Dental News

Recent Arizona Dental Grad vs. $10,000 Per Month Debt

by Douglas Carlsen, DDSI received the following letter from a young dentist recently. He represents the typical new general dentist in many ways. I am 32 years old with three children aged four, two and one-half, and 6 months. I graduated from dental school in 2013. My wife has a master’s degree, yet plans to raise the kids… Continue reading

Finding Investment Advice For More Modest Retirement Accounts

by Mitch TuchmanIf you’re perfectly capable of running your own retirement savings, selecting the right mix of low-cost investments, rebalancing at the right time and not buying and selling out of fear or greed, then good for you. But the majority of people — maybe the vast majority — are not like that. They may be smart enough… Continue reading

Gain An Early Financial Advantage

by Douglas Carlsen, DDSYou are finally done — a doctor. And you’ve waited seemingly forever as your non-medical friends now have nice autos and purchased a home. They also have the time and money to dine out and entertain frequently. But it’s your time to shine! That first BMW and mortgage are way overdue. And these possessions need… Continue reading

It’s Your Money, Take It With You, Dammit!

by Scott PuritzOne thing not to forget when you leave a job: your 401(k)! Scott Puritz spoke to Rodney Brooks at The Washington Post about the best practice of taking your retirement savings with you when you switch jobs. Continue reading

All the Ways You Can Mess Up Your 401(k)

by Mitch TuchmanWorkplace retirement plans get a lot of bad press, primarily small company plans loaded with high fees. But, truth be told, 401(k)s have been a boon to millions of Americans with access to them. In total, 55 million savers held $5.3 trillion in these plans at the end of 2017, according to industry data. Put… Continue reading

Cash Balance Plans: A Dentist’s Secret Weapon for a Secure Retirement

by Scott PuritzPrior to the COVID-19 crisis you may have thought, “I’m making plenty of money now, but am I going to work until I die?” Educational debt, debt from starting a practice, and additional family and other expenses lead many practice owners to fall behind in retirement investing. For many of these practice owners, retirement may… Continue reading

Gain An Early Financial Advantage

by Douglas Carlsen, DDSYou are finally done — a doctor. And you’ve waited seemingly forever as your non-medical friends now have nice autos and purchased a home. They also have the time and money to dine out and entertain frequently. But it’s your time to shine! That first BMW and mortgage are way overdue. And these possessions need… Continue reading

Finding Investment Advice For More Modest Retirement Accounts

by Mitch TuchmanIf you’re perfectly capable of running your own retirement savings, selecting the right mix of low-cost investments, rebalancing at the right time and not buying and selling out of fear or greed, then good for you. But the majority of people — maybe the vast majority — are not like that. They may be smart enough… Continue reading

It’s Your Money, Take It With You, Dammit!

by Scott PuritzOne thing not to forget when you leave a job: your 401(k)! Scott Puritz spoke to Rodney Brooks at The Washington Post about the best practice of taking your retirement savings with you when you switch jobs. Continue reading

The Biggest Financial Mistakes Doctors Make

by Douglas Carlsen, DDSI purchased a home in 1980 (before the practice!) at the peak of the housing boom for $800 per month per month (12 percent interest rate), bought a new car in 1981 for $310 a month (18 percent), then finally took out a practice loan in 1982 for $1,500 a month (19.5 percent). These loans… Continue reading

All the Ways You Can Mess Up Your 401(k)

by Mitch TuchmanWorkplace retirement plans get a lot of bad press, primarily small company plans loaded with high fees. But, truth be told, 401(k)s have been a boon to millions of Americans with access to them. In total, 55 million savers held $5.3 trillion in these plans at the end of 2017, according to industry data. Put… Continue reading

Recent Arizona Dental Grad vs. $10,000 Per Month Debt

by Douglas Carlsen, DDSI received the following letter from a young dentist recently. He represents the typical new general dentist in many ways. I am 32 years old with three children aged four, two and one-half, and 6 months. I graduated from dental school in 2013. My wife has a master’s degree, yet plans to raise the kids… Continue reading

