled to participate in a sold-out panel for the CFA Society (co-sponsored by the Financial Planning Association) aimed at educating investors on the many differences between active and passive investing. During the lively panel discussion, I represented the side of “passive” or index investing, speaking to the potentially harmful drawbacks of… Continue reading

Here’s What Shark Tank’s Mark Cuban Calls the Key To Smart Investing

by Mitch TuchmanYou’ve probably read a lot recently about 401k millionaires. Ordinary people who saved money over decades now are ready to retire with ease. Smart investing? Usually, no. In fact, most of the people who are now rich thanks to 401k plans did so with hardlly any investing at all. Sure, they owned investments. Typically they… Continue reading

Why Vanguard Dropped the S&P 500 From Its Own 401(k) Retirement Plans

by Mitch TuchmanThe fund being offered to Vanguard employees in their 401(k) plans is not a global fund. It focuses on U.S. stocks. But the point remains the same. As Malkiel has long argued, diversification is the only free lunch in finance. Diversification is an incredibly simple idea, yet so many investors miss out. Here it is… Continue reading

Wealth Management Secrets That Beat the Ivy League

by Scott PuritzIt turns out that the wealth management secrets of the Ivy League aren’t what they’re cracked up to be. Bill Abt, a former beer company executive, got 6.2% returns on a portfolio he manages for Carthage College in Kenosha, Wis. Over the same 10-year period, Harvard’s massive $37 billion endowment returned 4.4%. Yet Abt costs… Continue reading

Q & A: What Separates the Wealthy from the Well Off?

by Sally BrandonDuring a recent quarterly market review call, we received the following question from a young man at the University of Texas: How much net worth separates the wealthy from the merely well off? It was a great question, albeit one that’s highly subjective. I think of somebody wealthy as having enough assets put away and… Continue reading

Jack Bogle: Wall Street Buys In Bulk, Then Upcharges Investors to the Hilt

by Mitch TuchmanEver looked at the price labels on grocery store shelves? I mean really looked? Sure you have. Any good shopper knows that the big number is the price of the thing you want to buy, while the tiny number is the price per ounce, per pound, or some other unit. That way you can easily… Continue reading

How ‘Easy’ Target-Date Funds Can Endanger Your Retirement

by Mitch TuchmanAmericans love “set and forget it” products. Like rotisserie roasters and slow cookers that prepare delicious dinners while we’re miles from the kitchen, any approach that takes out complexity is beloved in our harried, overworked society. That’s why index funds are growing so rapidly. Why pay an advisor good money to pick stocks when the… Continue reading