Investment Advisors Archive

A Financial Advisor Cares About Your Financial Health

by Christie Whitney, CFP®Being a good financial advisor is a lot like being a good personal physician. You have to listen to what the patient means, whether they are saying it out loud or not. Every primary practice doctor has this experience. The patient comes in, gets weighed, blood pressure taken, and the doctor does his or her… Continue reading

The Simple Genius of Mark Mobius, Foreign Investment Pioneer

by Mitch TuchmanMark Mobius, a fixture in international investing from his perch at the Franklin Templeton mutual fund company, will retire this month after three decades of leading American investors to foreign shores. Like the founder of Franklin Templeton, the late John Templeton, Mobius followed a simple but difficult-to-replicate investment strategy: Be there first. Mobius is an… Continue reading

You Can Leave These Mutual Funds — But Only If You Pay

by Mitch TuchmanHedge funds get a lot of grief over punitively high fees and low returns, with good reason. Among the most hated are so-called “gated” funds, those with rules that lock up investor money for specific periods of time. The gate is there to protect other investors, and often that includes the manager. If one large investor decides… Continue reading

Suze Orman Has A Killer Question For Your Retirement

by Mitch TuchmanSuze Orman is one of those singular personalities in the financial business who seems to be right on the pulse of everyone she meets. She’s written books, starred in her own television show and made innumerable appearances in person. Like Oprah and Bono, she’s nearly a one-name-only celebrity. Say “Suze” and you know who I… Continue reading

The ‘Vanguard Effect’ Means Your Investments Could Soon Cost Zero

by Mitch Tuchman“Disruption” is a term you hear bandied about in Silicon Valley, usually associated with young CEOs in t-shirts. The idea isn’t new. The 19th-century industrialist Andrew Carnegie would recognize it as competition. Joseph Schumpeter, an Austrian economist from the 1930s, would call it “creative destruction.” In finance world terms, my favorite version of disruption is… Continue reading

Is Your Financial Advisor In The Hidden Fee Hall Of Shame?

by Mitch TuchmanGasoline right at the highway exit is usually cheapest. Drive a few miles toward town and you might see a 10 cent per gallon jump. Ever wonder why? If you said “competition,” go to the head of the class. Gas stations tend to cluster around knots of highway traffic. The driver near empty on a country… Continue reading

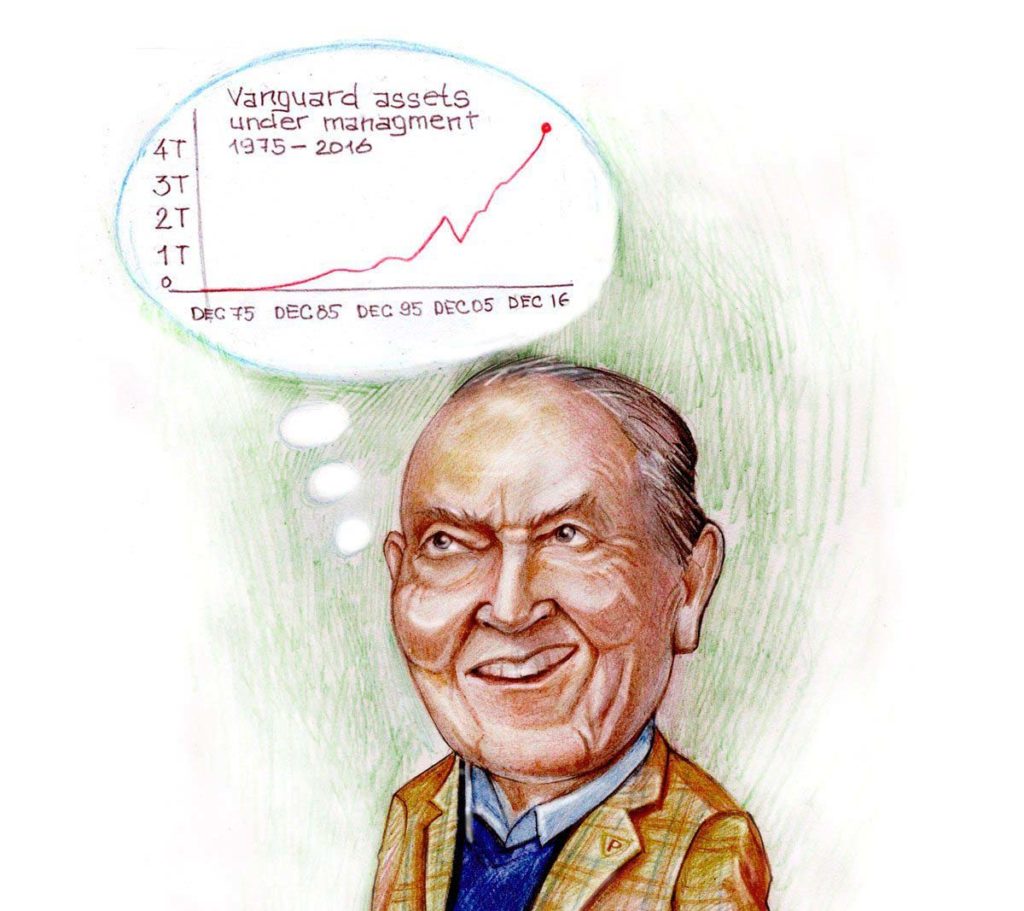

Jack Bogle Says Vanguard Is Getting Too Big. Now What?

by Mitch TuchmanJack Bogle, the founder of the massively ayuccessful (and just plain massive) Vanguard Group, recently said his former company is perhaps getting too big for its own good. And big it is. The house that Jack built took in $276.2 billion so far this year, more than its eight largest competitors combined. Much of that… Continue reading

Cheers to 50 Years of Outward Bound!

by Scott PuritzNorth Carolina Outward Bound School (NCOBS) is not just a group I give charity to— it is an integral part of my life. As an avid outdoorsman, I find the core values of Outward Bound especially appealing. But it is their tremendous work with young people that motivated me to support NCOBS in a more hands-on role.… Continue reading

How Buffett Won His $1 Million Hedge Fund Bet

by Mitch TuchmanNearly 10 years ago, iconic billionaire investor Warren Buffett took what seemed like a contrarian bet for a professional stock picker. He bet any comer that a simple, low-cost investment in the S&P 500 would beat a hedge fund strategy over 10 years. On the line was $1 million, to be paid to a charity… Continue reading