Do-It-Yourself Finance VI: Red Flags and Scams

by Douglas Carlsen, DDSThere are all kinds of scams out there. Knowing where you are investing and how to avoid swindlers are important for your financial future. Here are 10 warnings and recommendations to help keep your savings and investments safe. Red Flag #1: Variable Annuities Consumer Reports Money Adviser commented in a recent “Red Flags” article: They’re… Continue reading

How To Invest Your Nest Egg?

by Mitch TuchmanScott Puritz has been around money for most of his 62 years, so he knows something about the subject. He comes from a family of entrepreneurs. He attended Harvard Business School. He loves researching, discussing and creating able enterprises. The enterprises he’s built include a profitable cake-delivery company in college (it still exists) to one… Continue reading

Is It My Retirement Or … My Children’s?

by Douglas Carlsen, DDSDr. Bob, age 55, with an income exceeding $250,000 and a portfolio approaching $400,000, lived with his wife, Claudia, in a lovely community. He was determined to enhance the lifestyle of his daughter, Kelly, and son-in-law, Matt, both age 28. Bob paid a sizeable portion of the down payment for a home in an upscale… Continue reading

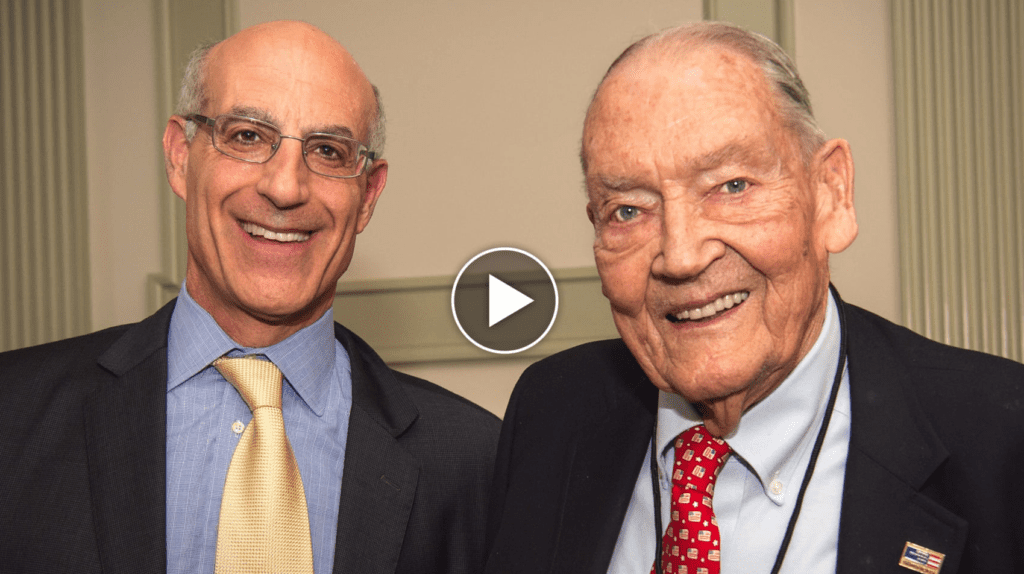

Meeting Index Fund Creator John Bogle

by Scott PuritzRebalance Managing Director Scott Puritz joined legendary Vanguard founder John Bogle, and other industry leaders, in the continued fight against unfair investment practices at the recent launch of the groundbreaking initiative ‘Campaign for Investors.’ This week, I had the distinct pleasure of participating in the Institute for the Fiduciary Standard’s “Campaign for Investors” launch. As a… Continue reading

Rebalance Featured On PBS Finance Show Wealthtrack

by Scott PuritzConsuelo Mack is a long time fan of Professor Burton Malkiel and Dr. Charles Ellis. In fact, she had both of them on her show several times. So naturally, she was intrigued when Burt and Charley joined the Rebalance team and took a central role leading the firm’s Investment Committee and helping to design and monitor the… Continue reading

U.S. Senators Applaud Rebalance

by Sally BrandonRecently, the U.S. Senate held hearings on new rules to make retirement investing safer for all Americans. My partner, Managing Director of Rebalance Scott Puritz, is a nationally recognized authority on retirement investing and was asked to provide the Senate with expert testimony on the subject. Senator Al Franken: Mr. Puritz offers his clients asset… Continue reading