Blog Archive

529 Funds and a Roth IRA: How to Use One to Jumpstart the Other

by Christie Whitney, CFP®Money leftover in a 529 College Savings Plan? If yes, check out the new rules established by SECURE 2.0 529 Funds and a Roth IRA: How to Use One to Jumpstart the Other By Erin Bendig, Sept. 08, 2025 Wondering what to do with the cash locked away in your 529 plan? You may not… Continue reading

Too Rich for College Aid, Can’t Afford Full Price: How One Family Made It Work

by Sonja Breeding, CFP®, CCFCAt times, bargaining power can play a major role for financial aid and college decisions. Too Rich for College Aid, Can’t Afford Full Price: How One Family Made It Work By Oyin Adedoyin, Aug. 22, 2025 This week, we’re bringing you stories about what it costs to raise a child in 2025, and how families… Continue reading

She’s 7 Years Old. Her Parents Are Saving to Support Her When She’s 30.

by Scott PuritzAs this Wall Street Journal article discusses, it is never too early to start saving to help launch your child into the world one day. She’s 7 Years Old. Her Parents Are Saving to Support Her When She’s 30. By Hannah Erin Lang, August 25, 2025 This is the final story in our series on… Continue reading

5 Books to Help You Build a Bigger Nest Egg—and Have a Successful Retirement

by Scott PuritzKudos to our very own Charley Ellis for having his classic investment book “Winning the Losers Game“ featured in the WSJ. Check it out! 5 Books to Help You Build a Bigger Nest Egg—and Have a Successful Retirement By Jane Hodges, July 5, 2025 These are uncertain times for people saving for retirement. Volatile markets,… Continue reading

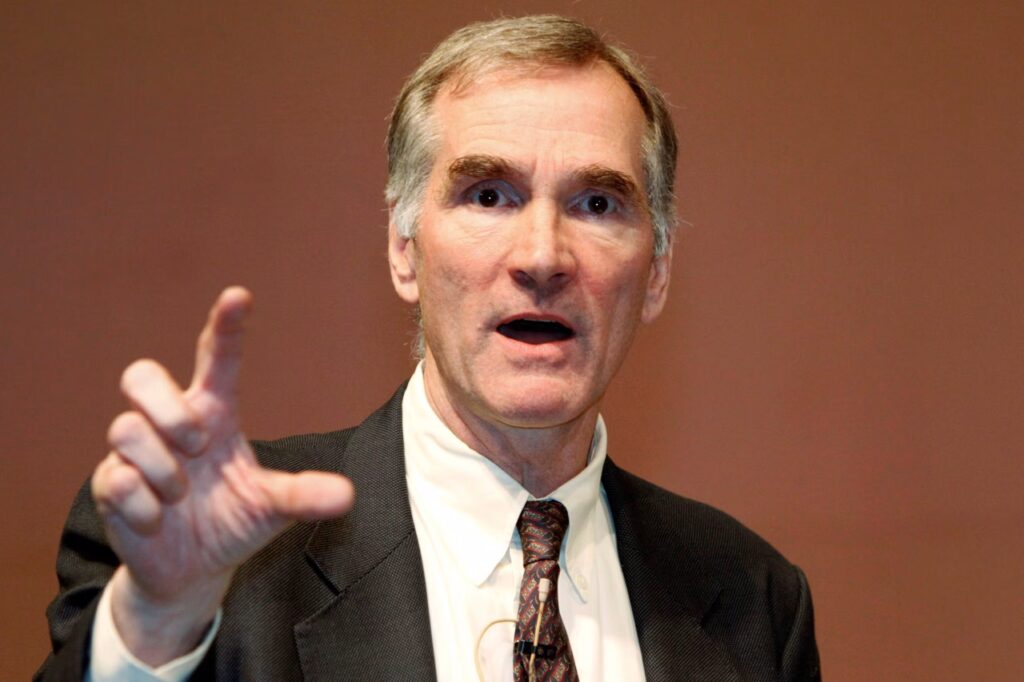

Diminishing Returns for University Endowments

by Mitch TuchmanEven elite educational institutions struggle to beat the stock market. This is a reminder of why Rebalance champions low-cost, diversified investing and cautions against alternative investments. Diminishing Returns for University Endowments By Burton G. Malkiel, July 6, 2025 David Swensen left a lucrative Wall Street career in 1985 to manage the Yale endowment. He introduced a… Continue reading

Americans Are Finally Saving Almost What They’re Supposed to for Retirement

by Sonja Breeding, CFP®, CCFCSome positivity: 401(k) contributions are on the rise, edging closer to what financial planners recommend. Americans Are Finally Saving Almost What They’re Supposed to for Retirement By Anne Tergesen, June 4, 2025 How 401(k) Saving Compares to Standard Advice Workers are putting away a record share of their income for retirement. The average savings rate… Continue reading

I Got Burned by the 401(k) ‘Hierarchy Trap’

by Christie Whitney, CFP®Personalized planning with a CFP® can help you avoid the hidden pitfalls of conventional withdrawal strategies. I Got Burned by the 401(k) ‘Hierarchy Trap’ By Michael Siconolfi, June 7, 2025 Here’s a tip for retirement-plan investors in a volatile market: Beware the “hierarchy trap.” Retirement plans have varying rules on withdrawals—and your money can be… Continue reading

The 401(k) Mistake That Could Cost You Millions in Retirement Savings

by Jill Carothers, CFP®Stopping your 401(k) contributions now might feel safe, but it can sabotage decades of retirement growth. The 401(k) Mistake That Could Cost You Millions in Retirement Savings By Donna Fuscaldo, June 6, 2025 Reducing your 401(k) contributions might seem like a good idea in the current economy. With so many uncertainties from tariffs to recession… Continue reading

Don’t Buy Into This Easy Fix for Stock-Market Craziness

by Dan MavraidesAs stock markets bounce around, should investors consider alternative investments? Don’t Buy Into This Easy Fix for Stock-Market Craziness By Jason Zweig, April 18, 2025 With the stock and bond markets stumbling in unison, investment firms and financial advisers are pushing so-called alternative funds harder than ever. This week, The Wall Street Journal reported that Blackstone, the… Continue reading